Press Room

New Identity Management Study from LexisNexis Risk Solutions and Aite-Novarica Group Reveals Increase in Fraud as Industry Reports Uptick in Digital Transactions

09/22/2021

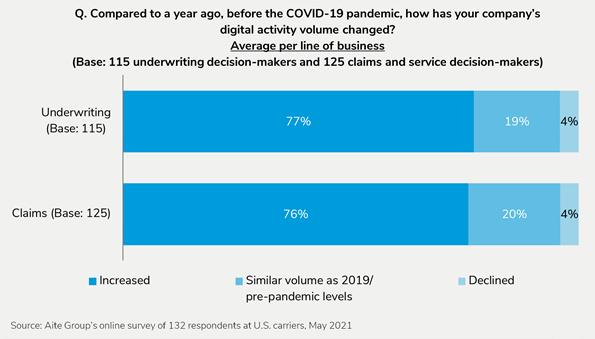

ATLANTA — A new insurance industry research study reveals that insurance carriers saw an increase in consumer digital activity across both underwriting (77%) and claims (76%) during the coronavirus pandemic and indicated this recent increase in digital activity has in turn spurred more identity fraud activity, according to 67% of survey respondents. Authored by Aite-Novarica Group and presented by LexisNexis® Risk Solutions, a leading provider of data, advanced analytics and technology for the insurance industry, the Insurance Fraud: Rethinking Approaches in the Digital Age report provides advice for carriers on how to identify vulnerabilities and ways to mitigate these vulnerabilities, while providing the ultimate customer experience to genuine consumers.

The survey focused on identity fraud prevention subject matter experts and decision makers at U.S. insurance carriers across life, personal (auto and home), and small commercial lines. Participants were asked to identify reoccurring points of entry for fraudulent individuals/activities and to share their thoughts about how carriers can better protect their underwriting, customer service and claims transactions without inhibiting the digital experience. The study reveals that as insurers seek to achieve business goals tied to digital transformation and place increasing importance on customer experience, they should evaluate their fraud strategies and capabilities across underwriting, customer service and claims, which needs to include implementing a multi-layered and comprehensive fraud mitigation strategy.

“Our experience tells us the largest drivers of identity fraud for insurance are a combination of purely digital transactions and the increased availability of consumer data whether on the dark web, social media or online consumer portals across all industries,” said Kim Brown, director, insurance identity access management solutions, for LexisNexis Risk Solutions. “Even as consumers opt for digital interactions, they still expect their policies, accounts and transactions to be protected against fraud. Similarly, some carriers expect digital activities to continue to grow over the next 12 months, and therefore need to invest in advanced identity verification and fraud mitigation solutions to ensure their business and their customers are protected. These identity verification and fraud mitigation solutions provide the dual benefit of helping carriers identify and flag discrepancies in the submitted data proactively, while providing carriers the ability to identify and fast-track genuine consumers with confidence”.”

Cost of Enhanced Customer ExperienceWhile carriers’ digital interactions are enhancing customer experience and creating deeper customer relationships over the life of a policy, 67% of insurers surveyed said that the increase in digital transactions has resulted in higher fraudulent activity. The most common points of entry for identity fraud among property and casualty (P&C) carriers are:

- Underwriting or at the point of application

- Customer service or at the point of account

- Claims at the point of payment

There are many types of solutions that have emerged to help protect online identity and accounts, but the level of adoption among carriers varies. While multi-factor authentication is being widely implemented across lines, more advanced fraud mitigation solutions like digital fraud risk scores and link analysis remain underutilized. Aite-Novarica recommends using a combination of solutions that specifically address fraud risk in underwriting, customer service and claims to complement existing customer-facing solutions and fill any additional vulnerabilities. According to the report:

- 73% of carriers currently use multi-factor authentication citing its increased accuracy in identifying fraud as well as its benefits for easing compliance, deployment and efficiency.

- 70% use one-time passwords, particularly life and small commercial carriers who highlighted its efficiency.

- 67% use password-free authentication, which is the top solution for reducing underwriting and claims fraud.

- Only 58% of carriers use link analysis and 54% use digital fraud risk scores, underscoring the need for further exploration and investment by many carriers.

Aligning solutions that can provide identity verification and authentication can help carriers avoid unnecessary risks, provide genuine consumers with a faster, low friction experience. Being able to systemically isolate the higher risk, carriers can now make better decisions across their workflow and defend their brand and their customers from cybercriminals and potential fraud.

“In order to bolster their defense against fraud throughout the policy life cycle, carriers need to ensure that their solutions accurately identify and prevent fraud from the point of entry, which will require multiple capabilities and a multi-layer approach,” said Michael Trilli, practice leader, insurance, for Aite-Novarica Group. “For carriers evaluating their current fraud strategies, I recommend looking for ways to merge data from multiple sources, combining fraud solutions to validate identity verification, and adopting processes to authenticate and escalate all potential security risks.”

The report outlines five recommendations to help carriers stay a step ahead of fraud before it impacts their bottom lines:- Recognize that the evolving digital activity between carriers, agents and consumers has become the new normal, and that you need to grow with it.

- Don’t overlook the current increase in fraud - address it before it results in higher claims costs, strained operations and tainted consumer relationships.

- Close the capability gap by implementing more advanced fraud prevention solutions.

- Adopt a multi-layered approach with multiple solutions for a stronger defense because no single technology will adequately detect and prevent fraud.

- Spread investment across functional areas to ensure your customers are protected throughout their policy life cycle.

To read the full report on Insurance Fraud: Rethinking Approaches in the Digital Age, click here.

Visit LexisNexis Insurance Fraud Solutions to learn more about the company’s identity access management and fraud prevention offerings.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts. Visit us on the web and connect with us on Twitter and LinkedIn.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463