1850

1850Step Right Up!

Early fraudsters included snake oil salesmen and other peddlers of patent medicines that were purported to cure all types of ailments.6

In 2011, the U.S. government spent that entire amount. Ending world poverty would only take 5.1% of that.3

The National Cancer Institute has spent $90 billion on research and treatment over

the last 40 years.4

An evaluation by WHO shows that to supply water to unserved nations would

cost $22.6 billion.5

Milestones from the Frontier to the Future.

1850

1850Early fraudsters included snake oil salesmen and other peddlers of patent medicines that were purported to cure all types of ailments.6

1872

1872

Congress enacts the Mail Fraud Statute to combat a post-Civil War outbreak of swindles using the mail.7

1876

1876

The invention and eventual widespread use of the telephone eliminated the need for face-to-face contact, opening the door for new types of scams.8

1879

1879

In what may be the earliest high profile case of life insurance fraud, Chicago serial killer H.H. Holmes staged deaths of stolen cadavers and then murdered at least 27 people (many in his custom-built castle-like residence) to collect on their life insurance policies.9

1910

1910

As a precursor to modern day identity fraud, perpetrators would assume the identity of another person, and then call a bank to request a wire transfer from the victim’s bank account. 10

1917

1917

To combat a common crime of the day, Volney D. Cousins of the American Telephone and Telegraph Company (AT&T) filed for and was granted a patent for an “improvement in Fraud-Detecting Telephone Toll Systems,” where users were prevented by Cousins’ device of evading payment by connecting a ground to the line independently of the coin box 11

1920

1920

Charles Ponzi initiated what has become the namesake of fraudulent investment operations, where organizers lure investors with the promise of exceptional returns, but then pay returns — and themselves — out of diverted funds rather than profits. 12

1933 — 1934

1933 — 1934

In partial response to reckless behavior leading to the Stock Market crash of 1929, Congress passed the Securities Act (1933) to “prohibit deceit, misrepresentations and other fraud in the sale of securities,” followed by the Securities and Exchange Act (1934), which created the Securities and Exchange Commission.13

1938

1938

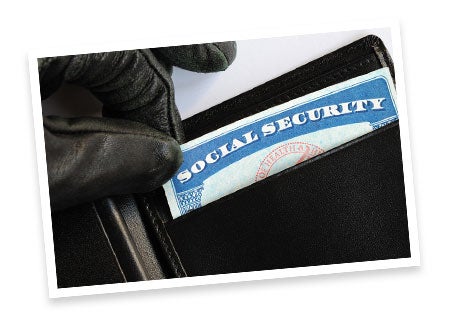

Hilda Schrader Whitcher became the first identity theft victim when her actual Social Security number was printed on “demo” cards included in the display pockets of wallets sold by a wallet manufacturer, which caused confused customers to use Hilda’s Social Security number as their own.14

1976

1976

The first state insurance fraud bureau was created in North Carolina. 15

1977

1977

A mere 12 years after the Social Security Act was amended to establish Medicare, Congress passed Anti-Fraud and Abuse Amendments which increased the severity of penalties from a misdemeanor to a felony. 16

1980

1980

Visa and MasterCard reported $110 million in losses due to fraud. (By comparison, that number is more than $5 billion today.)17

1982

1982

Identity fraud became a federal crime through the False Identification Crime Control Act of 1982 (P.L. 97-398), and it is codified at 18 U.S.C. §1028. 18

1988

1988

Robert Tappan Morris, a then undergraduate at Cornell University, became the first person convicted under the 1986 Federal Computer Fraud and Abuse Act for his introduction of the first Internet worm virus.19

1991

1991

The culmination of much research from various contributors, the first true Internet browser was introduced in 1991, enabling us to efficiently navigate interconnected computer networks via the World Wide Web. The Internet is not only the most powerful communication medium to exist to date, but is arguably a huge boon for fraudsters, who can use it to inflict significant damage without ever leaving their computer monitor.20

