Press Room

LexisNexis Demand Meter Shows U.S. Auto Annual Insurance Shopping Rate Decreased in Q3

New and Used Car Sales Decrease Year Over Year

11/22/2021

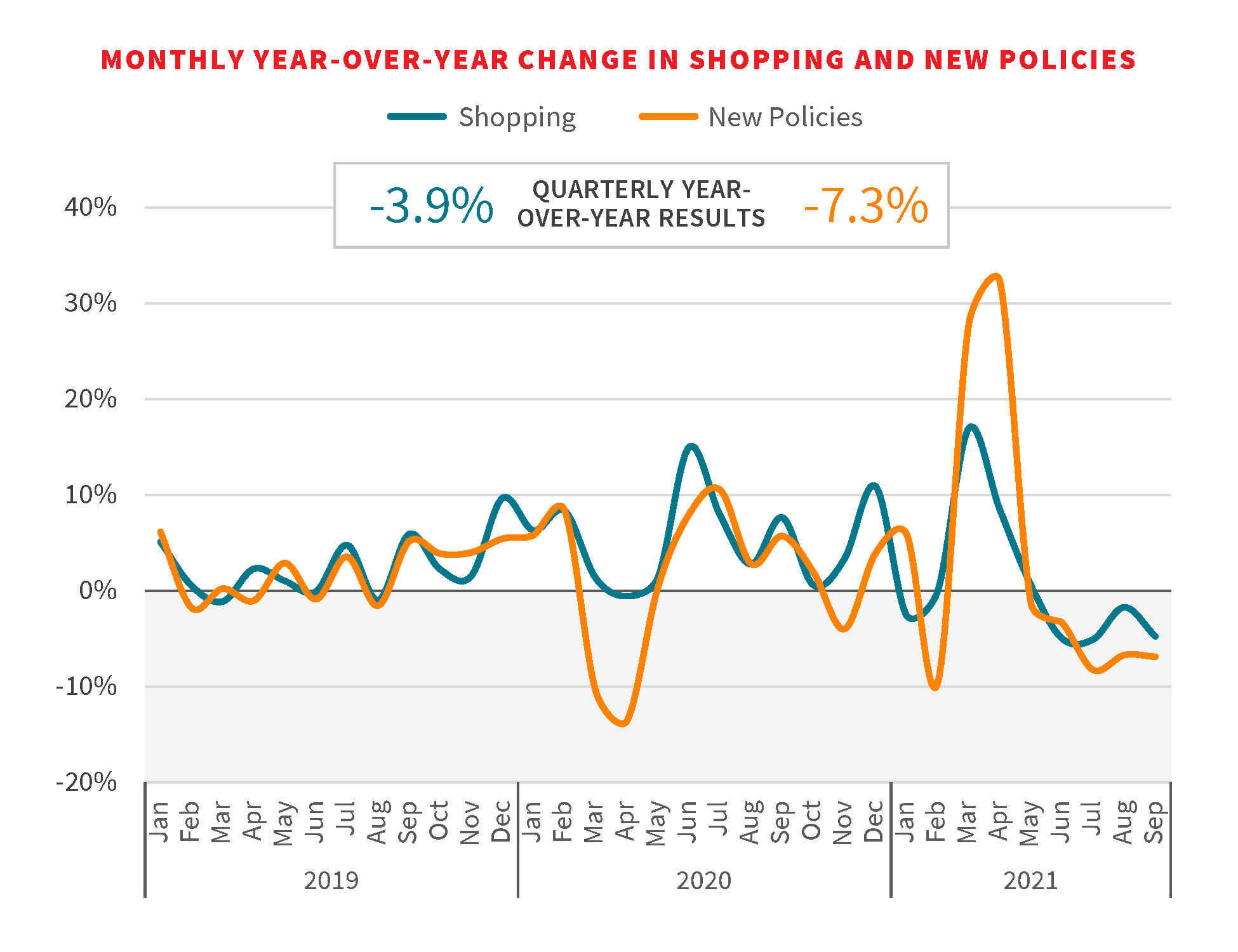

ATLANTA — The latest edition of the LexisNexis® Risk Solutions Insurance Demand Meter reports the overall annual U.S. auto insurance shopping growth rate decreased to -3.9% for Q3 2021. New policy growth also reached a two-year low, dropping to -7.3% for the quarter. While negative growth rates have been rare over the past decade, decreases in new business policy growth followed the downward trend that began in May and June as the insurance industry continues to face unparalleled circumstances and economic factors.

“Insurance shopping in Q3 returned to levels that compare to 2019 and years prior rather than following the unusual trends of 2020,” said Adam Pichon, vice president of personal lines insurance at LexisNexis Risk Solutions. “Prior quarters this year were fueled by consumers returning to normalcy, but that pattern was tempered by macroeconomic and carrier-driven factors that began impacting the market in Q2 and carried over into the third quarter.”

More consumers stayed with their current insurance carrier than in previous quarters, compared to the same time last year. Several micro and macroeconomic trends impacted insurance shopping in Q3, including:

- Global microchip shortages fueled new car inventory shortages and rising costs for used cars meant fewer overall new and used car purchases, which typically account for one in three shopping events;

- Claims frequencies have increased with drivers returning to the roads, which can lead to insurance carriers filing for rate increases and decreasing marketing spend to address profitability challenges. In some states where regulators have not approved increased rates, decreased carrier marketing spend is notable; and

- State-issued moratoria on policy cancellations were lifted, which may have caused more consumers to keep their policies than would normally occur.

In Q3, more U.S. consumers began leaving the auto insurance market, in volumes higher than the previous four years. This pattern was potentially influenced by rate increases and by the car shortage, where policy holders who lacked collision coverage may have been unable to replace vehicles.

“Leveraging more than ten years trends, we have seen the cyclical nature of insurance shopping trends,” said Chris Rice, associate vice president of strategic business intelligence, insurance, at LexisNexis Risk Solutions. “Consumers shop when they see their premiums increase, which often results from either a consumer experiencing a life event, such as purchasing a new home or vehicle or adding a newly licensed driver, or a higher bill when their policy renews as a result of a claim, a traffic violation, or their carrier raising rates.”

Download the latest Insurance Demand Meter.

About the LexisNexis Insurance Demand MeterThe LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly 90% of the universe of insurance shopping activity.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463