Using Prescreen for Acquisition: Financial Triggers Can Help

Optimize your insurance marketing dollars by focusing on consumers more likely to be in the market for insurance

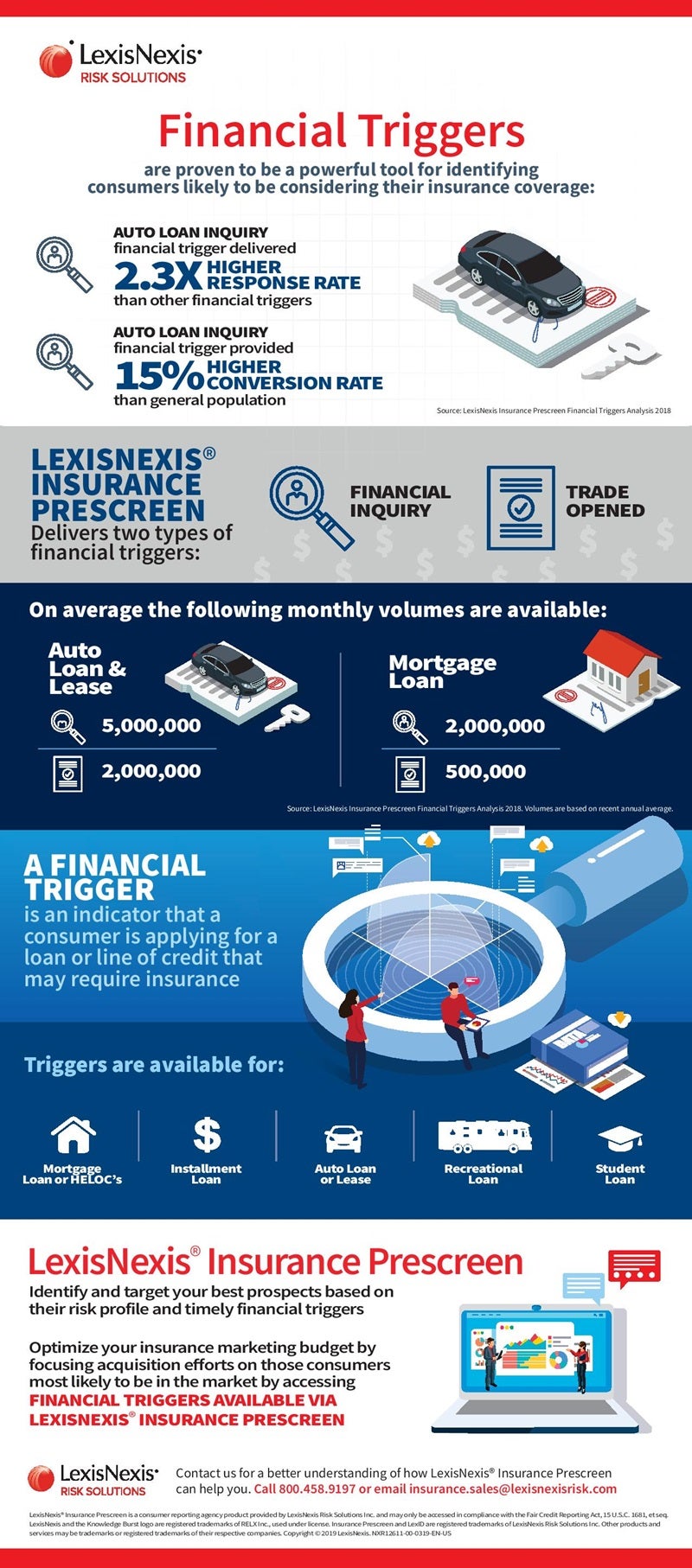

Financial triggers help identify consumers more likely to be in the market for insurance

LexisNexis Insurance Prescreen can help identify and target your best prospects based on their risk profile. Timely triggers can pinpoint when they are most likely to be considering their insurance coverage.

A financial trigger is an indicator that a consumer is applying for or has opened a credit product that may require insurance or is indicative of financial changes that can correlate to insurance shopping activity. Timely financial triggers can be the boost that your prescreen acquisition campaigns are searching for, helping to identify more consumers in the market for auto and home insurance.

There are two types of financial triggers – inquiry (a consumer applies for a financial product, such as an auto loan) and an open trade (a consumer accepts the offer and opens the financial product, such as an auto loan). Both trigger types provide the opportunity to reach out to consumers with a well-timed offer of insurance.

Financial triggers available with LexisNexis Insurance Prescreen enable you to target your marketing acquisition efforts on consumers who are focused on their financial needs and are more likely to be motivated to review their insurance coverages.

To learn more about Acquisition & Retention Solutions from LexisNexis Risk Solutions visit our webpages.