Raising the Bar for Credit-Based Insurance Scores

LexisNexis® Attract™

Attract™ credit-based insurance scores help carriers conveniently and accurately classify insureds and applicants according to their risk potential, leading to improved underwriting.

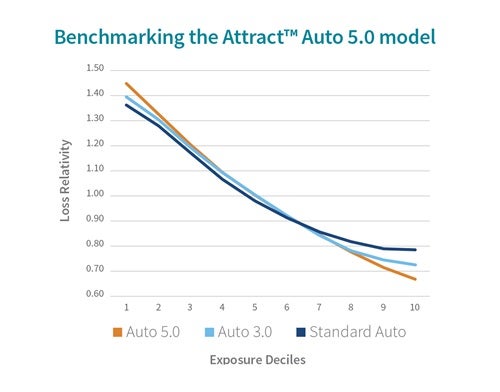

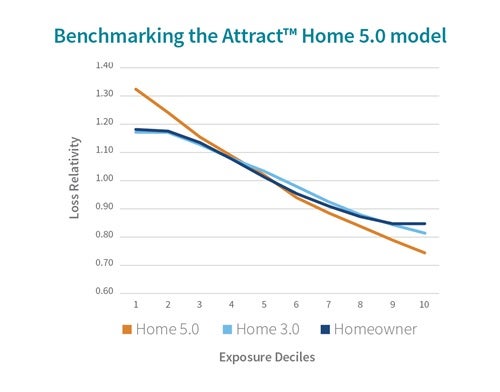

Advances in statistical computing allow for an ever-more iterative approach to model building. Our team of statisticians possesses a wealth of model-building experience, including our existing off-the-shelf Attract™ models, along with numerous carrier-specific models. Our modeling team has re-examined and overhauled minimum scoring criteria, resulting in fewer “no-score” returns than previous models.

Take advantage of these next-generation credit-based insurance scores to actively manage risk. Apply new Attract™ capabilities to rank applicants and make better use of credit-related data for accurate risk assessments that boost underwriting efficiency.

I'd like to speak to a LexisNexis Risk Solutions Representative about Attract™

LexisNexis® Attract™ is a consumer reporting agency product provided by LexisNexis Risk Solutions and may only be accessed in compliance with the Fair Credit Reporting Act, 15 U.S.C. 1681, et seq. Due to the nature of the origin of public record information, the public records and commercially available data sources used in reports may contain errors. Source data is sometimes reported or entered inaccurately, processed poorly or incorrectly, and is generally not free from defect. This product or service aggregates and reports data, as provided by the public records and commercially available data sources, and is not the source of the data, nor is it a comprehensive compilation of the data. Before relying on any data, it should be independently verified.