Combating insurance digital identity claim fraud with a multilayered approach

Research from LexisNexis® Risk Solutions brings insights into digital identity fraud detection

Digital claims bring convenience and risks

Virtual and touchless claims are becoming commonplace in the personal insurance marketplace. Lowering friction for successful digital claims processing delivers customer convenience and cost savings to carriers. But digital claims also bring significant risks. Fraudsters are now evading detection, filing digital claims using synthetic identities constructed from stolen and artificially created data. LexisNexis® Risk Solutions new report Detecting the Undetectable offers key metrics for assessing digital claims threats and highlights how some carriers differ from their competitors in responding to insurance identity fraud.

Awareness of the problem accelerates response

The LexisNexis® Risk Solutions research showed knowledge is driving action. The more companies that understand the issue, the greater their response. Leaders are recognizing the risks of digital claims identity fraud and staying at the forefront of detection efforts in the industry by using more advanced ID verification tools. Laggards are running a risk that grows every day, as yesterday’s security measures are rendered useless by tomorrow’s digital tactics. To guide decision-making, the research offers seven key questions carriers must answer to develop their own successful approach for authenticating genuine customers and defeating fraud attempts.

Identity Fraud risk increasing

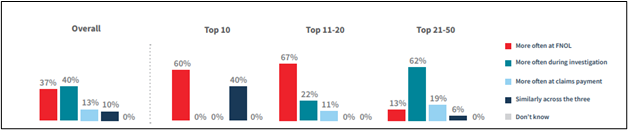

As use increases, identity fraud is going to rise along with it. Catching digital identity fraud at First Notice of Loss (FNOL) rather than during investigation is identified in the research as a key difference between industry leaders and laggards. Leaders were shown to be trying a variety of solutions and recognizing the need to be at the forefront of the industry. Laggards by comparison are running a risk that grows larger every day, as existing security measures are rendered useless by cutting-edge digital tactics. The research also notes the knock-on benefits to robust security, including lowered operational costs and reduced detrimental impacts to customer trust and brand reputation.

Digital claims here to stay

Adoption of digital claims processes spiked in response to the pandemic. Today 62% of carriers are offering digital and online portals for their customers. More than half of claims are now submitted via online or mobile channels. More than a quarter of claims are now paid out by alternative methods such as digital payment, mobile wallet or prepaid virtual cards. In two years, most insurance companies will be offering digital self-service options. It’s clear that digital claim fraud must be top of mind for an insurance organization to be an industry leader. Read the full report Detecting the Undetectable to understand the critical differences separating leaders from laggards in the efforts to detect and prevent insurance identity fraud.