LexisNexis® U.S. Auto Insurance Trends Report

The Risk Right Now: Market Shifts Shaping U.S. Auto Insurance

Multiple long-term trends reached inflection points in 2024. Due to major shifts in retention rates, policy shopping levels and attorney representation, the future of the U.S. auto insurance industry has never felt more fluid.

The annual LexisNexis® Risk Solutions U.S. Auto Insurance Trends Report presents five key trends impacting the auto insurance industry and offers insights to help insurers keep up with this dynamic landscape. Insurers can use these insights to help benchmark industry performance and identify new and shifting sources of risk.

Key takeaways:

- Claims severity continues to evolve as bodily injury severity jumped 9.2%, and property damage severity climbed 2.5% year over year (YoY). In contrast, collision severity declined by 2.5% year over year.

- All driving violations increased 17% year over year and driving violation rates across the U.S. surpassed 2019 levels.

- Rate increases are beginning to ease, rising 10% YoY in 2024 compared to a 15% hike in 2023, as market conditions soften.

- Insurer profitability is improving, with direct written premiums growing 13.6% to $359 billion and incurred loss ratios stabilizing, enabling some carriers to pursue growth strategies and file for rate decreases.1

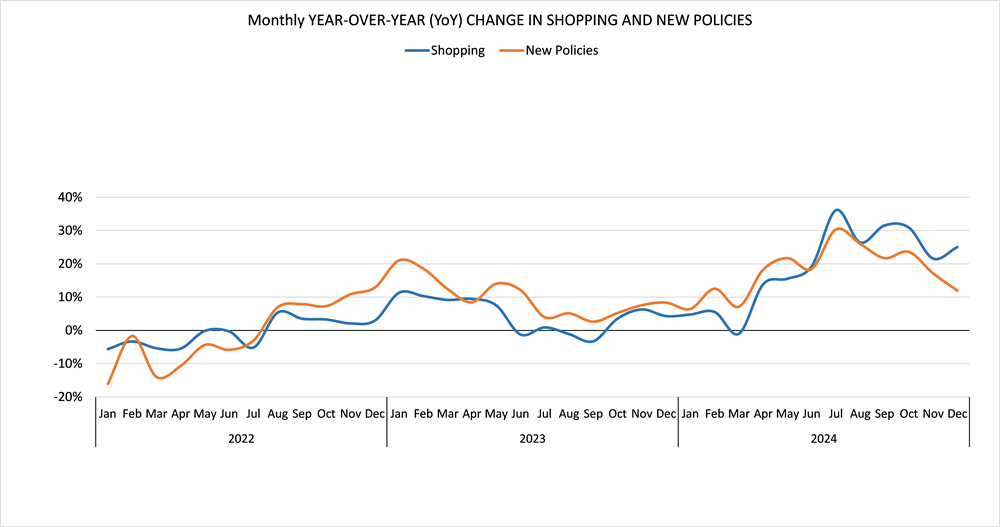

- Policy shopping reached an all-time high, with more than 45% of policies in force shopped at least once by year-end.

- EV transitions are introducing new risks, as drivers moving from internal combustion engine (ICE) vehicles to EVs experienced a 14% rise in claim frequency.

- Older and long-tenured policyholders are leading the shopping trend, with consumers aged 66 and older shopping and switching more than any other age group. Additionally, shopping among long-tenured (10+ years) customers rose 35% year over year, with the rate of high-survivability shoppers hitting 40% by the end of 2024.

2024 NAIC Market Share Report1

Download the report to explore:

- Rate adjustments and premium growth

- Consumer auto policy shopping’s impact on retention rates

- Driving behavior trends

- Changes in household and vehicle risks

- Auto claim challenges

Explore each section to gain additional insights

Access the Report

Download Previous LexisNexis® U.S. Auto Insurance Trends Reports

2024 Auto Insurance Trends Report

2023 Auto Insurance Trends Report

The 2023 report examines key trends from the previous year and offers insights to help insurers make better business decisions now – and into the future.

2022 Auto Insurance Trends Report

How insurance carriers can better navigate market stressors moving forward.