Understand How Rising Costs are Reshaping the Future of Financial Crime Compliance

While digital transformation has ushered in growth opportunities, it has also exposed institutions to higher risk of financial crimes. This, coupled with rising customer expectations, creates a broad spectrum of challenges.

Financial institutions are facing the need to re-evaluate their FCC processes, and focusing on the customer experience is key. By embracing new technologies, there is an opportunity to evolve FCC to achieve sustainable growth while also meeting applicable FCC requirements.

Explore the study to learn more about the key challenges facing institutions, as well as key opportunities to evolve the future. This is a commissioned study conducted by Forrester Consulting.

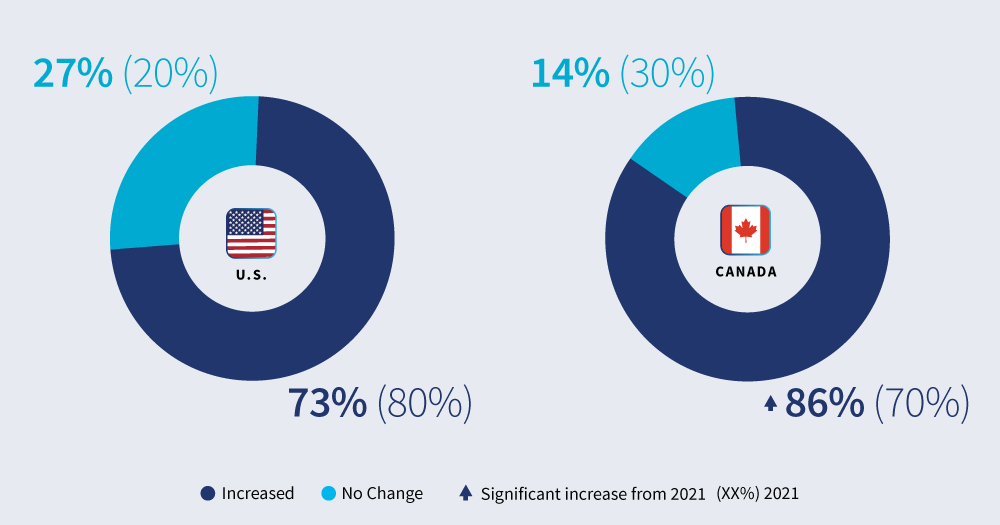

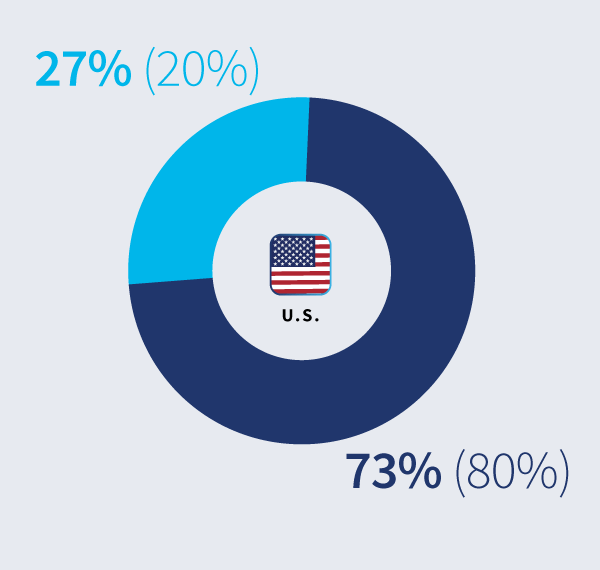

1. True Cost Of Financial Crime Compliance Study, 2023: U.S. and Canada

Products You May Be Interested In

-

AML Insight™

Protect against money-laundering, fraud and non-compliance

Learn More -

Bridger Insight® XG

Automate account and payment screening with real-time insights into AML, ABC and CFT risks

Learn More -

Due Diligence Attributes

Identify relevant financial crime compliance risk with targeted attributes.

Learn More -

Firco™ Continuity

Screen transactions at speed, control costs and meet regulator requirements

Learn More -

InstantID®

Complete identity verification, spot fraud and uncover identity discrepancies in real time

Learn More -

InstantID® Business

Verify the business and its authorized agents... without awkward pauses

Learn More -

RiskNarrative®

Redefine how you onboard customers and monitor financial crime risk through a single API and platform environment

Learn More -

WorldCompliance™ Data

Robust databases of high-risk individuals and entities

Learn More