LexisNexis Data Prefill Solutions for the Insurance Industry

Harness the power of high-quality data and advanced analytics for a more accurate picture of the risk.

More of the right data. Better insights. Greater confidence.

Data prefill solutions from LexisNexis leverage vast public and proprietary data stores and patented linking technology to provide more complete and accurate information so that you can process quotes, applications or claims quickly and with confidence.

Auto Insurers

Access robust data delivered through a streamlined quoting process that considers both the driver and the vehicle.

Commercial Insurers

Automate your process and speed up your quote turnaround times to deliver a positive customer experience.

Home Insurers

Leverage our existing data sets to provide a robust view of total risk. Verify data, don't collect it.

Life Insurers

Streamline your application process to reduce the time and cost of capturing the data you need to properly evaluate

your submission.

your submission.

Claims Professionals

Shorten claim cycle times, lower your ULAE, and improve customer satisfaction.

Insurance Technology Organizations

Integrate your products into insurers’ workflows,

while offering a positive customer experience.

Benefits of LexisNexis Data Prefill Solutions

With just a few customer data points, our prefill solutions pre-populate applications and claims for insurance carriers and other organizations in the insurance ecosystem. We draw from the largest source of trusted industry data and apply our advanced analytics to instantaneously deliver rich insights for better risk decision-making, streamlined workflows and improved customer experience.

Speed and Efficiency

Access more correct

information up front

to reduce errors and time

spent on data entry.

Profitability

Increase policy volume and reduce

premium leakage by pricing more

precisely and ensuring you have the

right details the

first time.

first time.

Cross-Sell Potential

Tap into comprehensive attributes and

vast data assets to easily identify and

suggest relevant products and drive

additional business.

additional business.

Customer Satisfaction

Meet customer expectations for

automation and direct service, and

eliminate unnecessary back and forth or

reworks due to incorrect or missing data.

Featured Content

E-BOOK

Creating Lifelong Customer Relationships with Data Prefill

Speed and accuracy are the new competitive differentiators. Read our E-Book to learn how you could create lifelong customer relationships with data prefill solutions from LexisNexis.

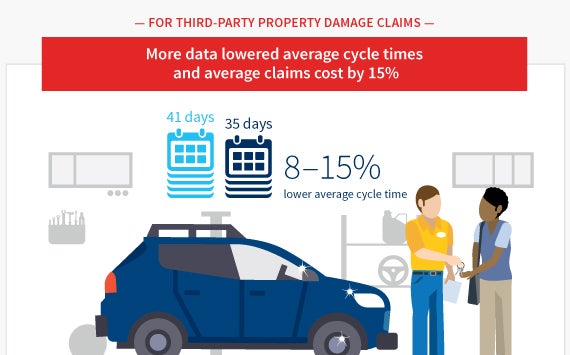

INFOGRAPHIC

The Impact of More Data

Learn how bringing in more data earlier can deliver considerable benefits at First Notice of Loss (FNOL) and across the claims process.

Find out how our data prefill solutions can help your business.

All data in the text or on the sample reports and screens shown herein are of fictitious persons and entities. Any similarity to any real person, and their date of birth, driver’s license number, social security number, address, school, business, other entity or other personal data is purely coincidental.