Is distracted driving the new DUI? Rising violation data suggests it could be, especially for younger drivers.

It takes about five seconds to send a text message. That’s not a lot of time. But if you’re sending that text message while driving at 55mph, it is. You can travel the length of a football field in that time.1

Texting isn’t the only form of distracted driving. But phones are major culprits, with research showing that texting increases crash risk by 2.5 times and using handheld cell phones by 1.8 times.2

Distracted driving is on the rise—especially among Gen Z

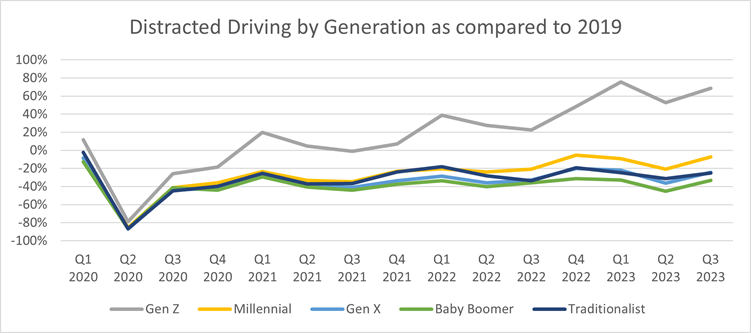

Internal LexisNexis® Risk Solutions data analysis reveals that distracted driving violations increased by 10% from 2022 to 2023. Our analysis also shows that younger drivers are more susceptible to being distracted.

Between 2022 and 2023, distracted driving violations were up 9% among millennials. And among Gen Z? Between 2022 and 2023, distracted driving violations among Gen Z increased by 24%—that’s a 66% increase from 2019 to 2023.

This increase in distracted driving violations, plus Gen Z’s driving inexperience compared to other generations, has implications for both personal lines and commercial lines carriers.

Distracted driving violations are on the rise, especially among Gen Z

Source: LexisNexis® Risk Solutions internal data

Comparing the financial and legal consequences of distracted driving and drunk driving

The rise of distracted driving prompts the question: is distracted driving the new DUI?

They’re both responsible for tens of thousands of preventable deaths. There were 10,546 fatalities due to distracted driving in 2019,3 and 13,384 due to drunk driving in 2021.4 And they are both costly. In 2019, the most recent year for which cost data is available, the economic impact of distracted driving was over $98 billion,5 and drunk driving over $68 billion.6

But drunk driving comes with greater legal and financial consequences:

- All 50 states have laws against drunk driving and a drunk driving conviction can mean hefty fines, license suspensions or jail time.

- After a DUI, insurance premiums typically increase by 58%,7 ranging from 44% in Alaska to 307% in North Carolina.8

In comparison, distracted drivers get off lightly:

- Texting while driving is prohibited in all states (and the District of Columbia) with the exception of Montana.9 In states where texting while driving is prohibited, fines range from $25 for the first offense to over $1,000 for repeated and severe violations.10

- After a distracted driving violation, insurance premiums increase an average of 27%: 8% in New York and 45% in New Jersey.11

In personal lines, DUIs and distracted driving are treated differently

Most insurers consider DUIs an indicator of elevated risk. While that attention is warranted, our analysis shows that for a driver with an otherwise clean driving record, the first DUI has a loss cost on par with minor speeding. It’s indicative of risk, but there are other driving violations with far greater impact to loss costs.

It’s possible the first DUI scares drivers into being more cautious. In addition to the financial and legal consequences, consumers are aware that DUIs affect their insurance premiums, and that more than one DUI might make insurance coverage prohibitively expensive—or impossible to get.

In contrast, most insurers consider distracted driving a minor violation. This, despite the link between distracted driving and road fatalities, and research that distracted driving is correlated with risky behaviors like aggressive driving, lane changes and speeding.12 Given distracted drivers are more likely to get in car accidents, could they also be driving up insurers’ loss frequency?

But the financial, legal and insurance consequences of distracted driving aren’t on par with DUI. If fear prompts drivers with one DUI to shape up, there isn’t similar pressure for distracted drivers to change their behavior.

