- Home

- Insights and Resources

- Research

- Automotive Brand Loyalty Study - Mapping Brand Loyalty

LexisNexis® Risk Solutions Automotive Brand Loyalty Study

Automotive brand loyalty climbs to over 52.6% in 2024

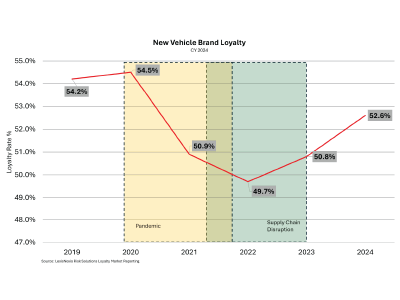

Automotive brand loyalty has rebounded to an impressive 52.6% for buyers of new vehicles in 2024. That represents a 1.8 percentage points increase from the end of 2023, when the loyalty rate was 50.8%. Loyalty rate refers to customers repurchasing new vehicles from the same brand they currently own. The 2024 rate through December, is nearing pre-pandemic levels. The 2024 figure is 1.6 percentage point below the year-end 2019 rate of 54.2%.

Eleven brands are above the industry average in brand loyalty. That is an improvement compared to 2023, when nine brands exceeded the average, and is on par with the number of brands achieving the same in 2019.

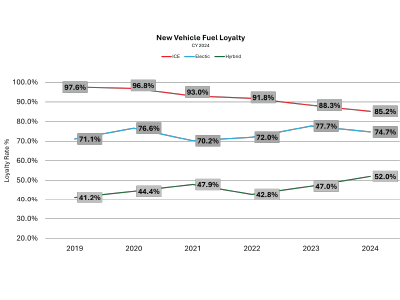

To understand how consumers are migrating across fuel types, LexisNexis® Risk Solutions analyzed new vehicle owners that disposed of a new vehicle and replaced it with another new vehicle. The fuel type of the disposal and the replacement were compared, and loyalty established when the fuel types of both vehicles were the same.

Consumer migration across fuel types saw owners continuing to dispose of an ICE (internal combustion engine) in exchange for hybrid and electric powertrains (see figure 1). Loyalty to ICE was 97.6% in 2019 and has steadily fallen to 85.2% in 2024. Loyalty to electric and hybrid vehicles have both been on an upward trajectory since 2019 however electric vehicle loyalty in 2024 decreased slightly from 77.7% to 74.7%. Hybrid vehicle replacements jumped 5 pp from 2023 to 52% in 2024.

Compared to 2023, in widely reported industry data, there is now more inventory available on dealer lots, offering consumers a wider range of choices. Consumers are no longer finding themselves in a predicament where they may need to switch brands to find the vehicles they want due to a lack of inventory. Affordability, however, continues to be a headwind for consumers looking to purchase a new vehicle.

Overall, the automotive industry's brand loyalty is on an upward trajectory (see figure 2). This trend is a positive indicator of brand strength and is particularly important as automakers address rising inventories and a shift in consumer preference toward EV and hybrid powertrains in the post-pandemic market.

figure 1

LexisNexis® Risk Solutions Loyalty Market Reporting, as of December 2024

figure 2

LexisNexis® Risk Solutions Loyalty Market Reporting, as of December 2024

Automotive brand loyalty has rebounded to an impressive 52.6% for buyers of new vehicles in 2024. That represents a 1.8 percentage points increase from the end of 2023, when the loyalty rate was 50.8%. Loyalty rate refers to customers repurchasing new vehicles from the same brand they currently own. The 2024 rate through December, is nearing pre-pandemic levels. The 2024 figure is 1.6 percentage point below the year-end 2019 rate of 54.2%.

Eleven brands are above the industry average in brand loyalty. That is an improvement compared to 2023, when nine brands exceeded the average, and is on par with the number of brands achieving the same in 2019.

To understand how consumers are migrating across fuel types, LexisNexis® Risk Solutions analyzed new vehicle owners that disposed of a new vehicle and replaced it with another new vehicle. The fuel type of the disposal and the replacement were compared, and loyalty established when the fuel types of both vehicles were the same.

Consumer migration across fuel types saw owners continuing to dispose of an ICE (internal combustion engine) in exchange for hybrid and electric powertrains (see figure 1). Loyalty to ICE was 97.6% in 2019 and has steadily fallen to 85.2% in 2024. Loyalty to electric and hybrid vehicles have both been on an upward trajectory since 2019 however electric vehicle loyalty in 2024 decreased slightly from 77.7% to 74.7%. Hybrid vehicle replacements jumped 5 pp from 2023 to 52% in 2024.

Compared to 2023, in widely reported industry data, there is now more inventory available on dealer lots, offering consumers a wider range of choices. Consumers are no longer finding themselves in a predicament where they may need to switch brands to find the vehicles they want due to a lack of inventory. Affordability, however, continues to be a headwind for consumers looking to purchase a new vehicle.

Overall, the automotive industry's brand loyalty is on an upward trajectory (see figure 2). This trend is a positive indicator of brand strength and is particularly important as automakers address rising inventories and a shift in consumer preference toward EV and hybrid powertrains in the post-pandemic market.

figure 1

LexisNexis® Risk Solutions Loyalty Market Reporting, as of December 2024

figure 2

LexisNexis® Risk Solutions Loyalty Market Reporting, as of December 2024