1994

1994

The advent of e-commerce spurred the emergence of new types of credit card fraud that involved the Internet. 21

1997

1997

Costs from identity theft, which is a component of identity fraud, increased to $745 million. 22

1998

1998

Identity theft was designated a federal crime via the Identity Theft Assumption Deterrence Act (P.L. 105-318). 23

2000

2000

The Internet Fraud Complaint Center, a partnership between the FBI and NW3C, was established to “adequately identify, track, and investigate new fraudulent schemes on the Internet on a national and international level.” 24

2000

2000

At $1.7 billion, the Columbia HCA case involved the largest ever settlement for health care fraud from the overbilling of Medicare and Medicaid. 25

2002

2002

Bogus and abusive auto claims increased to between $4.3 billion and $5.8 billion. 26

2003

2003

According to a study by the Federal Trade Commission, identity theft impacted 3.25 million Americans, costing consumers about $5 billion year, and $50 billion for businesses. 27

2008

2008

Bernie Madoff was arrested. His $65 billion Ponzi scheme is considered the largest stock fraud (and largest accounting fraud) by an individual in U.S. history. 28

2008

2008

Losses from mortgage fraud were estimated at between $15 and $25 billion based on suspicious activity reports (SARs) from federally insured financial institutions. This figure does not even take into account fraudulent activity related to independent mortgage companies and other non-federally funded institutions. 29

2009

2009

The incidence of questionable insurance claims from staged automobile accidents rose nearly 50 percent from 2007, according to the National Insurance Crime Bureau. 30

2012

2012

Credit card and debit card fraud resulted in losses amounting to $5.3 billion in the United States ($11.27 billion globally).31

2012

2012

Occurrence of one of largest Medicare frauds in modern history, totaling $450 million and involving 107 people, including health care providers, in seven U.S. cities. 32

2012

2012

Consumer complaints to the Internet Crime Complaint Center (formerly the Internet Fraud Complaint Center) totaled 289,874, with an adjusted dollar loss of $525,441,110. 33

2013

2013

Fraudulent property and casualty insurance claims amount to $32 billion/year. 34

2013

2013

Account takeover fraud hits a new high and comprises 28 percent of all identity fraud losses (totaling $5 billion), with highest increases among utilities and mobile phones. 35

2014

2014

Merchants lost, on average, 0.68% of revenue – a 33% greater proportion than the previous year, and incurred more costs in addition to their fraud losses, with each dollar of fraud costing them $3.08, compared to $2.79 in 2013. 36

Fraudsters have not changed much over time. The snake oil salesmen of yesteryear are not fundamentally different from those who commit online phishing schemes today. Globalization, improvements in infrastructure and changes in technology – particularly the advent of the Internet – have aided the modern fraudster’s cause.

As we move into the next decades, it remains to be seen how fraud will evolve to accommodate emerging computer network architectures and forms of data management, virtual currencies, identification technologies, and other real or prospective technological or cultural advancements.

If anything, fraudsters will continue to become more organized and sophisticated and inflict greater amounts of damage as they adapt their schemes to society’s developments.

The Impact of Fraud by Industry.

From banking to credit lenders to mortgage and real estate, the financial services industry may be one of the most at risk when it comes to fraud. The estimated impact is in the billions of dollars, and fraud losses are accumulating from synthetic or manipulated identities, account takeovers, counterfeiting, hacking and other emerging criminal activities.

Financial organizations are desirable targets for fraud because of the potential size of the prize, and the sheer volume of transactions at a fraudster’s disposal. What’s more, today’s fraudulent activity targeting the financial sector is frequently driven by organized fraud rings that tend to amass a great deal of damage quickly. Challenges will continue to grow as on-demand service expectations from legitimate customers and mobile banking gain prominence.

To prevent fraud, financial services organizations need solutions that protect profitability and mitigate risk without compromising customer convenience.

