Press Room

LexisNexis Insurance Demand Meter Shows Strong Rebound in U.S. Auto Insurance Shopping and New Business Volumes in Q3 2022

11/16/2022

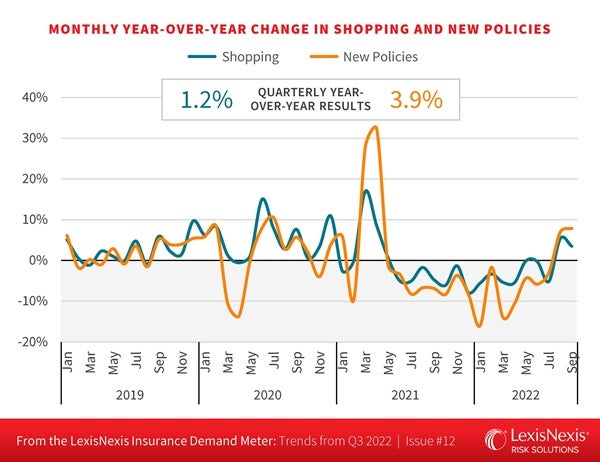

ATLANTA — The latest edition of the LexisNexis® Risk Solutions Insurance Demand Meter reports that quarterly year-over-year U.S. auto insurance shopping was up 1.2% in Q3 2022, up from -2.0% in Q2 2022, marking the first quarter-over-quarter growth since Q2 2021. The upward momentum occurred despite the fact that new vehicles sales remain depressed compared to pre-COVID annual trends, and significant temporary shopping decreases in late-September due to Hurricane Ian. LexisNexis Risk Solutions® observed that much of the Q3 shopping activity occurred in states where rate increases have been implemented in response to a surge in claims costs that began during the second half of 2021.

New policy growth increased 3.9% for the quarter, up from -7.1% in Q2 2022. Rate increases are prompting different profiles of consumers to shop, which has led to this significant increase in new business volumes from July (-3.0%) to +7.0% and +7.9% in August and September, respectively.

“We began Q3 with July trending down with the shopping growth suppression we’ve seen since Q3 2021, but shopping came roaring back later in the quarter. August matched record volumes from 2020, and then surpassed them in September,” said Adam Pichon, vice president and general manager of Auto and Home Insurance at LexisNexis Risk Solutions. “It is clear the auto insurance market’s rate activity is serving as a key catalyst in causing U.S. consumers to shop, especially in a handful of states where insurers have been able to quickly implement rate changes. In fact, we likely could have seen greater rises in shopping if not for Hurricane Ian and the devastation it caused in Florida.”

Shopping Up Even on the Heels of Hurricane Ian’s Disastrous Impact

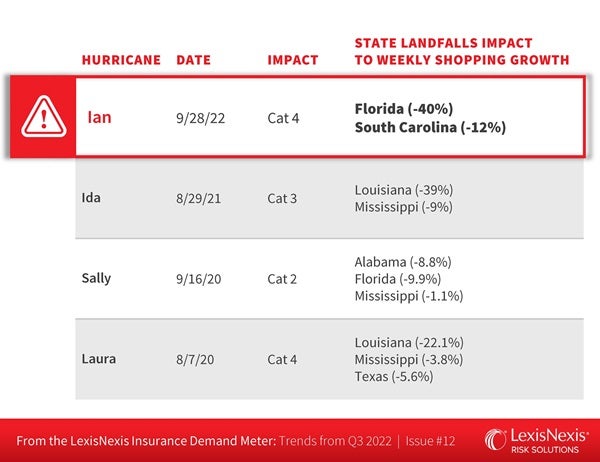

As of the Insurance Demand Meter’s publication, insured losses from Ian are estimated at more than $60 billion.1 Prior to the storm, Florida experienced auto insurance shopping volumes that were up 10% for most of August and September, including 13% higher the week before the storm. The week Ian made landfall, shopping volumes in Florida decreased 40%, impacting country-wide shopping volumes the following week by -6%.

“Unfortunately, these numbers are not surprising given the density of the impacted areas and the amount of destruction inflicted,” said Pichon. “Ian had a similar impact on shopping patterns seen with some of the other large storms that have made landfall in recent years.”

Rate Increases Reveal a Bevy of Consumer Behavior Changes

In the Q2 2022 edition of the Insurance Demand Meter, LexisNexis noted a shift to the middle-aged 25–55-year-old demographic shopping at the highest clip, and that trend continued into Q3 even as shopping growth rose across all age groups. While all age brackets shopped for lower premiums, each group turned primarily to independent agents.

“The independent agent distribution channel has shown the largest growth in volumes for the past few quarters,” said Chris Rice, associate vice president, strategic business intelligence, LexisNexis Risk Solutions. “Just as consumers shop during these volatile times, so too do independent agents seeking out and advising those individuals who have seen their premiums rise.”

Two notable consumer changes also became apparent during Q3:

- Consumers are shopping more carriers

- Those shopping are increasingly likely to buy a new policy

“Some of these changes can be attributed to the growth of shopping in the independent channel as agents can help customers shop multiple carriers at once,” said Rice. “We also saw many consumers shop across non-independent agent channels. We believe this is likely the result of more rate disparity in the market due to the timing of recent rate increases, which has enabled more consumers to find lower rates with insurers who may not have reacted as quickly to loss costs as their competitors.”

A Look Ahead

States where insurers already implemented rate increases such as Florida, Georgia, Illinois and Texas are likely to continue to see upward shopping growth in the months to come. But a number of other factors that could impact the U.S. auto insurance industry landscape may also be in play when it comes to whether shopping continues to surge or level out.

“It is very likely that certain states will see continued shopping momentum, but we are also tracking the lasting impacts of Ian, potential rate taking in many other states, and the potential for new car sales rebounding in the months to come,” said Pichon. “All of these factors will play a critical role in shopping patterns as we close 2022 and begin to look ahead to 2023.”

Download the latest Insurance Demand Meter.

*Editor’s Note: LexisNexis Risk Solutions will provide further information on the continued impact of Hurricane Ian on the U.S. auto insurance industry in its Q4 2022 Insurance Demand Meter.

About the LexisNexis Insurance Demand Meter

The LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly 90% of the universe of insurance shopping activity.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463