Authorized Transfer Scams — Challenges, Solutions and Plans

Over 400 industry leaders share how financial institutions can transform an epidemic of authorized transfer scams into an opportunity to mitigate financial loss and build trust with customers.

Download StudyHow Well Is Your Financial Institution Detecting and Mitigating Scams?

Benchmark your institution’s progress against industry peers.

Authorized transfer scams pose a growing threat to financial institutions and their customers.

Across the United States, scams increased substantially at more than half of financial institutions in the 12-month period ending July 2023. Over one-third of fraud losses at U.S. financial institutions were attributed to scams.i

Customers increasingly expect protection against authorized transfer scams, as well as compensation if they fall victim to a scam.ii Financial institutions face the “impossible” situation of having to detect when consumers themselves have been deceived or manipulated in an authorized transfer scam, and engage with enough confidence to dissuade the consumer from authorizing a malicious transfer.

Across the United States, scams increased substantially at more than half of financial institutions in the 12-month period ending July 2023. Over one-third of fraud losses at U.S. financial institutions were attributed to scams.i

Customers increasingly expect protection against authorized transfer scams, as well as compensation if they fall victim to a scam.ii Financial institutions face the “impossible” situation of having to detect when consumers themselves have been deceived or manipulated in an authorized transfer scam, and engage with enough confidence to dissuade the consumer from authorizing a malicious transfer.

How Financial Institutions Can Transform An Epidemic Into An Opportunity

Financial institutions must either understand and implement better strategies for detecting and mitigating authorized transfer scams, or risk rising financial losses and customer frustration.

To explore how financial institutions are addressing scam detection and mitigation, we commissioned a survey of over 400 financial services decision-makers. The study, “Defend Against Authorized Transfer Scams,”iii illustrates how financial institutions are grappling with authorized transfer scams, from current challenges to near-term investment plans to success criteria, including:

Download StudyTo explore how financial institutions are addressing scam detection and mitigation, we commissioned a survey of over 400 financial services decision-makers. The study, “Defend Against Authorized Transfer Scams,”iii illustrates how financial institutions are grappling with authorized transfer scams, from current challenges to near-term investment plans to success criteria, including:

- How long each of the three types of scams go undetected, including impersonation of financial services employees.

- Maturity of capabilities, from detecting payor and payee risk, to detecting victim-coaching and mitigating scams.

- Plans for investment in scam detection and mitigation capabilities, both broad-spectrum and specialized, over the next 24 months.

- Anticipated benefits after adopting or upgrading Scam detection and mitigation solutions.

Study Table Of Contents

- Executive Summary

- Key Findings

- Fraud Risk And Mitigation Strategy Leaders Contend With More Sophisticated Scams

- With High Customer Expectations And Lagging Solutions, Financial Institutions Face An Uphill Battle

- Develop A Multilayered Approach To Scam Detection And Mitigation

- Key Recommendations

- “How important are the following authorized transfer scam detection and mitigation goals to your organization over the next 12 months?”

- “How confident are you in the effectiveness of your organization’s scam detection tools and solutions when it comes to their ongoing ability to support its scam detection and mitigation goals?”

- “If any of the following scams are detected, how quickly are your organization’s customers alerted to them?”

- “What tools or solutions has your organization implemented to detect attempted scams on its clients or customers?”

- “How challenging is it to complete the following actions of your organization’s current scam detection process?”

- “How challenging are the following actions when convincing your organization’s customers that they’re being scammed?”

- “How much do you agree or disagree with the following statements about authorized transfer scam detection and fraud management at your organization?”

- “Is your organization interested in and/or planning to upgrade or invest in the following scam detection and mitigation capabilities?”

- “What do you hope to accomplish by upgrading your organization’s authorized transfer scam detection and mitigation solutions?”

- “In what order would you prioritize the following anticipated benefits after adopting or upgrading scam detection and mitigation solutions at your organization?”

i 2023 LexisNexis® True Cost of Fraud™ Financial Services and Lending – North America.

ii “Defend Against Authorized Transfer Scams - How Financial Institutions Can Transform An Epidemic Into An Opportunity,” a commissioned study conducted by Forrester Consulting on behalf of LexisNexis Risk Solutions, January 2024.

iii Ibid.

Study: Defend Against Authorized Transfer Scams

Learn how financial institutions are addressing scam detection and mitigation. Download the study, “Defend Against Authorized Transfer Scams,” based on insights from over 400 financial services decision-makers.

Infographic: Key Findings From Industry Survey

How are other financial institutions addressing authorized transfer scams? Get this infographic for a quick, actionable summary.

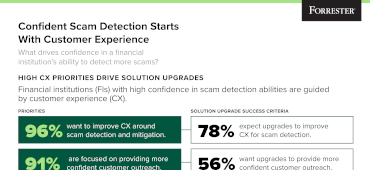

Infographic: More Confident Scam Detection

What makes some financial services decision-makers more confident in their FI’s ability to detect more scams? High confidence drives differentiated plans and priorities.

Products You May Be Interested In

-

BehavioSec®

Uncover user intent from login to logout with real-time behavioral and device intelligence

Learn More -

Emailage®

Emailage® is a proven risk scoring solution to verify consumer identities and protect against fraud

Learn More -

One Time Password

Authenticate a user with a one-time login transaction

Learn More -

Phone Finder

Connect phones and identities with rank-ordered results

Learn More -

ThreatMetrix®

World-leading digital identity intelligence and embedded AI models through one risk decision engine

Learn More