Responding to latest AI and digital innovations used for personal insurance claims fraud

LexisNexis® Risk Solutions research highlights the importance of multi-factor authentication in fight against digital identity claims fraud

New tools, new threats

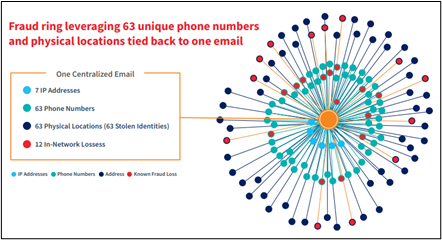

Artificial intelligence, synthetic identities and self-service claims are the latest tools being used to commit insurance digital identity claims fraud. New research from LexisNexis® Risk Solutions, Detecting the Undetectable, shows a growing gap in the response as personal lines insurance companies choose to actively meet the challenge or retrench behind limited service options as a means of reducing identity fraud opportunities.For years fraud rings relied on the stolen personal details of real people to commit insurance identity fraud. Now criminals have gone a step further, inventing synthetic identities stitched together from real and fake info, mounting larger and larger attacks on insurance companies’ digital self-service claims processes.

These frauds are increasingly difficult to detect before or after the event. Successful fraud with synthetic identity attempts can also go undetected, further impacting ROI. It leaves personal line carriers in a dilemma. Providing low-friction customer experiences while filtering out fraud and criminal elements is critical for success.

Innovations bring expectations

Digital claims channels are changing the insurance industry forever. The need to offer digital claims channels for customer convenience and the bottom-line benefits of modern self-service options cannot be ignored. Balancing customer experience with identity fraud mitigation is a key goal. Companies that don’t offer these features will lose market share to competitors with cutting-edge customer service.

Understand your best response

More than half of personal line claims are now submitted via online or mobile channels. More than a quarter of those claims are now paid out by alternative methods such as digital payment, mobile wallet or prepaid virtual cards. In two years, most insurance companies will be offering digital self-service options.

As digital claims use increases, identity fraud is going to rise with it. The LexisNexis Risk Solutions research outlines how companies that aren’t following best practices have a fraud cost that’s 25% higher than companies using a multi-layered approach. Digital claim fraud presents risks to brand reputation, operational costs and the bottom line. Effective responses are possible with a better understanding of critical factors. Read Detecting the Undetectable to gain the latest insights.