Strengthen program integrity by defending

against identity-based threats.

Pinpoint Fraud with Focus

and Precision

Get a crystal-clear view of identities with AmplifyID

TM

Identity Risk Navigator.

Fraudsters are global and becoming more sophisticated. They’re continually refining their methods and testing for new vulnerabilities to access government benefits. During COVID, fraudsters entered government programs by using online platforms with low security perimeters. Unfortunately, fraud may be widespread throughout many program ecosystems.

Find the needles in the haystack

Government agencies are taxed not only with preventing fraudulent new applicants from entering their program but also finding the risk and fraud already hiding within their population. But surfacing those fraudulent identities is extremely time consuming. It can feel like an exercise in futility.

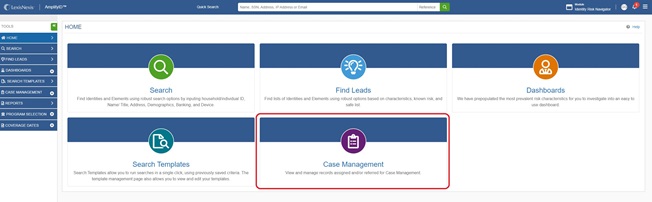

LexisNexis® AmplifyID™ Identity Risk Navigator (IRN) provides a crystal-clear view of your program’s participants so you can pinpoint fraudsters. It finds the needles in the haystack for you, by shining a light on the risk and fraud hiding in your population. Validate low-risk identities to review and clear cases quickly, allowing your investigators to uncover and focus on cases that require attention. AmplifyID™ Identity Risk Navigator enables you to:

- Use the Search and Quick Search tools to find risk tied to known identities

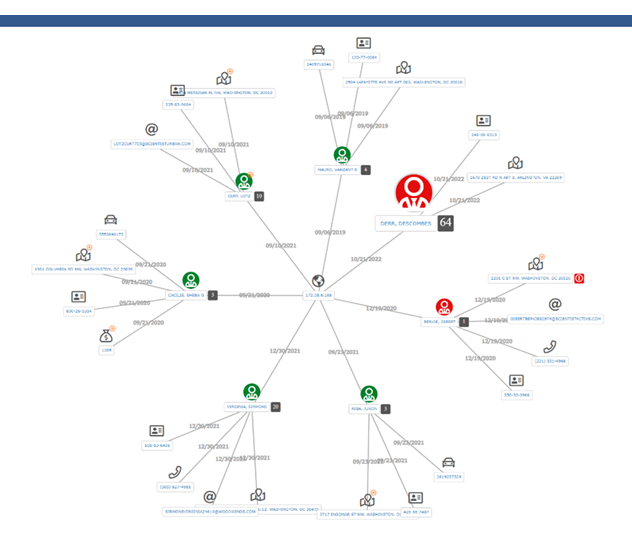

- Leverage Link Charts to expose risky relationships

- Uncover patterns of fraud and identify new perpetrators easily via the Find Leads tool

- Use uncovered insights to bolster agency defenses against future fraud and strengthen program integrity

- Create a queue and make notes with our Worklist feature in our Case Management tool

- Leverage Dashboards to quickly pinpoint areas of color-coded risk (red, yellow, green)

The full complement of tools available in Identity Risk Navigator gives investigators the edge in rooting out fraudsters and mitigating further fraud risk.

Stay true to your agency’s mission

Identity Risk Navigator strengthens fraud detection. Suspicious identities and activities become evident. With a clear view of identity in your population, you can allocate investigative resources effectively and stop more fraud.

AmplifyIDTM Identity Risk Navigator is your easy button to:

- Clear cases quickly and reduce backlogs

- Provide faster, frictionless service to eligible applicants

- Pinpoint fraud with confidence

- Reveal potential fraud early to prevent improper payments

- Streamline investigations and build strong cases

AmplifyIDTM Identity Risk Navigator offers:

- Easy implementation and use

- Actionable identity intelligence

- Unified view of fraud risks

- Insights for front-end preventive workflow

- Unique fraud tools such as Find Leads

- Smooth integration with DDP, RDP and other identity solutions

- Ability to easily assign/reassign, delegate roles, take notes, upload files, track case histories, tag key words, and integrate referrals

- Access to LexisNexis Risk Solutions investigative services

Make mission-critical, identity decisions with 99.99% precision.

AmplifyID Identity Risk Navigator brings texture and depth to suspicious identities. Visualization tools further reveal risky connections that signal larger coordinated schemes or evolving threat types. Investigators can use these insights to prioritize cases, allocate resources effectively, and stop more fraud.

Get answers fast

- Top 30+ risk attributes to detect fraud and risky behavior

- 98% coverage of the U.S. adult population

- 84 billion records

- 10,000+ data sets including alternative data Unrivaled, large-scale, data linking abilities analytics for identity insights

AmplifyID Identity Risk Navigator delivers robust, connected risk intelligence and analytics for investigations into possible fraud. It checks your agency’s data against 500 risk attributes, 30+ solely focused on risk – a leader in the industry. Your agency receives a comprehensive view of participants, one that quickly detects identity fraud and high-risk data elements.

Amplify investigative powers with services

AmplifyID Identity Risk Navigator can be agency self-directed or augmented with our LexisNexis® Special Investigation Unit (SIU). The SIU offers critical investigative services with analysts providing experience-driven insights into situations that might otherwise be impossible or take too long to unravel. These SIU analysts are former law enforcement, financial services, retail fraud, national security intelligence, and military intelligence analysts.

Utilizing the SIU in combination with AmplifyID Identity Risk Navigator empowers your agency with additional investigative and analytical bandwidth to investigate suspicious patterns and dubious identities fast.

The SIU can also provide:

- Research into agency data or investigations, with real-time monitoring of fraud and identity solutions

- Performance monitoring and analyzing of data to help stop attacks, technical issues, or other anomalous behavior before they become a problem

Want to know more? Request additional information about AmplifyIDTM Identity Risk Navigator.

Products You May Be Interested In

-

ThreatMetrix® for Government

Prevent fraud with next-generation digital identity assessment by ThreatMetrix®

Learn More -

BehavioSec®

Uncover user intent from login to logout with real-time behavioral and device intelligence

Learn More -

Emailage® for Government

Add email intelligence as a layer of defense to fraud prevention.

Learn More -

Flex ID

Speed customer onboarding and extend reach into expanding markets

Learn More -

InstantID®

Complete identity verification, spot fraud and uncover identity discrepancies in real time

Learn More -

One Time Password

Authenticate a user with a one-time login transaction

Learn More -

Phone Finder

Connect phones and identities with rank-ordered results

Learn More -

Risk Defense Platform for Government

Prevent fraud while providing a positive online experience for citizens

Learn More -

TrueID®

Recognize a true identity and fight fraud in real time

Learn More -

AmplifyID™ Master Person Index

Ensure equitable access and smooth service delivery with a precise, whole-person view

Learn More