The Link Between Human Trafficking and Money Mule Fraud

Mules, mobile and money: Combatting human trafficking-fueled fraud

When Nadia Green, a data scientist at LexisNexis® Risk Solutions began examining behavioral biometric data from mobile phones for a customer in Southeast Asia, she found an unexpected link. Low atmospheric air pressure recorded by sensors on mobile devices appeared to be highly predictive of fraud activity for this customer. Intrigued, Nadia dug deeper.

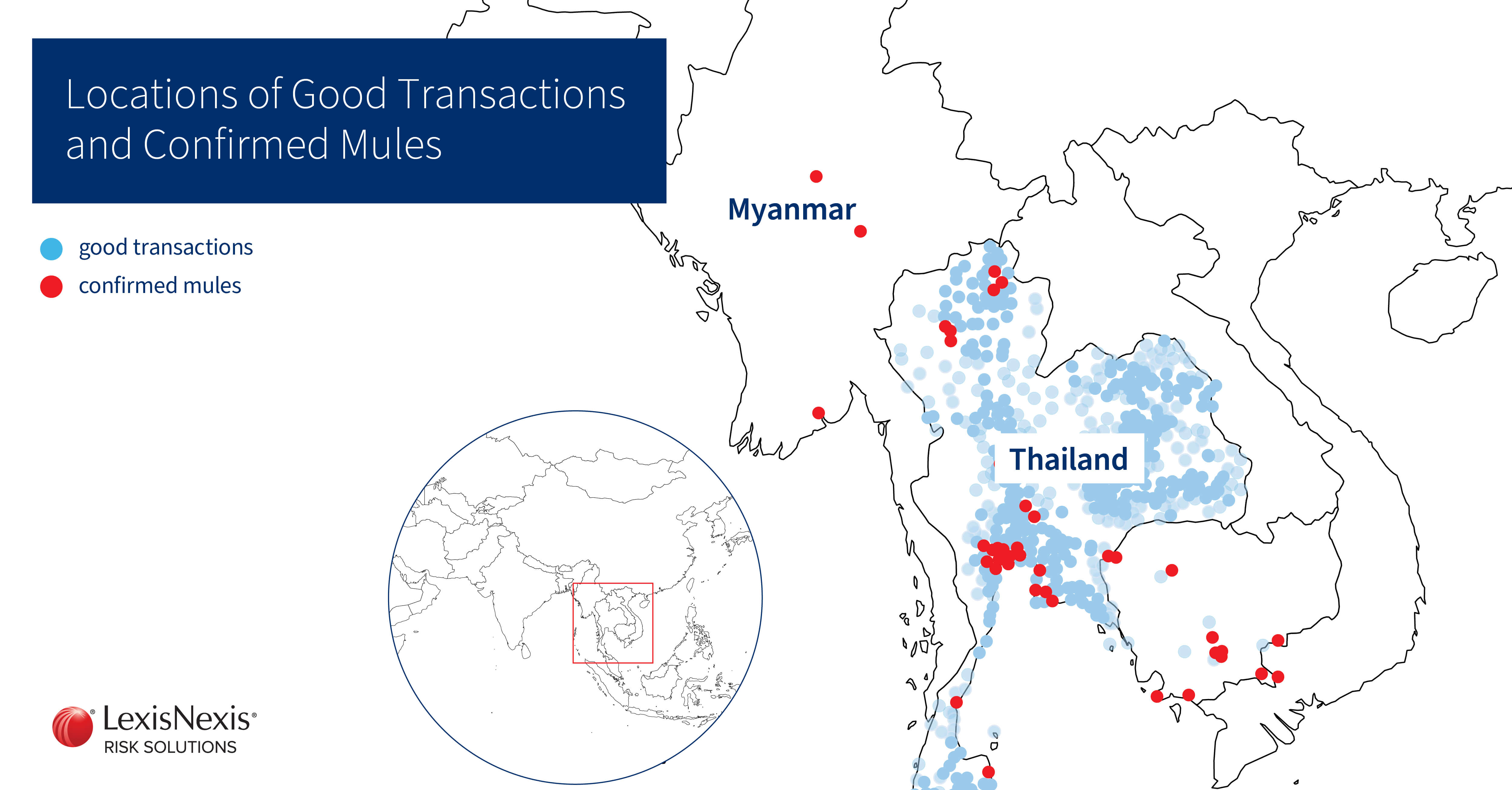

Using location intelligence in parallel with behavioral data provided insight at a country level. The activity was coming from Myanmar. But there was not enough granular information to determine the exact coordinates or cities involved. However, once Nadia realized that low air pressure readings were likely due to a high altitude, a quick internet search revealed a mountain range between Myanmar and Thailand. It only took a bit more research to learn that a refugee center was located in this mountainous area.

