Press Room

U.S. Auto insurance Shopping Shows Positive Growth in Q3 Despite August Slowdown

New Policy Purchases and Equips Insurers with Trended Data to Guide Decision-Making

ATLANTA — To help carriers understand the ever-changing market and offer them benchmark insights, LexisNexis® Risk Solutions released its latest Insurance Demand Meter, reporting on Q3 U.S. auto insurance shopping activity. The Meter shows that both shopping and new business policy volumes increased overall in the third quarter, but slowed in August, likely impacted by the end of the Coronavirus Aid, Relief and Economic Security (CARES) Act benefits, significant hurricane activity, and the wildfires in the West.

Extreme weather events

Destructive hurricanes in the Gulf, including hurricanes Laura and Marco, which both made landfall in Louisiana less than a week apart, and an unusually large number of wildfires across the West seemingly significantly impacted auto insurance shopping on a regional level.

- Comparing shopping volumes against those days in 2019, shopping volumes fell 18% from last year’s volumes after Hurricane Marco hit; then volumes fell off 36% after Hurricane Laura’s impact a few days later.

- California fires appear to have caused a reduction in shopping volumes for two consecutive weeks in mid-August (-9.2%, -8.0%, respectively) and Washington saw a drop in growth by -8.2% in late-August, correlating with the peak of fire activity within those states.

Uninsured and Insured Shopping

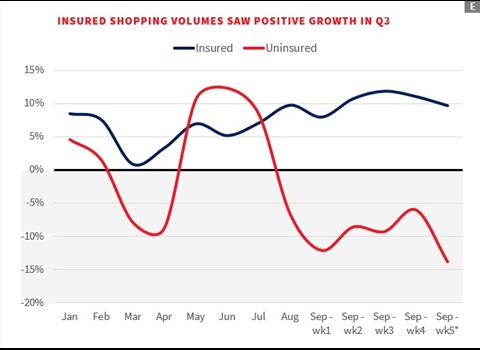

Insured shopping volumes saw a positive growth of nearly 10% in Q3. Conversely, uninsured shopping started falling in August, holding a steady -10% growth rate from mid-August through September, likely a result of a combination of unemployment benefits expiring at the end of July and insurance carrier cancellation moratoria that resulted in fewer insureds leaving the market.

“Despite a challenging Q3 for many consumers, as the economy continues to improve and unemployment levels normalize, we expect consumers to return to the auto insurance market, which will accelerate new policy growth and ultimately help to decrease uninsured motorist claim frequency,” said Tanner Sheehan, associate vice president of auto insurance at LexisNexis Risk Solutions. “Extreme weather events also proved to disrupt the auto insurance market this quarter and if no improvement is shown, we could see continued negative implications for insurance carriers down the line.”

Additional key insights from Q3 include:- New policyholders, new revenue opportunities: The auto insurance shopping quarterly growth rate averaged 6.1 % in Q3, ending the quarter at 7.6%. New business growth also increased to 5.7% during the quarter, which was nearly twice the growth rate of both the previous year and the 5-year quarterly average.

- Trends by shopping channels: The reduction in shopping among the uninsured impacted each of the distribution channels differently. For example, direct channel volumes remained flat to negative, which tends to be most preferred by shoppers without insurance.

“Given the unprecedented impact we’ve seen thus far, the COVID-19 pandemic will likely continue to influence the auto insurance shopping market throughout 2020 and continue to affect market dynamics into 2021. As of now, potential stimulus and Americans eventually returning to work in-person will be the biggest drivers of results in the insurance market in the near term,” Sheehan continued.

About the LexisNexis Insurance Demand MeterThe LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly 90% of the universe of shopping activity.

To download the latest Insurance Demand Meter, click here.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions leverages the power of data, advanced analytics platforms and integrated AI solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463