2025 Alternative Credit Data Impact Report

Exploring the global evolution of alternative data use in financial services.

Download the reportFinancial institutions are looking to alternative data to reduce risk exposure and improve portfolio performance.

In 2024, alternative data helped lenders regain visibility into consumer creditworthiness. Today, growing confidence in the predictive power of these insights is driving deeper integration across the credit lifecycle, as lenders make strategic adjustments to strengthen decision making and improve portfolio performance.

LexisNexis® Risk Solutions worked with Datos Insights to conduct a global online survey of 875 individuals at financial institutions across 10 countries. Collectively, their responses indicate a stronger focus on end-risk management and operational precision in response to current and anticipated market changes. In the latest edition of our annual report:

Download the reportLexisNexis® Risk Solutions worked with Datos Insights to conduct a global online survey of 875 individuals at financial institutions across 10 countries. Collectively, their responses indicate a stronger focus on end-risk management and operational precision in response to current and anticipated market changes. In the latest edition of our annual report:

- Discover the top challenges lenders expect to face over the next two years

- Learn about leading drivers behind alternative data adoption and expansion

- Explore the measurable impact of alternative data on risk evaluation and portfolio performance

Turn alternative data into your competitive advantage.

Explore how alternative data is helping organizations sharpen risk assessment, optimize efficiency and compete more effectively through clearer, deeper insights into consumer behavior and financial stability.

Download the following resources to learn more:

Have Sales Contact Me

Gain Next-Generation Insights

Alternative credit data looks beyond traditional credit data, which typically focuses on long-established credit activities. These expanded credit insights, when paired with traditional credit behaviors, deliver a more comprehensive view into a consumer's creditworthiness.

|

Public Records |

|

Identity Insights |

|

Stability Insights |

|

Address Insights |

|

Alternative Credit

|

|

Asset Insights |

Alternative Data Offers Expanded Insight

An improved understanding of consumer credit risk can help you see

opportunity where others simply see risk.

Benefits of Non-Traditional Credit Sources

The key to better lending decisions is incremental predictive insights.

Using scoring models and attributes which tap into proven and reliable sources of alternative credit data allows you to:

Extend better offers

Improve credit decisions on the margin by moreeffectively evaluating borderline applicants.

Grow approval rates

Identify off-margin consumers underestimatedby traditional credit scores.

Expand your addressable market

Seize opportunities to turn credit invisibles — boththin-file and no-file consumers — into valuable customers.

Improve booking rate and profitability

Extend more accurate pricing and terms to consumers across the credit spectrum who have been misclassified by traditional credit assessments.

Enhance portfolio management process

Monitor changes across the customer lifecycle. Have Sales Contact Me

Frequently Asked Questions

Alternative credit data (sometimes referred to as alternative data) is credit decisioning data that incorporates life event insights like professional licenses, asset ownership and public records, as well as credit-seeking behaviors from markets like online lending and short-term lending. Alternative data is not credit tradeline information.

Our alternative data provides risk intelligence to better assess an individual or organization's credit risk beyond traditional credit data. These insights may include enriched visibility into credit-seeking behavior, professional licenses, residential stability, asset ownership and more.

Alternative data examples include utility payments, professional licensing, asset ownership, liens, judgments and bankruptcy records.

Alternative data can help fill the gaps in credit history to present a more robust view of creditworthiness—allowing lenders to more accurately assess consumer credit risk, expand addressable markets and extend new financial opportunities to historically underserved populations.

Financial institutions that use alternative data for credit risk assessment can address the two primary consumer segments who struggle with financial inclusion, credit invisible consumers and non-prime consumers. By scoring the vast majority of credit invisible consumers underestimated by traditional data, alternative data can unlock meaningful financial inclusion opportunities for lenders.

Fostering Financial Inclusion with Alternative Data

It’s time to take an alternative look at financial inclusion.

20% of U.S. consumers have little to no credit footprint using only tradeline credit indicators, but many may actually meet lenders’ risk standards.1 Many in this diverse group are eager to access credit products and services but are too often underestimated by traditional credit scores.

Alternative data can help fill the gaps in credit history to present a more robust view of creditworthiness—allowing lenders to more accurately assess consumer credit risk, expand addressable markets and extend new financial opportunities to historically underserved populations.

