Prescreen Marketing for Insurance Acquisition

What You Need to Know to Take Advantage of Prescreen Marketing for Insurance Acquisition

Prescreen marketing for insurance acquisition ― your questions answered. Click through our new eBook to discover what you need to know.

But we also know some carriers are hesitant to dive in. They have questions spanning a wide range of topics related to prescreen marketing. You might have questions too. We’ve put together this comprehensive Q&A, grouped by category, to help you easily get the answers you need so you can begin taking advantage of the benefits of prescreen marketing for acquisition…right now.

What is the size of the prescreen market?

Over two billion prescreen offers were put to the market throughout 2018 and 2019, with an estimated 1.1 billion direct mail pieces sent in calendar year 2019 using prescreen data. This is an uptick over previous years, and we expect this to continue as carriers seek to expand their acquisition campaigns. This is printed mail only and doesn’t include email, which is beginning to show volumes in marketing channel deployment1

Isn’t prescreen just for the top carriers?

There’s a perception that only “the big guys” are using prescreen, but that’s not the case. We’re seeing smaller regional carriers as well as the larger carriers use prescreen, for all the same reasons―more accurate consumer data, the ability to match risk to underwriting appetite and to reach out to prospects when they are most likely in the market. By connecting with an experienced and authorized third-party processor, carriers of any size can take advantage of the precision that prescreen marketing campaigns offer.

What do consumers think of prescreen material?

There is no recent consumer research on consumer attitudes toward prescreen marketing. However, in this age of personalization and heightened consumer expectations, an offer of insurance timed to coincide with when a consumer is in the market for insurance is a signal to the consumer that the carrier “knows them” and understands their needs. Prescreen can provide consumers relevant information that might not be available via general advertising, such as pricing options or discounts. Prescreen can also be an excellent way to reach consumers who do not actively shop. And while some might argue consumers could be annoyed by receiving direct mail based on credit information, consumers have the option of opting out of certain prescreen campaigns.

Does line of business matter?

Our prescreen marketing tools can be applied to any line of business. This includes acquisition campaigns for the auto, home and life insurance markets. In fact the life market represents opportunity for marketers, where only a handful of carriers have chosen to be early adopters and utilize prescreen for their acquisition campaigns2.

Why would I choose to do a prescreen campaign over an ITA campaign?

If you are looking to fine-tune your acquisition efforts and attract prospects who are more likely to match your criteria, and therefore more likely to convert to a policy, using credit-based prescreen marketing is for you. Here’s one simple example why. Our studies have shown that prescreen consumer address information is much cleaner than ITA data. That’s because ITA data tends to be compiled based on self-reported information. It’s not uncommon for consumers to provide incomplete, or not completely accurate, data when requested in return for information. Prescreen acquisition campaigns provide better response and conversion rates than ITA campaigns―as they are getting to the intended target. By using prescreen solutions, such as LexisNexis® Insurance Prescreen, you can segment your market and focus on prospects who are more likely to convert.

Why should I use credit-based data for my acquisition campaigns?

As carriers seek to balance profitability and growth of their policyholder base, their marketers have to ensure acquisition campaigns hit the mark in terms of attracting prospects who match the organizational risk profile and are more likely to convert to a policy. Credit-based acquisition campaigns have been shown to provide improved response and conversion rates―identifying prospects who match organizational risk criteria and are in the market for insurance. Because credit-based acquisition campaigns use actual credit data, the accuracy and reliability of the data is much greater than what you may see from other data sources, such as self-reported data. At the most basic level, ensuring your offer of insurance is getting into the hands of the exact individual you’re targeting can have a huge impact on return on investment (ROI). This is because with prescreen, a prospect’s address is current and they are likely to be in the market for insurance. These factors are crucial to marketers who are constantly challenged to strike that balance between growth targets and marketing ROI.

Why would I want to limit my universe of prospects?

If you have not used prescreen campaigns, the recommendation is to continue your existing marketing strategies and augment with prescreen to add more qualified responders to your quote work flow. The funnel of leads coming to your brand will not be reduced but enhanced with qualified leads. Over time, adjust marketing tactics between ITA and prescreen data to match ROI results as appropriate.

What type of results can I expect from a prescreen marketing campaign?