By combining this new information with other typically innocuous signals, such as low device angle, which indicates that devices are lying flat on a surface, and high magnetic field, which could arise from several devices placed close together, a more holistic picture emerged. Nadia had stumbled on suspicious activity likely indicating that the vulnerable refugees could be targeted to act as money mules and carry out scamming operations against their will.

A money mule is a bank account necessary for receiving fraudulent funds so these can be transferred and cashed out.

The double blow of human trafficking

Human trafficking is a global problem that is estimated to generate upward of $150 billion per year. More than 27 million people worldwide are victims of trafficking. Lured by the prospect of well-paying jobs, hundreds of thousands of innocent victims wind up in Southeast Asia where they are forced to work in online scam centers. This human trafficking-fueled fraud is particularly insidious as it has two sets of victims: those who fall prey to romance, investment and other scams and the trafficked workers forced into perpetrating these crimes.

The United Nations and Interpol have raised alarms about the growing number of online scam trafficking operations in Southeast Asia and now spreading to other regions. According to a recent report by the United Nations, these scam centers tend to operate near country borders. In fact, one of the border areas highlighted in the report was the mountainous region Nadia identified in her behavioral biometrics analysis.

Proximity to country borders makes sense from the economic perspective of human trafficking – the shorter the distance to a border, the less cost to traffickers. But could the distance of a transaction from a country border be used to identify fraud centers?

Putting the pieces together

Only a unique set of signals from phone sensors could have captured the high-risk mountainous region Nadia originally identified. Other areas that are likely to have human trafficking fraud centers may be more difficult to detect with sensor data alone. That is where location intelligence provides an additional layer of insight.

Using technology from LexisNexis® Risk Solutions, is it possible to compare the geolocation of a device to the local geography and compute how far a transaction is from country borders where human trafficking fraud centers are likely to be located.

