The Impact of More Data Earlier in the Claims Process

LexisNexis® Risk Solutions conducted a study that investigated how data affected the claims of several carriers listed in A.M. Best’s top 20 ranked carriers.

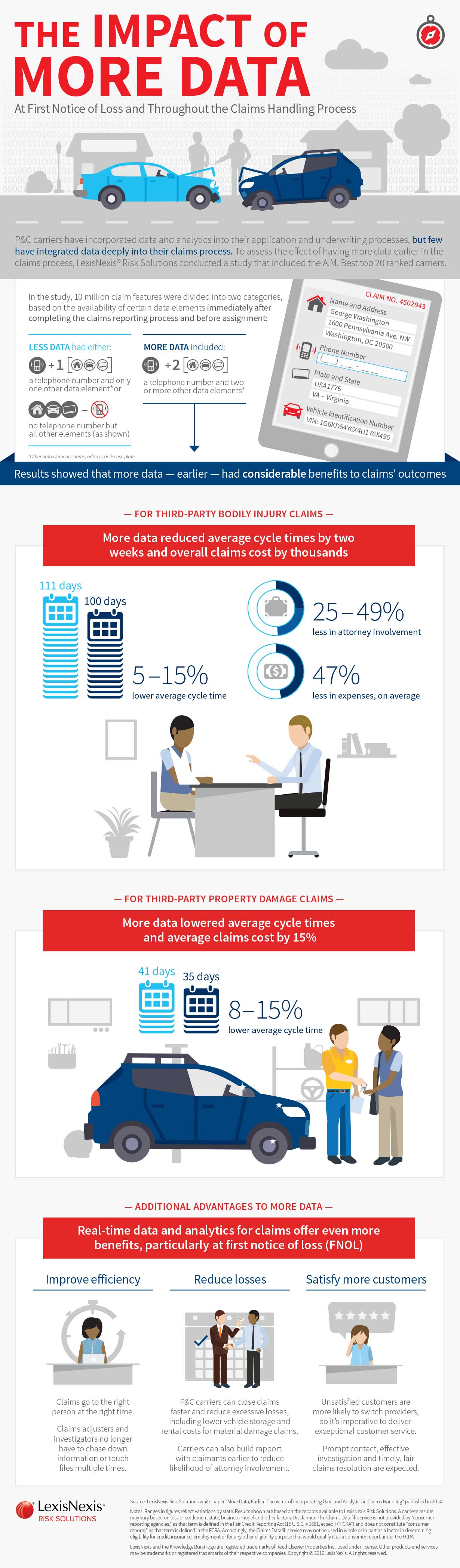

Data and analytics have become hot topics in the P&C space as many carriers have incorporated data and analytics into their application and underwriting processes. But few carriers have truly integrated external data deeply into their claims process. To assess the effect of having more data earlier in the claims process, LexisNexis® Risk Solutions conducted a study that investigated how data affected the claims of several carriers listed in A.M. Best’s top 20 ranked carriers.

The results? When carriers collect more data, earlier in the claims process, they experience significant benefits in cost and efficiency.

Our infographic below illustrates these positive outcomes by comparing claims that had less data (a telephone number and only one other data element, or no telephone number but all other elements) and those that had more (a telephone number and two or more other data elements). In this case, a data element is defined as name, address or license plate.

For third-party bodily injury claims, more data reduced average cycle times by two weeks and overall expenses by thousands. For third-party property damage claims, more data lowered average cycle times and average claims expenses by 15 percent.

Access Full Infographic

Download PDF