Authenticate Consumer Identities in Near Real-Time

Benefits

Realize the Benefits of Near Real-Time Knowledge-Based Authentication

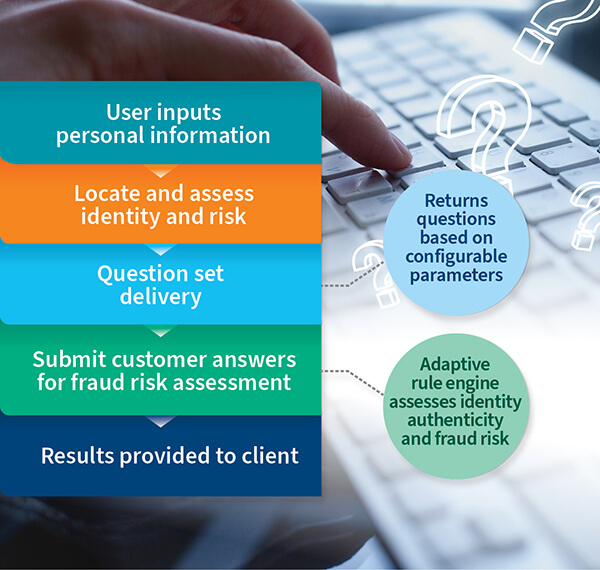

InstantID Q&A helps confirm a consumer's identity in seconds and gives your organization an easy, near real-time method to fight identity fraud at multiple points of consumer contact. Simplify the authentication process and help your business:

- Confirm identities on the spot in near real time

- Expand consumer touch points while mitigating fraud

- Accelerate consumer onboarding

- Improve the consumer experience

- Reduce the operational costs of authentication and improve margins

- Strengthen authentication

Leverage Identity Insight Built from Billions of Proprietary Records

Built-in intelligence and proprietary matching algorithms power the InstantID Q&A question engine, which is designed to develop questions and dynamically adjust question difficulty to a level where only an individual with personal knowledge could accurately answer. LexID®, our advanced data-linking technology, provides instant access to billions of commercially available and regulated data sources and non-credit content to generate a robust source of questions that are top of mind for your customer. The solution leverages superior linking technology and answers that sophisticated fraudsters cannot easily access. InstantID Q&A delivers near real-time Pass/Fail results, intelligent reporting and archiving to support informed decisions and improve consumer onboarding efficiency.

Authenticate Consumers by Asking Unique Questions with Answers Unavailable Elsewhere

InstantID Q&A can be enhanced with Shared Secret Questions and Customer Data Driven Questions for a superior quiz engine that fortifies your fraud security.

Shared Secret Questions is initiated during the enrollment process, where consumers provide answers to security questions which are used later for authentication. These secrets, by design, represent new data not available through credit reports, social media, online searches or other resources.

You have full flexibility to choose the questions, answers and wording that you want. Make questions specific to your geographical region, industry or any topic. For example, questions can be fill-in-the-blank, such as “What is the first name of your childhood best friend?” or multiple choice, “Which of the following is your favorite football team?”

Use Shared Secret Questions for authentication on functions such as password reset, account maintenance or changes, and high-risk actions like large fund transfers. Please note that Shared Secret Questions cannot be used for new account opening/registration or benefits enrollment.

For even more robust security, add Customer Data Driven Questions to InstantID Q&A. Using data only available within your organization, create unique questions that fraudsters are unlikely to answer. For example, “What is the amount of your recurring monthly payment to our company?” Your organization provides the correct answer, while the quiz engine generates the incorrect choices. Like Shared Secret Questions, Customer Data Driven Answers is not applicable to new account opening/registration or benefits enrollment.

Queries are unique to your business, adding another level of secure authentication without introducing unnecessary friction to the consumer experience. These new, enhanced questions add to the InstantID Q&A foundation of leading and refined question-based authentication products.

Prevent Identity Theft and Strengthen Compliance

InstantID Q&A delivers advanced tools to help you comply with Section 326 of the USA PATRIOT Act, the Gramm-Leach-Bliley Act, FFIEC (Federal Financial Institutions Examination Council) multi-factor authentication rules and the Fair and Accurate Credit Transactions (FACT) Act. InstantID Q&A is designed to fit your business policies and identity fraud risk tolerance levels with sophisticated features that enable you to customize scoring parameters and measure risk as questions are asked. Pass/Fail results are delivered in near real time via a secure web based portal, API integration or at the point of sale, enabling you to confirm consumer identities at the point of contact.

Features

Employ Proactive, up-Front Identity Fraud Detection

The Identity Event™ module proactively monitors identity intelligence risk levels and enables question types and multiple configuration options to be dynamically adjusted in near real time. Using the Identity Event module, the risk associated with an identity can be quantified as part of the existing authentication and the configuration of questions and risk tolerance can be adjusted to reflect the unique conditions discovered at run time.

Confirms “Something You Know” and “Something You Have”

InstantID Q&A via SMS* strengthens the consumer authentication by confirming both something they know and something they have. It leverages the same powerful content of the full quiz but requires an answer to only a single question. The user’s correct answer combined with their presence at an associated phone number helps confirm their identity.

The process requires only three quick steps:

- Consumer begins a high-risk transaction online. The system generates a question related to that consumer’s identity.

- Consumer receives an SMS text with multiple answers to a phone number associated with their identity.

- Consumer enters the code that corresponds to the correct answer. In a call center situation, the consumer tells the agent the code. The agent sees only the correct code, not the actual answers, so the consumer’s personal information isn’t exposed.

InstantID Q&A via SMS is ideal for situations in which a more secure method of authentication is necessary. But because it asks only one question, the onboarding process is streamlined and causes minimal friction for the consumer.

Easy-to-Audit Results

InstantID Q&A helps improve your margins by reducing the operational costs of authenticating users and mitigating the cost of exceptions processing and manual processing. Robust reporting features enable your organization to efficiently monitor your identity authentication processes.

InstantID Q&A delivers historical reports that can be accessed 24/7 through a self-service function. Detailed transaction reporting includes questions sets, pass/fail rates, users, status, reference number, and time and date. Additionally, LexisNexis® Risk Solutions archives all transaction histories.

Implement InstantID Q&A Quickly and Easily

Built on a universal ASP platform, InstantID Q&A can be deployed fast. There is an easy-to-use web portal with turn-key authentication processing, or the solution can be seamlessly integrated via API, an advanced web services interface or at the point of sale.

Comprehensive Customer Service

LexisNexis® Risk Solutions supports compliance and fraud personnel actively monitoring verification performance on a client-by-client basis.

Get it now: For more information about LexisNexis® InstantID® Q&A, please call 1-408-200-5755.

* The SMS feature is an additional configuration option. For more information, call 1-408-200-5755 or contact your sales representative.

InstantID® Q&A does not constitute a "consumer report" as that term is defined in the federal Fair Credit Reporting Act, 15 USC 1681 et seq. (FCRA). Accordingly, InstantID® Q&A may not be used in whole or in part as a factor in determining eligibility for credit, insurance, employment or another permissible purpose under the FCRA. Due to the nature and origin of public record information, the public records and commercially available data sources used in reports may contain errors.