How Does the True Cost of Fraud Impact Performance?

Increases in the true cost of fraud are tied to digitalization and cybercrime threats. Learn why a multi-layered, data-driven fraud management approach helps mitigate negative impacts on performance.

Get the StudyDiscover Why Digitalization Is Driving Up the True Cost of Fraud

Balancing strong fraud prevention and seamless customer experiences is becoming more complex for businesses and financial institutions in the Asia Pacific region. Rapid adoption of digitalization, rising risk volatility and multiplying cybercrime attack vectors are impacting every stage of the customer journey and raising the true cost of fraud.

Download our True Cost of Fraud™ Study for Asia Pacific to learn the latest statistics:

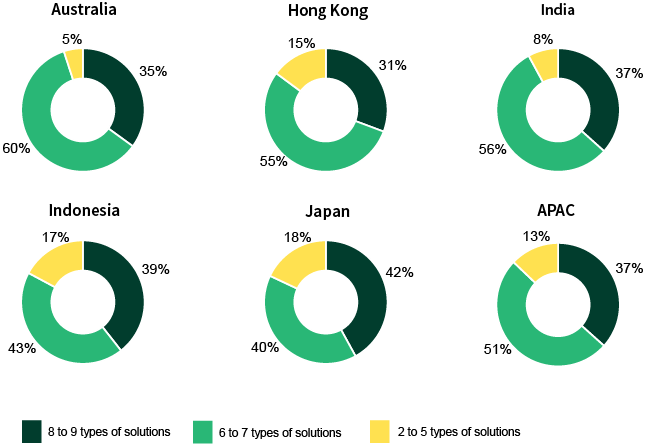

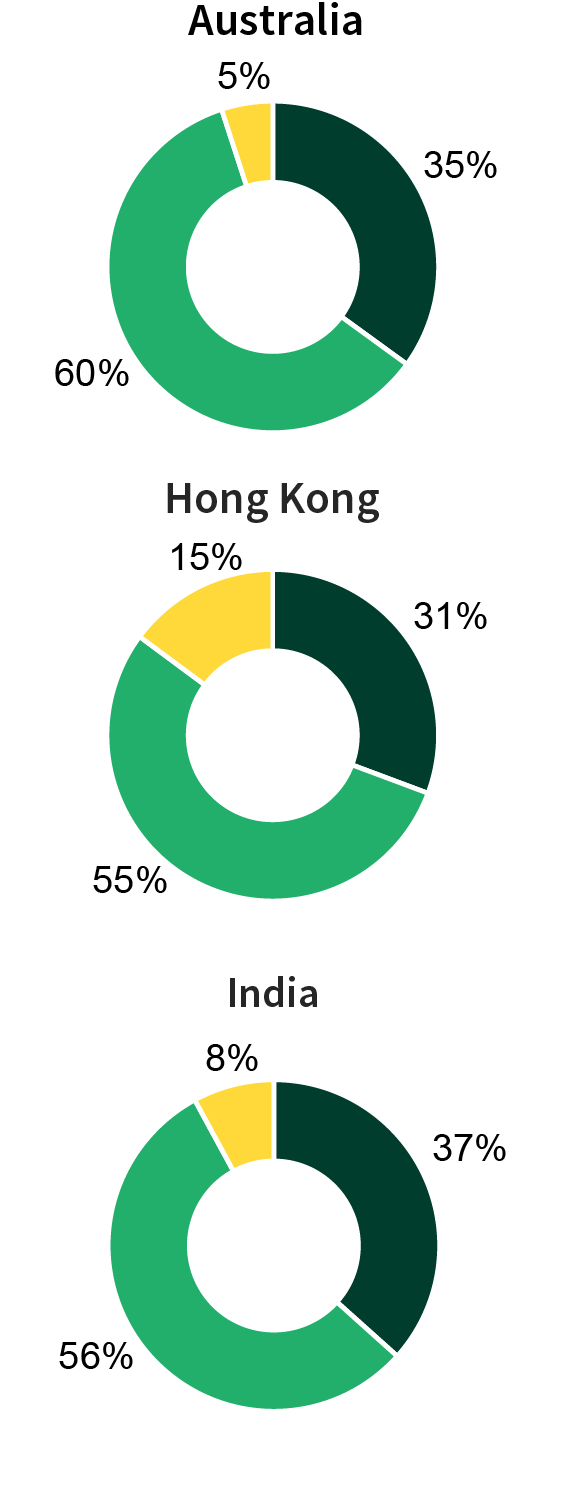

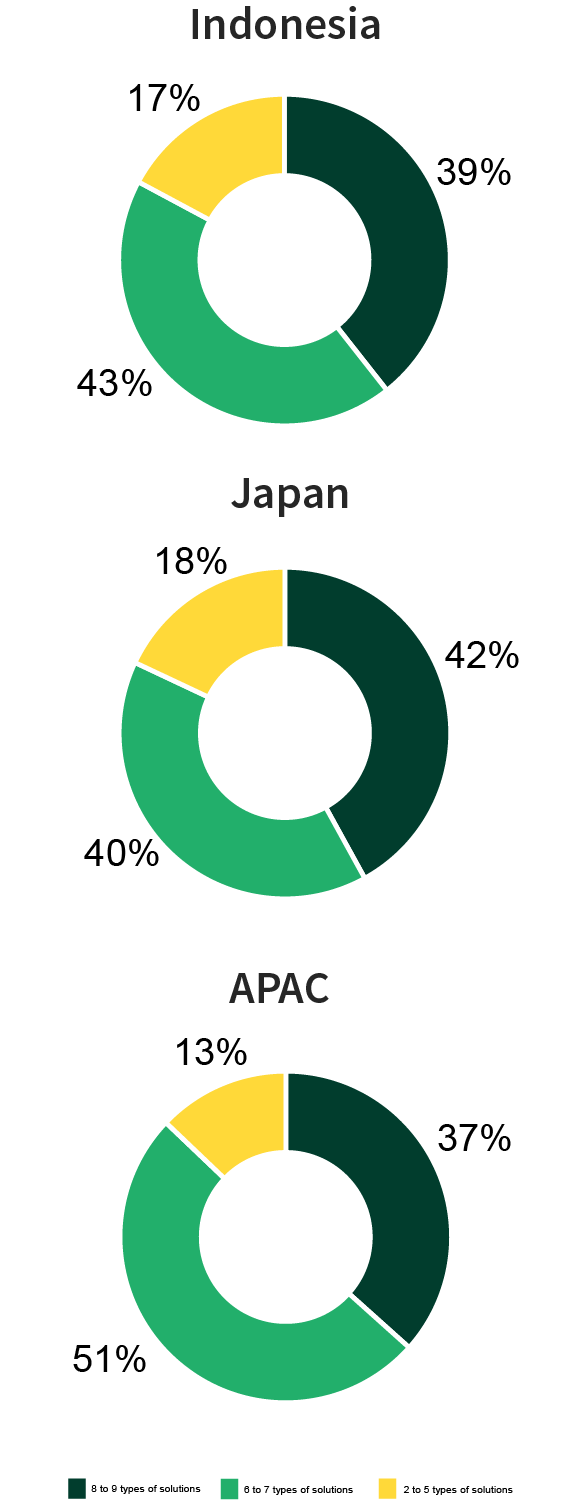

In the APAC region, Australia leads with 95% of organizations investing in a diverse array of fraud solutions spanning 6-9 types across various customer journey stages.

Following closely behind is India, with 93% of organizations also adopting this broad approach to tackling fraud.

- 52% of organizations surveyed reported a rise in fraud over the last 12 months

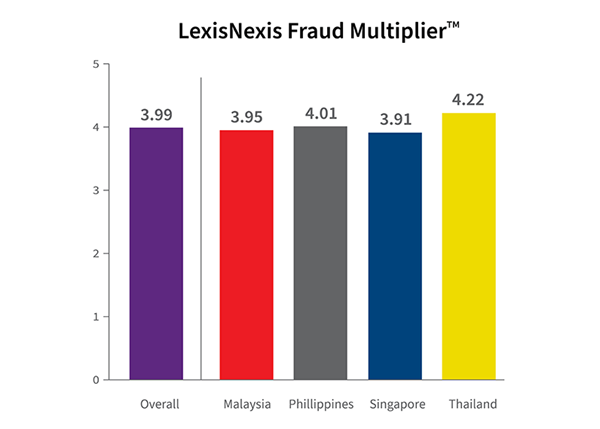

- Organizations are incurring fraud costs ranging from 3.07 times to 4.59 times the actual value lost to fraudsters

- Digital channels account for 51% of overall fraud losses in the APAC region

- 34% is the share of fraud traced back to new payment methods such as digital wallets, payment apps, crypto, Buy Now, Pay Later and more

