When it comes to compliance, you may have more exposure than you think. After all, in the digital world, there are no such things as county lines.

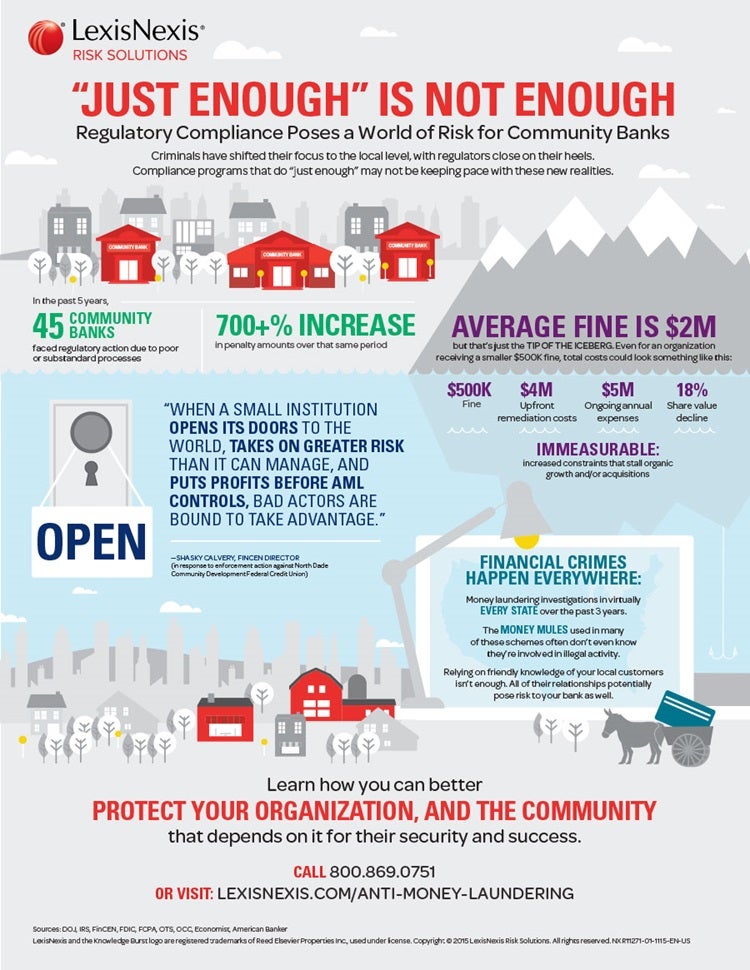

As large, global banks reinforce their processes, focus is shifting to the local level—both for criminals looking to exploit new targets and regulators looking to ensure all financial service organizations are protected.

Regulators are focusing on compliance protocols within the broad range of institutions, including community banks and many of the third parties you depend on to deliver financial services — such as MSBs (money service businesses) and correspondent banks.

The penalties for non-compliance can be severe and amount to a huge proportion of earnings.

The average fine is $2 million1 in addition to the enormous costs involved with remediation, staffing, new processes and training--not to mention the focus is taken away from revenue-generating business.

“Just enough” is no longer enough when it comes to compliance. See why community banks are re-evaluating their programs. And why, if you’re not already doing it, you should be.

1Cost based on the average cost of all the recent regulatory action enforcements from 2004 through 2014.

Free Trial - Connect to relevant risk intelligence

of individuals and businesses across more than 50 risk categories.