Press Room

Annual U.S. Home Insurance Trends Report Confirms Upward Trend in Loss Cost and Severity Across All Perils

Seven-Year Perspective

10/13/2022

ATLANTA — LexisNexis® Risk Solutions today released its seventh annual LexisNexis U.S. Home Trends Report, a source for U.S. economic home insurance and weather trends by peril for severity, frequency and location.

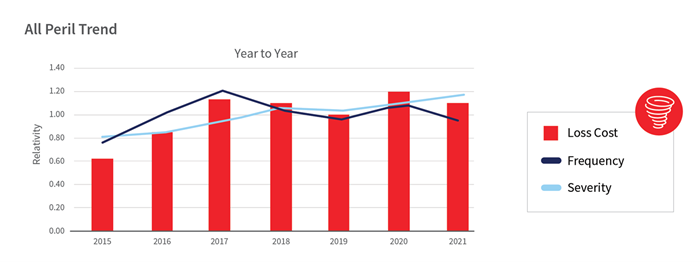

This year’s report, which is based on property exposures and losses for the seven-year period ranging from 2015 through 2021, reveals that although loss cost and frequency decreased across all perils in 2021, the seven-year trend shows a steady increase over time. Additionally, All Peril severity rose 7% year over year in 2021 as 95% of catastrophic losses were the result of Hail, Wind and Weather-Related Water perils, underpinning the fact that extreme weather events continue to be a major concern for U.S. homeowners and insurers.

“It is very important to provide the market with this seven-year data so that carriers will have a more balanced perspective and price risk within the context of long-term trends,” said George Hosfield, senior director of home insurance at LexisNexis Risk Solutions. “Given the unpredictable nature of extreme weather events like Hurricane Ian and their impact on catastrophic claims, as well as unforeseen events such as the COVID-19 public health crisis, carriers simply cannot afford to assess their books of business with limited or skewed data.”

Louisiana, Texas, Colorado and Nebraska experience highest loss costs

While All Peril combined loss cost was down in 2021, Weather-Related Water, Non-Weather Water, Theft and Other perils loss cost increased in 2021. In particular, the frequency of Weather-Related Water claims soared by 329% in 2021, and the frequency of those catastrophic claims rose 222% driven, in part, by the February storm in Texas that left many with broken pipes. Hailstorms in Texas, hurricanes in Louisiana and fires in California and Colorado contributed to the majority of catastrophe claims in 2021. Louisiana and Texas experienced the highest loss cost in 2021, followed by Colorado and Nebraska, which had the highest loss cost on average from 2015 to 2021.

Theft peril severity and loss cost reverse a five-year decline

The U.S. Home Trends Report also analyzed pre- and post-COVID-19 trends. As more people returned to the office, Theft peril severity and loss cost rose, reversing a five-year decline. Conversely, Liability peril continued its downward trajectory with loss cost decreasing 13% and severity down 23%. As noted in the report, the large decrease overall could be a continuation of the pandemic effects from 2020, when there were fewer social interactions and decreased legal system availability. A multitude of additional byproducts of the pandemic such as upticks in worker absences likely due to variants and sub-variants, ongoing supply chain issues, material shortages and rising home rebuilding costs all had significant impacts on homeowners and home insurers.

Additional key findings by peril from the LexisNexis Home Trends Report include:

- Wind: Wind loss cost decreased 35% and frequency decreased 36% from 2020 to 2021, while severity increased 2%. Loss cost and severity peaked in August 2021, driven by Hurricane Henri, Hurricane Ida and several tropical storms.i

- Hail: Loss cost of Hail claims decreased by 18% from 2020 to 2021, with 55% of Hail claims occurring in the second quarter. For the year, the U.S. experienced 3,763 major hailstorms.II

- Fire and Lightning: In 2021, loss cost for Fire and Lightning decreased, but the severity of claims remained at a similar level to that of 2020. Colorado accounted for 42% of catastrophe Fire and Lightning losses in 2021, up from 1.2% in 2020, while California only accounted for 16%, down 75% from 2020.

- Non-Weather-Related Water: Non-Weather-Related Water loss cost increased 8% and frequency increased 2% from 2020 to 2021, while severity also increased 6%. California had the highest loss cost in 2021, 10% higher than Arizona.

“When we speak to the benefit of looking at trends within a seven-year context as opposed to simply a one-year snapshot, combined Wind and Hail peril data are a prime example of how home insurers can be caught flat-footed without the right amount of data in their arsenal,” said Hosfield. “Certainly, it’s a positive for insurers that Wind and Hail had decreases in loss cost for 2021 when compared to 2020, but the seven-year trend indicates an average increase of 18% per year. This is just one example that home insurance carriers should keep in mind to help meet loss-ratio objectives and growth targets, as well as to help gain a deeper understanding of the risk associated with a particular location.”

Download the latest LexisNexis U.S. Home Trends Report.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

ii “Facts + Statistics: Hail,” Insurance Information Institute, 2022, https://www.iii.org/fact-statistic/facts-statistics-hail

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463