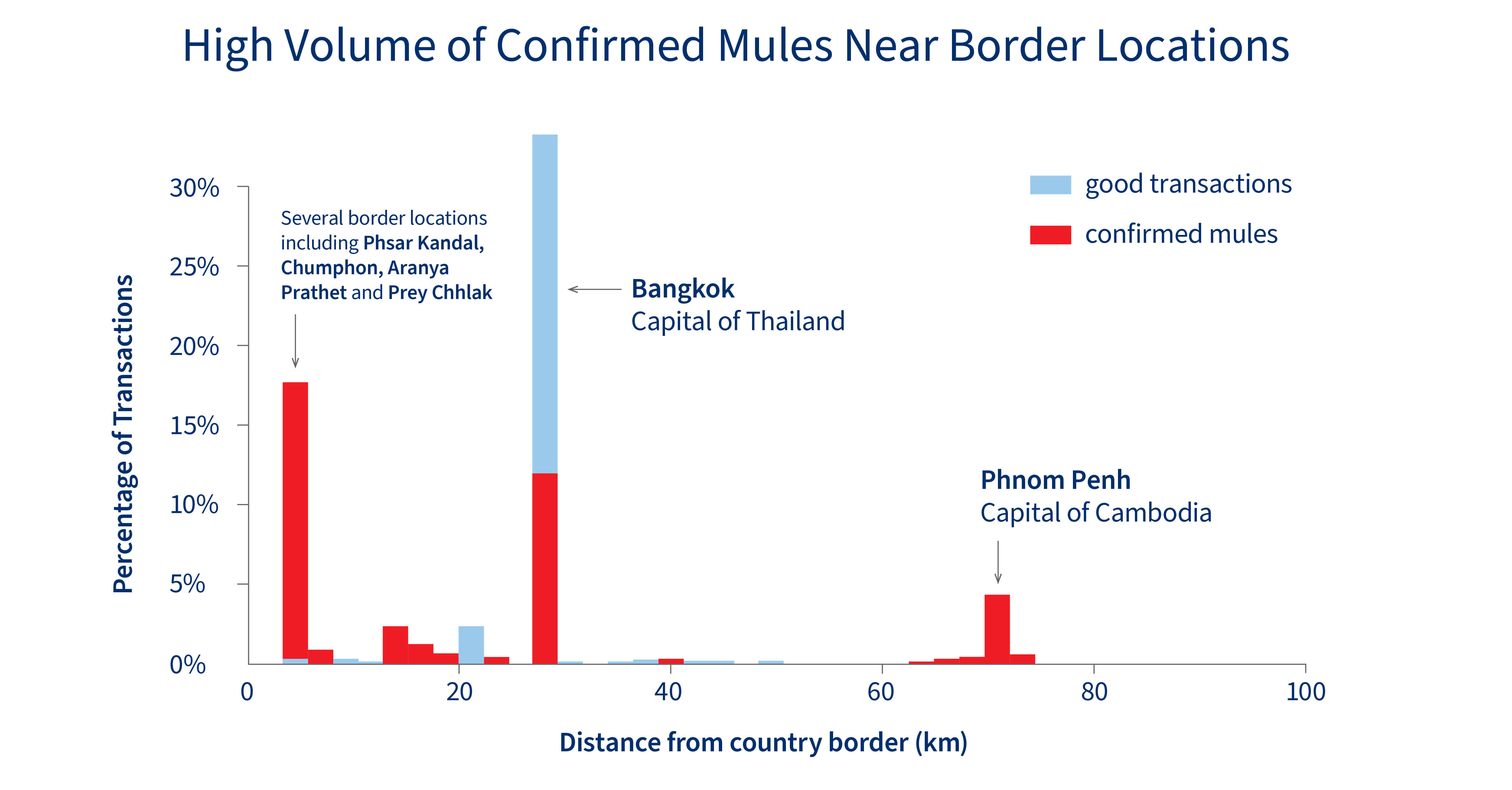

Based on nearly 7,000 mule transactions from the top five countries in terms of mule risk in a Southeast Asian bank, LexisNexis® Risk Solutions identified a clear pattern: transactions near to borders were at a higher risk of being mules. In other words, there was a clear fraud signal if a transaction in this region was close to a country border.

The graph below shows the volume of confirmed mules in locations with a high transaction volume, such as the capitals of Cambodia and Thailand, compared with the volume of confirmed mules near several border locations.

A three-prong approach to tackling money mules

Behavioral biometrics provided valuable intelligence in helping to identify the online scam center in the mountainous area between Myanmar and Thailand. But it is only one component in fighting fraud. Compiling a more robust picture of risk requires a more comprehensive approach from multiple fronts. Not only are online and mobile fraud growing globally, but the increasing sophistication of criminal enterprises, clandestine nature of mule operations and challenges sharing cross-border intelligence between public and private organizations, add to the complexity of identifying money mules.

To build the strongest offense for detecting and blocking money mule activity, organizations should look for solutions that:

Leverage data sharing: The LexisNexis® Digital Identity Network® platform helps harnesses global shared intelligence from nearly three billion monthly transactions. It links digital, physical, and behavioral insight to differentiate genuine, trusted users from fraudsters and bots. Consortium, a peer-based initiative, complements the crowd-sourced intelligence from Digital Identity Network®, empowering organizations to collectively fight fraud.

Mine intelligence: The use of data analysis, machine learning and rule modeling enable granular details of behavior to emerge. LexisNexis® Risk Solutions analyzes these unique behavioral attributes to identify patterns and anomalies that are indicative of fraud, providing organizations with the intelligence needed to make accurate and timely decisions.

Offer customization: While every organization wants to detect and prevent money mule activity, there is no one-size-fits-all solution. Working with knowledgeable professionals who know how to tailor a solution to fit a particular environment can make the difference between stopping fraud or letting it slip through the cracks.

Fraudsters are banding together into global criminal networks with sophisticated techniques that help them avoid detection. To tackle the increasing complexity and constantly changing landscape of fraud threats, it is essential to have cutting edge data-driven solutions.

LexisNexis® Risk Solutions not only provides organizations with a comprehensive and diverse set of data – including location, device, and behavioral biometrics intelligence – but offers an expert professional services team who can identify and mitigate the unique fraud threats your organization faces.

Have Sales Contact Me

Products You May Be Interested In

-

BehavioSec®

Uncover user intent from login to logout with real-time behavioral and device intelligence

Learn More -

Digital Identity Network®

Gain the ability to recognize good, returning customers and weed out fraudsters, all in near real time

Learn More -

Emailage®

Emailage® is a proven risk scoring solution to verify consumer identities and protect against fraud

Learn More -

ThreatMetrix®

World-leading digital identity intelligence and embedded AI models through one risk decision engine

Learn More