Press Room

LexisNexis Risk Solutions Delivers the Next-Generation Life Segmentation Model with Risk Classifier with Medical Data

07/21/2021

ATLANTA — LexisNexis® Risk Solutions, a leading provider of data, analytics and technology for the insurance industry, today introduced LexisNexis® Risk Classifier with Medical Data, the first solution to combine up to six sources of behavioral and medical data and provide life insurers with a predictive mortality model that allows them to more accurately rate risk and help competitively price policies. This innovative solution was developed to improve the life insurance experience for insurers and consumers, giving life insurers more predictive, valuable data for an in-depth picture of risk so that more consumers can get access to the life insurance they need to protect their loved ones.

LexisNexis Risk Classifier with Medical Data aggregates long-standing and actuarially proven data sources including public records, credit attributes and driving behavior data as well as prescription history, medical diagnosis and clinical lab attributes. It is available through a strategic relationship with ExamOne®, a Quest Diagnostics company, which obtains medical data for this purpose with an insured applicant’s authorization, to form a next-generation mortality model that life insurers can integrate into their existing workflow for accelerated underwriting.

“Life insurance carriers are continually looking for ways to drive better risk differentiation and improve the consumer experience to build a competitive advantage,” said Debra Gangelhoff, vice president and general manager of Life Insurance at LexisNexis Risk Solutions. “The combination of behavioral and medical data integrated in one model through LexisNexis Risk Classifier with Medical Data helps life insurers reveal additional unknown risks and improve their mortality scoring for confidence in their underwriting program. It also helps lower underwriting costs and can help put a higher percentage of consumers through an accelerated underwriting path.”

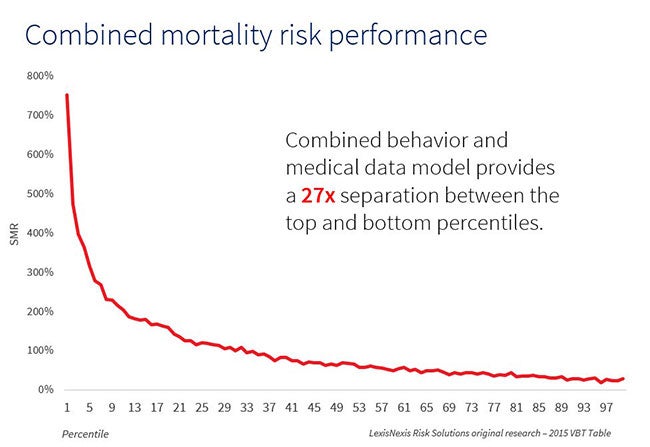

According to the data scientists at LexisNexis Risk Solutions, the next-generation combined model provides more mortality separation across risk classifications to determine a more accurate mortality score. This will help enable carriers to deliver consumers a faster and easier life insurance underwriting process. Ultimately, this can assist in getting more life insurance policies in the hands of more consumers.

“We found that when it comes to modeling mortality risk, combining behavior and medical data into a single model provides a 13x separation between the top and bottom deciles, which is 2.5x greater than prescription data alone, and it provides a 27x separation between the top and bottom percentiles,” said Patrick Sugent, vice president of Analytics at LexisNexis Risk Solutions.

Unlike traditional life insurance underwriting, which typically requires a paramedical exam, and often has lengthy application and underwriting processes, LexisNexis Risk Classifier with Medical Data helps life insurers get more information upfront, which may allow them to avoid the paramedical process altogether and accelerate their underwriting. As a result, consumers applying for life insurance appreciate the faster, more streamlined and less invasive life insurance underwriting process.

“The current economic climate and accelerated underwriting options provide life insurers with opportunities to reach new, untapped markets that have not traditionally bought life insurance before,” said Gangelhoff. “We are excited about the opportunity to help them continue maximizing data and advanced analytics to grow business and get life insurance in the hands of more families.”

For more information, please visit LexisNexis Risk Classifier with Medical Data.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463