Shifting Perspectives on Financial Inclusion

Building financial inclusion strategies that drive revenue and increase customer opportunity.

Alternative data insights can open a new path to inclusion and opportunity.

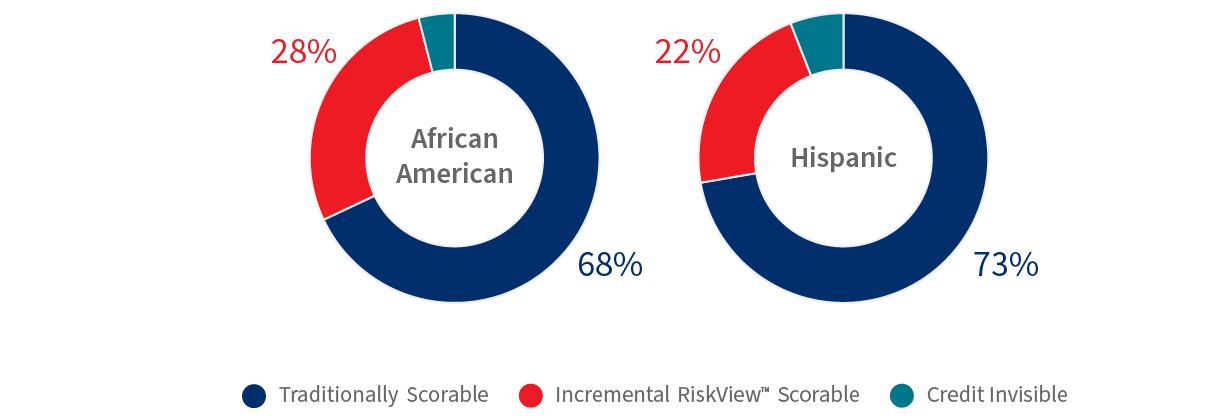

Historically, marginalized communities have consistently lower rates of credit scorability with traditional credit scores. Augmenting traditional credit scores with alternative credit data can help lenders build a more complete picture of creditworthiness.

Implementing alternative data into credit risk assessment can help lenders better serve overlooked creditworthy individuals and turn thin- or no-file consumers into valuable customers.

Alternative data could help financial institutions drive meaningful inclusion in underserved communities2.

Lower rates of credit scorability

Only 68% of African American and

73% of Hispanic communities are

scorable using traditional credit data

Expand scorable consumers

Evaluate 28% more African American

and 22% more Hispanic consumers

by leveraging alternative data

Gain greater clarity

23% boost in ability to score and

evaluate traditionally unscorable

consumers

1. LexisNexis Risk Solutions Information Hub, 2021

2. LexisNexis Risk Solutions RiskView Financial Inclusion eBook

2. LexisNexis Risk Solutions RiskView Financial Inclusion eBook

Gain Unprecedented Insight into Risk

Unlock a more robust view of consumer creditworthiness.

Traditional credit scores have long been a strong indicator of consumer credit risk — but in today’s shifting economic environment, lenders need fresh tools to drive portfolio growth and stay competitive.

Alternative data can be used to augment tradeline credit indicators, uncovering hidden risk factors that traditional credit data might miss. Using alternative data can give lenders the nuanced insights they need to improve consumer segmentation, provide more competitive terms and limit exposure to risk.

Enhance your credit risk assessment.

Alternative data allows lenders to sharpen segmentation based on the conventional broad categories — such as near prime, prime and super prime — into granular subgroups wherein credit scores fall within 20-30-point ranges.

Leveraging additional insights can allow lenders to uncover notable differences among consumers within the same traditional credit tier and thus make better decisions suited to the individual applicant.

40%

of consumers being in

a more prime score band1

30%

of consumers being in

a less prime score band1

The benefits of an expanded view of risk.

Gain greater visibilityinto changing credit risk

Better serve consumers withimproving financial situations

Identify evolving risk factorsand mitigate exposure

Attract and retain moreprofitable accounts

Boost booking rates and averagecustomer lifetime values

Increase your competitive edge

1. LexisNexis Risk Solutions RiskView Refining Prime eBook

This article is for educational purposes only and does not guarantee the functionality or features of LexisNexis products identified. LexisNexis does not warrant this article is complete or error-free .