Driving violations continue to rise as mileage returns to 2019 levels

In the early days of the pandemic, most drivers reduced their driving. Mileage plummeted as more people stayed home and off the roads.

But high-risk drivers took advantage of open roads. Major speeding, aggressive driving and risky behavior created unsafe roads, and unsafe driving behavior continues to dominate the news headlines.

In this blog post, we’ll look at driving behavior changes since the pandemic—and what that means for insurers. Note that we’re indexing data against 2019 levels, which was the last full year of pre-pandemic data.

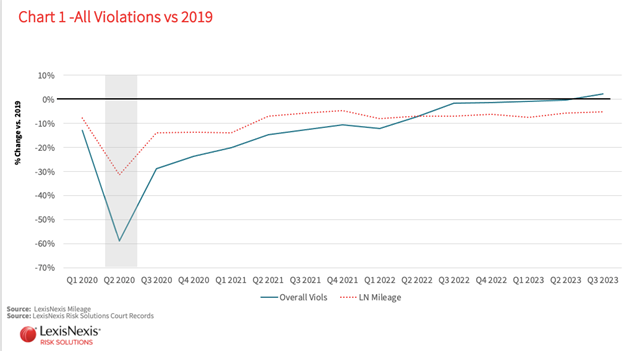

Overall, mileage and violations are back to 2019 levels

Miles driven plummeted at the beginning of COVID, but returned to 2019 levels in 2023.

At the beginning of the pandemic, moving violations were being ticketed at a higher rate compared to non-moving violations. This may have been due to law enforcement focusing on the highest-risk violations.

By 2023, we saw the convergence of all moving and non-moving violations being ticketed at the same rate. Between 2022 and 2023, all violations grew by 4% (Chart 1).

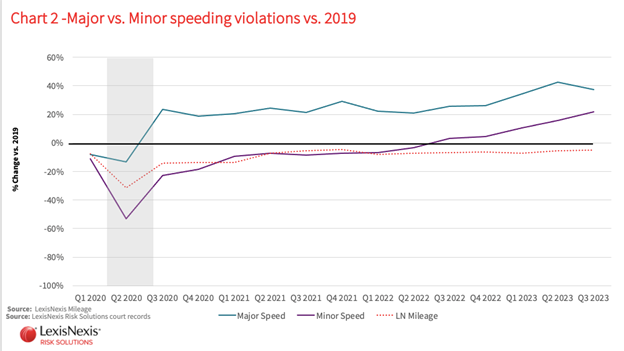

Major and minor speeding violations are up

Major speeding continues to increase, reaching 40% above 2019 levels (Chart 2). This represents an increase of 10% between 2022 and 2023, and 36% from 2019 to 2023.

The increase in major speeding poses a significant risk to road safety. Additionally, it could pose a risk to your book of business if you haven’t accounted for the elevated loss cost associated with major speeding—it’s 2.2 times riskier than the average.

At the beginning of the pandemic, minor speeding took a backseat to major speed ticketing. However, in Q4 2022, we saw minor speeding violations surpass pre-COVID levels and continue to increase. At time of writing, minor speeding levels are now more than 20% higher than they were in 2019—that’s an increase of 16% between 2022 and 2023, and 15% between 2019 and 2023.

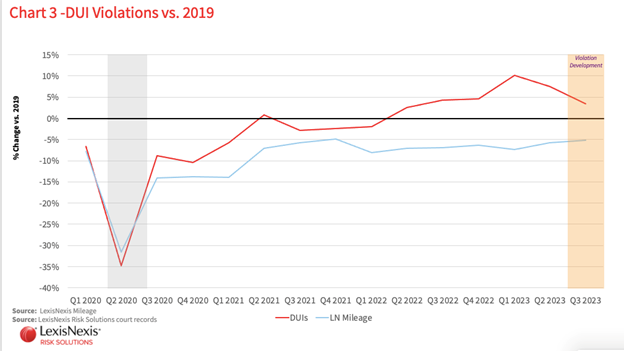

DUIs have continued to increase post-COVID

Like other violations, DUIs dropped dramatically during COVID, but have steadily been increasing since.

DUI violations are 10-20% above 2019 levels (Chart 3). Comparing the first six months of 2023 to 2022, DUIs grew by 8%. Similarly, comparing the first six months of 2023 to 2019, DUIs grew by 9%.

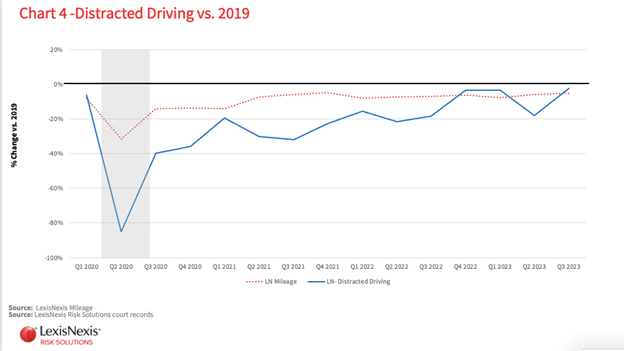

Distracted driving continues to increase

Distracted driving grew by 10% from 2022 to 2023, and now has surpassed 2019 levels (Chart 4). Many insurers consider distracted driving a minor violation, but it’s more serious than that—distracted driving continues to be a large contributor to traffic fatalities.

Insurers have opportunities to refine how they look at speeding violations

Mileage is back up to 2019 levels, but everything else is different. Insurers that haven’t updated their underwriting rules may be leaving premium dollars on the table. Download our white paper to learn about four changes to driving behavior that could affect how you underwrite post-COVID.

We recommend three steps to adapt to these shifts in speeding violations:

- Group speeding events to help uncover additional segmentation opportunities, and segment major speeding violations into more granular increments to find opportunities to better understand risk and help capture additional revenue.

- Update point systems across all categories—especially major speeding violations, where average loss cost relativity has increased.

- Consider how you use distracted driving violations, at both new business and renewal. Today it’s seen as a minor violation, but its effect on road safety is on par with DUIs. It’s likely that in the future, repeated distracted driving could be treated like repeated DUIs—with similar consequences for insurance coverage.

Finally, if you’re only underwriting for new business and not at auto insurance policy renewal, you may be missing hidden risks in your renewal book—and that could be costing you up to $4.9 billion.

To discover more ways to drive profitability with your renewal book of business, check out our auto renewal solutions site.