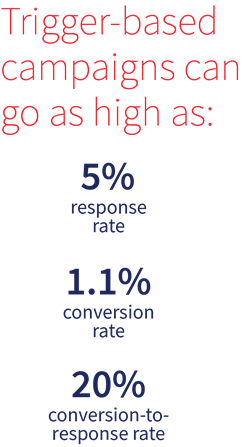

On average, we are seeing response rates in the range of 2% to almost 3% and conversion rates of a little over a quarter to two-fifths of a percentage point, conversion to response rates range from 11% - 14%. However, on very targeted campaigns that are based on when a consumer is actively in the market (trigger-based campaigns―see below), those numbers can go as high as a 5% response rate and 1.1% conversion rate and conversion to response rate of 20%!.

Each carrier’s results will vary based on many circumstances, such as brand recognition, pricing competitiveness and consumer shopping experience.

A broad market prescreen acquisition campaign can include vital segmentation attributes such as credit behavior and financial attributes, insurance risk scores and insurance shopping attributes. Driven primarily by risk profile, broad market attributes enable insurance marketers to identify and target the best prospects for their business. Generally speaking, broad market campaigns are not as time sensitive as triggers, so campaign cadence can be more spaced than with a campaign based solely on triggers, but the quality of credit data over ITA data makes this an attractive option.

What is a financial trigger?

A financial trigger is a specific behavior, such as when a consumer applies for a financial product―including an inquiry into or opening of an auto lease or loan, home mortgage or home equity line of credit. Bank card and student loans are also viable financial products. There is a positive correlation between these financial products and the need for insurance. Because financial triggers are indicative of a consumer potentially being in the market for insurance, these triggers can be used as attributes for the purposes of prescreen marketing. However, they require timely and immediate action by the insurance carrier.

What is an insurance trigger?

Similar to a financial trigger, an insurance trigger is a behavior directly related to an insurance purchase. It’s activated when a consumer shops or applies for insurance, providing a clear indication that a consumer is in the market for insurance. Much like financial triggers, insurance triggers require timely and immediate action by the insurance carrier.

Why would I elect to use triggers over broad market?

Financial and insurance triggers are highly indicative that a consumer is actively seeking insurance coverage. They are in the market for insurance and would therefore be more responsive to an immediate offer of insurance.

What if I cannot orchestrate my prescreen offers on a daily basis or at a high cadence?

Financial and insurance triggers require immediate outreach to the consumer, ensuring that the offer of insurance coincides with the consumer’s shopping activity. Third-party processors perform ongoing outreach to consumers and can help facilitate the orchestration of timely prescreen campaigns. The response and conversion results for prescreen campaigns using triggers can be significantly higher than for other types of campaigns, thus offsetting the potentially higher cost of a campaign using third-party assistance. Acquisition campaigns that use broad market prescreen segmentation criteria consistently outperform ITA campaigns. Working with a reliable and authorized third-party processor and adopting a regular cadence of consumer outreach can help ensure success for those carriers who are looking to execute highly targeted acquisition campaigns that zero in on consumers who match the organization’s risk profile and are more likely to convert to a policy.

Prescreened offers are FCRA-regulated. You should consult with an attorney to insure you are compliant with all laws regulating prescreen offers. Carriers also often find it helpful to work with an experienced third-party processor. These organizations are well versed in prescreen and help manage campaigns.

Are there differences by state, or more opportunities within certain regions?

There are states that do not allow credit information in the underwriting process. However, we do see prescreen campaigns used in some of these states to assess a consumer’s eligibility for certain payment plans. State and regional differences are governed more by a carrier’s competitiveness in any area. In this case, deciding where to market with prescreen is a business decision based on where a carrier feels they can win the most business. That being said, the fact that prescreen data is cleaner than ITA data remains a valid reason to use prescreen regardless of the state.

Sources:

1 LEXISNEXIS RISK SOLUTIONS US PRESCREEN MARKET ANALYSIS BASED ON COMPETISCAN DATA 2018-2019

2 LEXISNEXIS RISK SOLUTIONS INSURANCE PRESCREEN RESPONSE AND CONVERSION ANALYSIS 2019

Demystifying Insurance Prescreen

Prescreen Power of Prediction Infographic

Prescreen Financial Triggers Infographic