Health care fraud carries an enormous impact, with most estimates in the tens of billions of dollars and some even higher than that. In addition to fraud rings involving multiple providers or participants that often receive high profile publicity, health care fraud also encompasses numerous examples that can be more difficult to pinpoint, such as falsification or omission of information in a claim; cost shifting; unnecessary or inappropriate diagnoses; upcoding on tests or procedures to increase reimbursement; and other questionable practices that fall within the broad header of Waste and Abuse.

Because of the massive number of claims, and the complexities of the health care payment system, only around 5 percent of health care fraud is even detected, and may increase as providers and payers respond to a rapidly changing health care landscape comprised of declining reimbursements due to higher deductible insurance plans from patients, shifts to health care exchanges that pay less than traditional plans, and impacts from government budget cuts.

Health care entities need solutions that facilitate the aggregation and analysis of big data from multiple sources, and that offer transparency into fraud risks through the use of linking, predictive, and claims analytics to drive down improper payments.

Insurance fraud amounts to billions of dollars annually, with some estimates as high as $40 billion or more, and the National Insurance Crime Bureau estimates fraud is involved in approximately 10 percent of losses, costing policy holders an estimated $200-$300 a year in added premiums. No line of insurance – from Home and Auto to Life to Commercial – is immune, and fraud schemes can range from simple opportunistic attempts to add unrelated damage to an otherwise legitimate claim, to sophisticated rings that stage multiple accidents and amass millions of dollars of fraudulent claims.

Fraud investigators need increasingly sophisticated solutions that leverage advanced analytics capabilities and incorporate cross-industry data to minimize risks and make better decisions, without compromising customer satisfaction.

Fraud touches nearly every government agency that administers benefits, official documents, or refunds to citizens. Total costs are difficult to pinpoint, but may reach $20 billion or more – not even taking into account Medicaid fraud. Common examples of government fraud include tax refund fraud, unemployment insurance fraud, pension retirement fraud, food stamp fraud, public housing/Section 8 benefit fraud, Department of Motor Vehicle fraud, and student loan fraud.

Much of the fraud that impacts benefits programs is related to identity theft, which is the fastest growing crime in the United States, but may also disproportionately impact the government sector. According to the Federal Trade Commission, more than one third of all reported identity theft incidents in 2013 pertained to government documents and benefits, and most of those were related to tax and revenue. Savvy fraudsters have figured out that it is difficult for government agencies to possess all details of a person’s identity footprint – not to mention that the details are a moving target when 12 percent of Americans change something in their identity information each year. Now more than ever, federal, state, or local government agencies need tools and solutions with identity proofing and fraud detection and prevention capabilities.

Fraud in the retail space is increasing, with estimates in the billions of dollars. According to the 2014 LexisNexis® True Cost of Frauds study, costs associated with retail fraud are steadily rising, with merchants paying $3.08 for each dollar of fraud in their stores. Retail fraud encompasses fraudulent and/or unauthorized transactions, vendor collusion, and shoplifting. More and more retail transactions are moving online, and web-based sales include the added risks associated with e-payment and Card-Not-Present (CNP) transactions. This was substantiated by LexisNexis® data which showed that large eCommerce and mCommerce merchants are still among the hardest-hit by rising fraud losses and associated costs.

In addition to the direct financial impact to retailers, there can be negative fallout from highly publicized fraud events, and merchants are also beginning to recognize the toll that fraud can take on customer loyalty.

With the expansion of mobile and alternative payments, and the move toward virtual currency, merchants need layered solutions that help to detect potential fraud, score and rank potential risks and reduce false positives that impact sales revenue.

LexisNexis Risk Solutions is a leader in providing essential information that helps customers across all industries and government assess, predict and manage risk. Combining cutting-edge technology, unique data and advanced analytics, LexisNexis Risk Solutions provides products and services that address evolving client needs in the risk sector while upholding the highest standards of security and privacy. LexisNexis Risk Solutions is part of Reed Elsevier, a world leading provider of professional information solutions.

For more information, visit http://www.lexisnexis.com/risk/fraud-defense-network/,

or call