- 75% of organizations report a decline in customer conversion rates tied to increased verification checks

In the APAC region, Australia leads with 95% of organizations investing in a diverse array of fraud solutions spanning 6-9 types across various customer journey stages.

Following closely behind is India, with 93% of organizations also adopting this broad approach to tackling fraud.

Delivering secure and personalized customer experiences while effectively preventing fraud losses means understanding fraud from a multi-faceted perspective encompassing physical identity, digital identity and transaction risks. The True Cost of Fraud™ study highlights key recommendations to inform a multi-layered, data-driven fraud management approach that stays ahead of evolving digital demands and the increasingly diverse channels for customers to transact and pay.

Learn the latest strategies to help prevent the increasing fraud costs from impacting critical performance outcomes. Download the True Cost of Fraud™ Study, Asia Pacific now.

Complete the form to download the True Cost of Fraud Study, 2023 Asia Pacific

Products You May Be Interested In

-

BehavioSec®

Uncover user intent from login to logout with real-time behavioral and device intelligence

Learn More -

Digital Identity Network®

Gain the ability to recognize good, returning customers and weed out fraudsters, all in near real time

Learn More -

Emailage®

Emailage® is a proven risk scoring solution to verify consumer identities and protect against fraud

Learn More -

ThreatMetrix®

World-leading digital identity intelligence and embedded AI models through one risk decision engine

Learn More