2023 Alternative Credit Data Impact Report

Gain Next-Generation Insights

|

Public Records |

|

Identity Insights |

|

Stability Insights |

|

Address Insights |

|

Alternative Credit

|

|

Asset Insights |

Alternative Data Offers Expanded Insight

An improved understanding of consumer credit risk can help you see

opportunity where others simply see risk.

Benefits of Non-Traditional Credit Sources

The key to better lending decisions is incremental predictive insights.

Extend better offers

Improve credit decisions on the margin by moreeffectively evaluating borderline applicants.

Grow approval rates

Identify off-margin consumers underestimatedby traditional credit scores.

Expand your addressable market

Seize opportunities to turn credit invisibles — boththin-file and no-file consumers — into valuable customers.

Improve booking rate and profitability

Extend more accurate pricing and terms to consumers across the credit spectrum who have been misclassified by traditional credit assessments.

Enhance portfolio management process

Monitor changes across the customer lifecycle. Have Sales Contact Me

Incorporating alternative credit data can deliver greater visibility into credit risk than using traditional data alone.

Alternative credit data goes beyond traditional credit data to deliver a broader, more comprehensive picture of consumer creditworthiness and associated risk. Non-traditional data like professional licenses, asset ownership and public records can help bridge the gap when paired with traditional credit data.

Alternative Credit Data Impact Report

Impact of Alternative Data Report Infographic

Alternative Consumer Data: What You Should Know

A New Perspective on Small Business Lending

“84% of respondents use alternative credit data in marketing and credit risk assessment across the customer lifecycle.”

LexisNexis Risk Solutions delivers a comprehensive report on the state of alternative data usage across the lending ecosystem. 225 financial institutions were surveyed, collecting responses from banks, credit unions, non-bank lenders and fintech organizations to gain insights on how alternative data is being leveraged in lending decisions, origination strategies and prescreen marketing.

Financial inclusion, increased visibility and improved segmentation are driving adoption of alternative credit data

Alternative credit data is driving meaningful business impacts

Overall satisfaction with alternative data is high, though some challenges and barriers remain

The 2023 Alternative Credit Data Impact Report offers more insights into

alternative data usage and outcomes, including deep dives into:

-

The top drivers of alternative data adoption

-

Benefits of incorporating alternative data and its impacts on revenue growth

-

Challenges that may be limiting adoption rates

Fostering Financial Inclusion with Alternative Data

It’s time to take an alternative look at financial inclusion.

20% of U.S. consumers have little to no credit footprint using only tradeline credit indicators, but many may actually meet lenders’ risk standards.1 Many in this diverse group are eager to access credit products and services but are too often underestimated by traditional credit scores.

Alternative data can help fill the gaps in credit history to present a more robust view of creditworthiness—allowing lenders to more accurately assess consumer credit risk, expand addressable markets and extend new financial opportunities to historically underserved populations.

Shifting Perspectives on Financial Inclusion

Alternative data insights can open a new path to inclusion and opportunity.

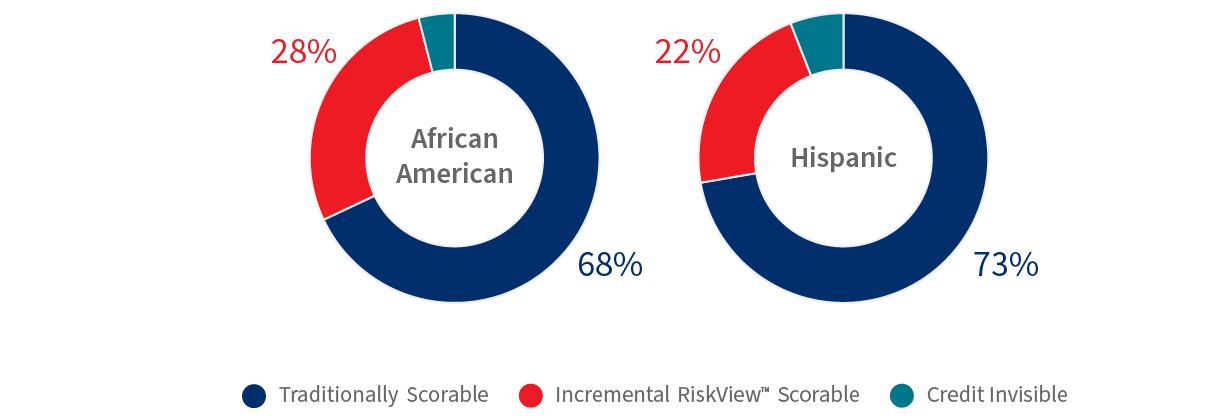

Historically, marginalized communities have consistently lower rates of credit scorability with traditional credit scores. Augmenting traditional credit scores with alternative credit data can help lenders build a more complete picture of creditworthiness.

Implementing alternative data into credit risk assessment can help lenders better serve overlooked creditworthy individuals and turn thin- or no-file consumers into valuable customers.

Alternative data could help financial institutions drive meaningful inclusion in underserved communities2.

Lower rates of credit scorability

Only 68% of African American and

73% of Hispanic communities are

scorable using traditional credit data

Expand scorable consumers

Evaluate 28% more African American

and 22% more Hispanic consumers

by leveraging alternative data

Gain greater clarity

23% boost in ability to score and

evaluate traditionally unscorable

consumers

2. LexisNexis Risk Solutions RiskView Financial Inclusion eBook

Gain Unprecedented Insight into Risk

Unlock a more robust view of consumer creditworthiness.

Traditional credit scores have long been a strong indicator of consumer credit risk — but in today’s shifting economic environment, lenders need fresh tools to drive portfolio growth and stay competitive.

Alternative data can be used to augment tradeline credit indicators, uncovering hidden risk factors that traditional credit data might miss. Using alternative data can give lenders the nuanced insights they need to improve consumer segmentation, provide more competitive terms and limit exposure to risk.

Enhance your credit risk assessment.

Alternative data allows lenders to sharpen segmentation based on the conventional broad categories — such as near prime, prime and super prime — into granular subgroups wherein credit scores fall within 20-30-point ranges.

Leveraging additional insights can allow lenders to uncover notable differences among consumers within the same traditional credit tier and thus make better decisions suited to the individual applicant.