Distracted driving has implications for commercial insurers

Distracted driving has implications for commercial auto losses and related claims. A study of commercial drivers found that distracted driving was a factor in 71% of car crashes, 46% of near crashes and 60% of all safety-critical events.13

According to a recent Nationwide survey, most everyone (92%) agreed that driving has become more dangerous, reporting other drivers are more often looking at their phones. Nationwide’s telematics driving data shows that drivers take their eyes off the road at least 12 times per day. The average distraction for a driver traveling at 45MPH would cover the length of three football fields!

Encouragingly, there are more stringent restrictions for drivers of commercial motor vehicles (CMV) than other drivers:14

- Texting or using hand-held phones while driving is prohibited.

- Driver offenses include civic penalties up to $2,750 and drivers can be disqualified for multiple offenses.

- Their employers are prohibited from requiring or allowing drivers to text or use a hand-held phone while driving, with civil penalties up to $11,000.

In addition, many CMVs require a commercial driver’s license (CDL), which has higher standards and requires more thorough training than a regular driver’s license.

However, an acute driver shortage puts transportation companies in a tough spot, with roughly 80,000 drivers needed in 2021 and an estimated shortfall of 162,000 by 2030.15 With more open positions than applicants, many have had to lower their driver applicant standards. That means younger, less experienced commercial drivers—and as we saw earlier, younger drivers are more likely to drive distracted.

Also consider that commercial drivers include gig economy workers—and gig economy workers are four times more likely than other drivers to use their smartphones while driving.16 In addition, accidents involving gig economy drivers could create issues if their auto insurance policy wasn’t correctly underwritten.

What you can do about it:

- Think differently about distracted driving violations. Distracted driving has been correlated with other risky behaviors. Distracted drivers can be more likely to get into car accidents,17 which can drive up loss frequency. Insurers that haven’t properly accounted for distracted driving may be underwriting hidden risk and leaving premium dollars on the table.

- Monitor your book of business for changes in driver risk. A lot can change between new business and renewal. Our internal analysis shows that insurers are missing $4.9 billion due to missing key events at renewal underwriting, including distracted driving violations. LexisNexis® Active Insights allows you to automatically monitor your book of business for changes in risk , and provide coverage that meets your customers’ changing needs.

- Underwrite consistently, at new business and renewal. At new business, most carriers conduct significant due diligence to understand an individual’s risk profile and price it appropriately—but they don’t bring that same underwriting discipline to policy renewal. Where the renewal book regularly makes up 75% or more of an insurer’s business, up-to-date violation data can have a big impact on profitability and competitiveness.

Learn more about how data can drive profitability at auto policy renewal on our auto renewal solutions site.

1 https://www.nhtsa.gov/risky-driving/distracted-driving

2 https://aaafoundation.org/wp-content/uploads/2018/01/CellPhoneCrashRisk_FINAL.pdf

3 https://www.nhtsa.gov/speeches-presentations/national-distracted-driving-coalition

4 https://www.nhtsa.gov/risky-driving/drunk-driving#alcohol-abuse-and-cost-5091

5 https://www.nhtsa.gov/speeches-presentations/national-distracted-driving-coalition

6 https://www.nhtsa.gov/risky-driving/drunk-driving#alcohol-abuse-and-cost-5091

7 https://www.fool.com/the-ascent/insurance/auto/articles/heres-how-much-a-dui-affects-your-auto-insurance-rates/

8 https://www.carinsurance.com/how-much-does-your-insurance-go-up-after-a-dui/

9 https://www.ghsa.org/sites/default/files/2023-07/DistractedDrivingLawChart-July23.pdf

10 https://www.autoinsurance.com/research/cell-phone-use-while-driving/

11 https://www.carinsurance.com/how-much-car-insurance-goes-up-after-texting-ticket

12 https://www.ghsa.org/sites/default/files/2023-07/DistractedDrivingLawChart-July23.pdf

13 https://rosap.ntl.bts.gov/view/dot/17715

14 https://www.fmcsa.dot.gov/driver-safety/distracted-driving

15 https://www.statista.com/statistics/1287929/truck-driver-shortage-united-states

16 https://www.iihs.org/news/detail/smartphone-apps-drive-gig-workers-parents-to-distraction

17 https://www.cdc.gov/transportationsafety/distracted_driving/index.html