Press Room

LexisNexis Insurance Demand Meter Shows Jump in Q1 U.S. Auto Insurance New Policy Activity and Continued Shopping Growth

05/26/2021

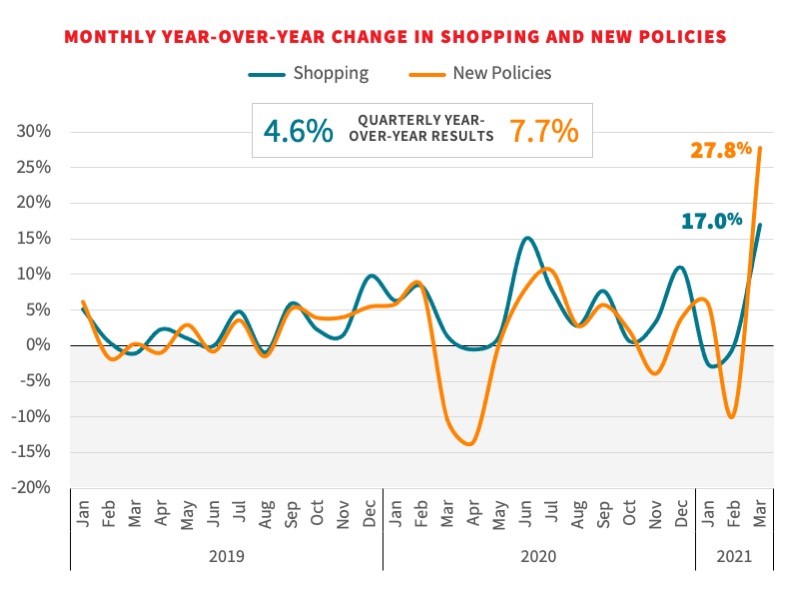

ATLANTA — LexisNexis® Risk Solutions released its latest Insurance Demand Meter, reporting on Q1 2021 U.S. auto insurance shopping activity. Despite big setbacks in February from delayed tax returns and a deadly winter storm, the quarterly year-over-year new business growth rate exceeded 7 percent and ended the quarter with notably large year-over-year gains in March.

“March marks the one-year anniversary of the beginning of pandemic-related shutdowns, which brought much of our lives – including auto insurance shopping and switching – to a screeching halt. A year later, we are starting to hurdle that very deep trough from the first quarter of 2020, and this is reflected in this quarter’s Demand Meter,” said Tanner Sheehan, associate vice president, auto insurance, LexisNexis Risk Solutions. “The end-of- quarter growth is even more notable when you consider the sharp mid-quarter drops from Winter Storm Uri and a delay in tax credits and returns.”

Shopping patterns tend to increase during the first quarter of each year, fueled mainly by income tax credits and returns, making it a primary driver for growth as insured and uninsured buy new policies. However, growth rates in February 2021 were impacted by a number of unordinary factors.

- Winter storm Uri – The effects of this system touched the entire country. Texas, as the most affected state, saw a shopping volume decrease of 41% points due to power outages and damaged infrastructure, but many surrounding states and much of the Eastern Seaboard were also impacted.

- System outages at insurance companies with infrastructure located in the path of the storm – Impacted areas caused quoting declines in 48 states and the District of Columbia. Across the country, shopping growth was -4.6% the week of the storm after growing 10.2% the week prior.

- Income tax credits and returns – Delays in income tax processing temporarily stalled shopping growth in a market already affected by the winter storm.

While shopping rates seemed to go in all directions, March gave a more promising picture of what the future may bring.

- Income tax processing delays may have caused new policyholders to shop in March instead of February

- Resurging economy and lockdown lifts contributed to new volume growth of 27.8% for the month

- The quarter overall finished with year-over-year new policy growth of 7.7%

“As people return to a normal way of living, we expect the industry and shopping activity to bounce back. Carriers will need to be prepared with their new business and renewal programs to take advantage of shopping growth and build on their brand promises,” Sheehan concluded.

About the LexisNexis Insurance Demand MeterThe LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly 90% of the universe of shopping activity.

To download the latest Insurance Demand Meter, click here.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463