LexisNexis® Tax Refund Investigative Solution

Detect and prevent tax refund fraud and tax identity theft

Detect fraudulent tax activity using identity information and proven analytics

Stop tax refund fraud before improper payments are issued, protecting government revenue and the identities of law-abiding taxpayers.

Featured Capabilities

Get a Nationwide View

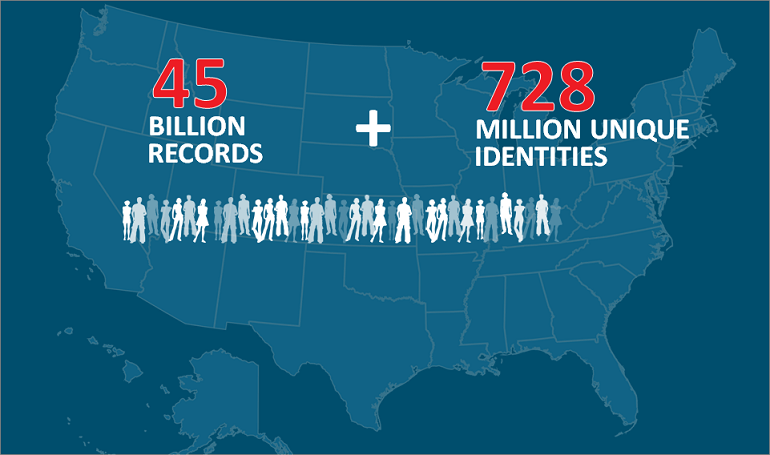

To authenticate identities you need a broad view, one that goes well beyond your tax data warehouse and offers visibility across state lines. LexisNexis® has the leading identity data repository in the country. It covers over 98% of the adult population in the U.S. and draws from over 10,000 sources of public records to greatly increase your chances of discovering fraudsters.

State-of-the-Art Identity Linking, Analytics and Scoring

The Tax Refund Investigative Solution is powered by world-class analytics. It detects fraudulent tax return refund requests by comparing personally identifiable information with billions of identity records from thousands of public records sources. It can uncover suspicious returns in a matter of minutes.

Multi-level Identity Authentication

If the Tax Refund Investigative Solution suspects a fraudulent submission, the individual will then be asked a series of identity authentication questions that require personal knowledge identity criminals do not have, such as familial relationships, former residences and vehicles possessed. The intuitive question sets are easy for consumers to verify and can be customized for adaptation to your agency’s risk policies, procedures and requirements.

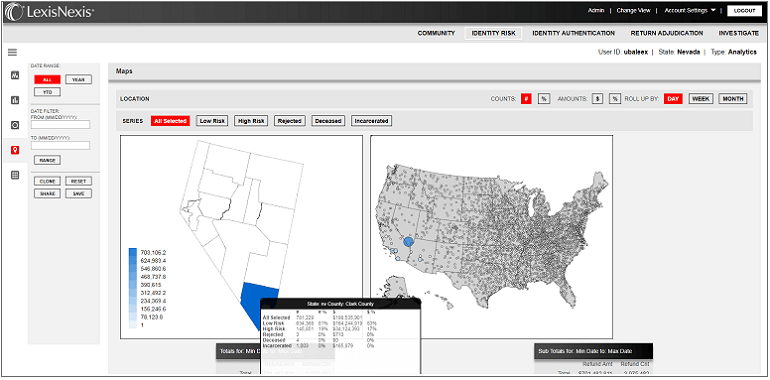

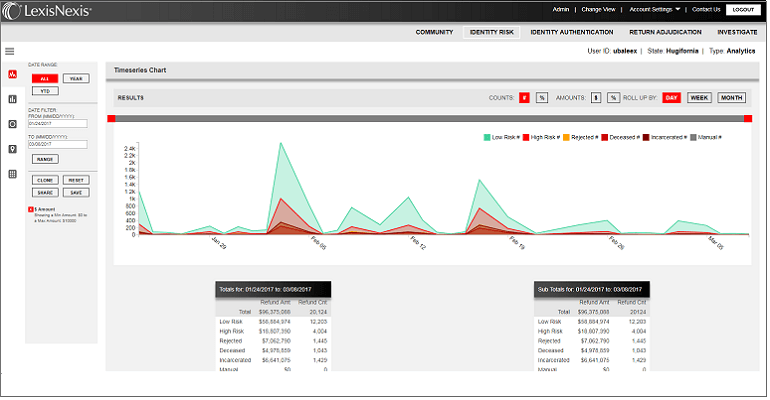

Visual Analytics Dashboard

Built-in, easy-to-understand graphic tools make results more meaningful. Our analytics dashboard displays logical and insightful representations of data that help you easily spot connections between people, places and information. Understanding relationships is critical to the process of identifying potential fraudsters.

Prioritize Audits and Investigations

Leveraging sophisticated rules-based analytics, the Tax Refund Investigative Solution pinpoints suspicious refund requests and determines the cases most likely to have successful outcomes. You’re able to filter results and drill down into investigative data to inform and support decisions. The Tax Refund Investigative Solution also reduces the number of false positives and provides “suspicion scores” with transparent explanations to prioritize cases.

How Your Agency Benefits

Combat Tax Fraud

Stop the fast-growing problems of tax refund identity fraud and stolen

identity refund fraud.

Save Millions in Revenue

Stop the fast-growing problems of tax refund identity fraud and stolen

identity refund fraud.

Improve Workflow Efficiency

Use analytical dashboards to assess situations and make data-driven

decisions to maximize efficiency and allocation of resources.

Break Down Data Silos

Use analytical dashboards to assess situations and make data-driven

decisions to maximize efficiency and allocation of resources.

Here’s what our clients are saying…

“States are looking for a fast, cost-effective approach they can easily integrate. The Tax Refund Investigative Solution achieves those goals, and I don't think anybody has a better database to compare information with than LexisNexis.”

Commissioner of the Department of Revenue

State of Alabama