Landing the Plane During a Storm: Using Data to Drive Profitable Growth During a Hard Insurance Market

The Insurance Industry’s “100-year Storm”

As the insurance industry moves farther away from the height of the Covid-19 pandemic of 2020-2021, the market effects that followed and continue to persist are still reverberating in the industry. The hard market - or the insurance industry’s “100-year Storm” is providing carriers with several compounding headwinds that are making it difficult to grow and remain profitable:

As the insurance industry moves farther away from the height of the Covid-19 pandemic of 2020-2021, the market effects that followed and continue to persist are still reverberating in the industry. The hard market - or the insurance industry’s “100-year Storm” is providing carriers with several compounding headwinds that are making it difficult to grow and remain profitable:

- The economy has experience persistent inflation following the height of the pandemic. As of July 2023, inflation was +4.7%.1

- Vehicle repair costs have increased significantly, growing 21.7% from July 2021-2023.2

- The industry has experienced unprecedented insurance profitability issues. The private auto combined ratio for the year ended 2022 was 111.8%.3

- Insurer rate increases grew by 14% in 2023.4

- Estimated cuts in carrier annual advertising spend compared to 2021 to reach -$5.0 billion.5

Pilots, like insurance carriers, have to navigate storms to fly their planes to their destinations safely. Instead of economic and market headwinds, pilots will face literal headwinds that may prevent a smooth flight and or landing. Pilots have three choices when facing a severe storm in their flight path. They can divert the plane to a different airport, circle the sky and wait the storm out, or can land the plane. Similarly, insurance carriers are taking one of three actions when facing this “100-year Storm”:

- Diverting and abandoning current growth plans – Some carriers are exiting states and even lines of business, eliminating distributions channels, shutting down marketing spend and purposefully losing market share.

- Circling and putting plans on hold – Other carriers are restricting underwriting criteria, limiting distributions channels, reducing marketing spend and even shedding select policies.

- Landing and growing profitably through the hard market – The third and final group is advancing toward rate adequacy, unlocking marketing spend to grow, focusing more on retaining high lifetime value customers and taking advantage of available opportunistic gains in market share.

Navigating a Hard Market: The Insurance Market Intelligence Cycle Summary

In a storm, pilots rely on technology and tools to help them navigate and determine their course of action. It is no different for carriers determining their best path toward profitable growth during this “100 Year Storm.” Data-driven acquisition and retention campaigns and strategies can help guide a successful strategy that steers the way toward insurance profitability.

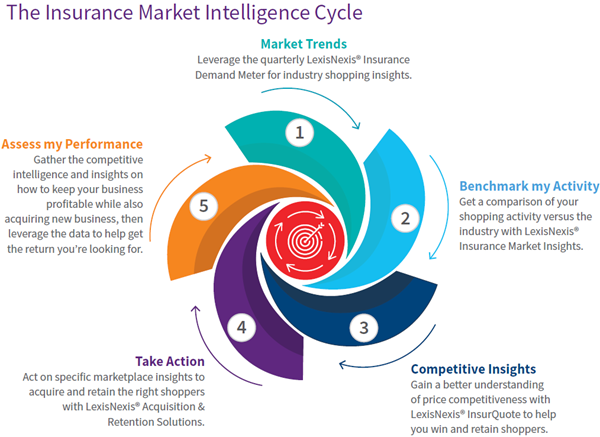

LexisNexis® Risk Solutions has developed the Insurance Market Intelligence Cycle to provide carriers a foundational framework to put data at the center of acquisition and retention decision making, enabling profitable growth during all market cycles the industry is facing.

- Market Trends – Leverage the quarterly LexisNexis® Insurance Demand Meter for industry shopping insights.

- Benchmarking my Activity – Get a comparison of your shopping activity with LexisNexis® Insurance Market Insights.

- Competitive Insights – Gain a better understanding of price competitiveness with LexisNexis® InsurQuote® to help you win and retain shoppers.

- Taking Action – Act on specific marketplace insights to acquire and retain the right shoppers with LexisNexis® Acquisition & Retention Solutions.

- Assessing my Performance – Gather the competitive intelligence and insights on how to keep your business profitable while also acquiring new business, then leverage the data to help get the return you’re looking for.

Taking Action and Landing the Plane

Some insurance carriers are choosing to land the proverbial plane and are using advertising and marketing spend to drive profitable growth. These carriers are using data-driven insights to aid them in identifying the right customers to acquire and or retain. Usually, marketing spend is one of the first things that a carrier cuts if they are trying to reduce P&L expenses. Carriers will curtail or even cut state-level advertising until new business rate adequacy is reached, usually by taking rate increases. This is when carriers need to assess new sources of data and customer segmentation integrations to understand the value that a consumer would bring to their business and how to win or retain that person as a customer.

Data and customer segmentation allows carriers to identify the profitable leads that best support profitable customer growth and better resource allocation to retain high value existing customers that are at risk of leaving. Carriers are investing both internally and externally on building and utilizing various forms of predictive customer segmentation. Examples include risk propensity, churn propensity, next best action, customer lifetime value and conversion propensity models. These models aid carriers in segmenting and optimizing their advertising initiatives across marketing channels like email, mail, aggregator lead platforms, programmatic display/video and connected TV.

LexisNexis® Risk Solutions is able to provide carriers insurance-specific predictive customer segmentation models for their acquisition and retention use cases.

- LexisNexis® Marketing Risk Classifier – a non-FCRA predictive model that helps segment a consumer’s insurance risk profile aligned with your underwriting standards.

- LexisNexis® Prospect Survival – a non-FCRA predictive model that helps provide carriers insights into the consumers that are likely to be retained after the first policy term.

Having customer segmentation models available is one thing, but being able to integrate them into the advertising or lead purchasing ecosystem is how a carrier will ultimately use data to drive profitable growth. One unique way LexisNexis® Risk Solutions has been able to bring these highly predictive customer segmentation models into the advertising ecosystem is via LexisNexis® Lead Optimizer. It enables carriers to bring insurance-specific models and data attributes into the aggregator lead space to assess things like lead risk propensity or lead churn propensity as part of the lead purchase decision. It gives carriers the power to allocate more resources to leads that are more likely to be profitable for their business in the long run and stop allocating resources to potential poor performing business. This data-driven enhancement allows carriers to better allocate customer acquisition cost proportionately to a predicted customer lifetime value in the aggregator lead channel.

All Storms Dissipate and New Ones Form

As the current “100-year Storm” begins to dissipate and the insurance market stabilizes, carrier customer acquisition and retention strategies to take market share will begin to increase. However, how things were done in the past will no longer hold true for the future. Data is becoming more and more important as carriers steer toward acquisition and retention business outcome goals centered around quality and insurance profitability. Being able to use data and segmentation to drive profitable growth will become the new normal for insurance marketers. Marketers’ objective will be accelerating profitable growth through the customers a carrier acquires and retains - no matter what the market conditions are. Exciting times indeed!

- “CPI-U, US City Average, All Items Less Food and Energy,” U.S. Bureau of Labor Statistics, July, 2023

- Federal Reserve Bank of St. Louis Economic Research, Federal Reserve Economic Data [FRED], July, 2023

- Jason Woleben. “US private auto insurers report historically bad underwriting results in 2022,” S&P Global Market Intelligence, May 8, 2023

- LexisNexis® Risk Solutions Internal Data

- Kantar media platform, https://www.kantar.com. Accessed Aug. 2023 and Pathmatics Explorer platform, https://www.pathmatics.com/. Accessed Aug. 2023