Identity Made Simple

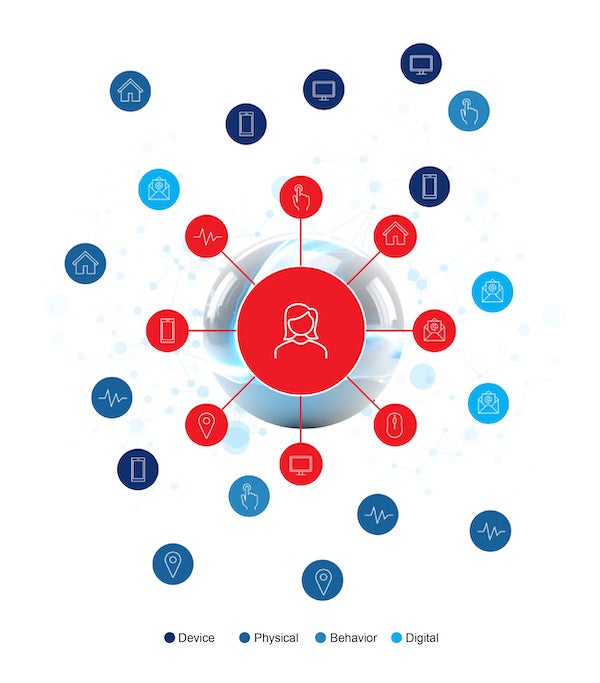

Understanding identity is central to navigating the evolving cybersecurity landscape and ensuring citizens have a positive digital experience.

Delivering secure and frictionless service starts with understanding identity verification and authentication at the core.

In the ever-changing landscape, the surge in global domestic cyber and fraud threats persists. Simultaneously, integrated and centralized systems, alongside digital identities, have become the norm. Agencies, in their pursuit to counteract threats, modernize legacy systems, and enhance the often-digitized constituent experience, grapple with escalating costs, dwindling resources, and soaring expectations. Within this dynamic scenario, LexisNexis Risk Solutions emerges as a valuable partner, providing expertise in navigating these challenges.

We work with government agencies to effortlessly fulfill their missions. From enabling transformative initiatives to delivering secure government services in real time through a centralized portal, or augmenting team resources with investigative analytics, we contribute to driving efficiency, transparency, and oversight across channels and agencies. LexisNexis Risk Solutions achieves this by precision by understanding identity. This isn't just what we do; it's who we are.

What We Do For Identity

- Public CIOs/IT

- Federal Social Services

- Public Health

- Federal Services

- Business Intelligence

- Loans & Funding

- Unemployment Insurance

- Department of Motor Vehicles

- Retirement & Employee Pensions

- State Social Services

- State Benefit Programs

- Fiduciary/Department of Revenue

- State Portals/Digital IDs

- Gaming/Gambling

- SNAP Disaster Assistance

- Collections

- Data Registries

- Education

- Tax & Regulatory

- Utilities

- Vital Records Offices

• Mobile

• In-Person

• Call Center

- Batch

- API

- Portal

- Online

- Channel

- Custom

- Contributory

- Breaks down data siloes

- Empowers ‘one golden record’

- 99.999% identity linking precision

- Single source for data, technology, analytics, and services

- Award-winning IAL2 compliant identity verification workflow

- 50+ years managing data and providing innovative for significant risk data analytics challenges

- Leading privacy-centric crowdsourced networks providing real-time global threat intelligence

- The LexisNexis® Digital Identity Network is implemented in over 179,000 websites and mobile applications globally

- Over 9,500 federal, state, and local government customers

- Nearly 100% coverage of U.S. population

Enabling Frictionless Identity Experience in Government

Modernize across channels and journeys with the power of global risk identity intelligence powered by privacy-centric crowdsourced networks that provide real-time global threat intelligence and behavioral identity authentication.

- Status account change verification

- Claims due diligence & request fulfillment

- Dual participation screening

- Financial & asset information

- Benefit assessment

- Investigative analysis & services

- Cross-agency account view

- Status account change verification & notification Data hygiene

- Program participant analysis

- Continuous monitoring

- Executive dashboards & analyses

- Identity verification & confirmation

- Knowledge-based authentication

- Document authentication

- Multi-factor authentication

- Behavioral biometrics

- Device authentication & feedback

- Email risk assessment

- Advanced bot detection

- Geolocation analysis

- Identity verification

- Document authentication

When Trust and Security Matters

Addressing Multiple Objectives Requires Balance

- Able to detect transnational and non-human threat vectors and networks.

- Adaptable security systems that evolve with new threats, including AI and other technologies.

- Proven ability to prevent identity fraud before it starts.

- Ability to understand who a person is across channels and devices and accelerate trusted interactions, while stopping criminals.

- Clear understanding of identities across systems, agencies, and states.

- Frictionless and secure user experience across interactions.

- Precise understanding of the true-identity of citizens.

- Equitable access for new-to-country, those with no credit, and digital footprint as well as minors.

- Ability to scale for low-tech, elderly, and financially-at-risk vulnerable constituents.

- Transform at scale for long-term growth.

- Executive dashboards to measure risk and efficiency.

- Able to deliver across channels seamlessly.

- Ability to leverage government investigative services to offset resource constraints.

People + Technology

People and their information change, and with billons of records to manage, it can be difficult to link records and identities.

Frictionless Technology

Our technology seamlessly links every individual's data overtime with 99.999% precision, giving you a complete picture of a person, not just a current snapshot.

Coverage of nearly100%of the U.S.

More than250 millionU.S. consumer entities.

Over87billion records.

Insights & Resources

Related Products

-

EssentialID™

Ensure fast and secure access to government programs with LexisNexis EssentialID™. Our seamless identity proofing process provides unparalleled global insights, speed, security, and transparency.

-

AmplifyID™

AmplifyID leverages decades of identity intelligence expertise and insight to preserve program integrity, provide equitable access and prevent fraud across Federal, state and local government.