Hunting Money Mules with a 360-Degree View of Identities

Learn how money mules operate and why forward-thinking organizations leverage digital, physical, email and behavioral intelligence to help prevent money mules from aiding fraud.

Download the ebookMoney Mules Play a Dangerous Role in Fraud Schemes

Money mules are a key enabler of digital banking fraud which impacts consumers and organizations across the globe.

A money mule is a bank account, or the holder of the account, necessary for receiving fraudulent funds so these can be transferred and cashed out.

Mules are also often used for the purposes of laundering money through the financial system. In this instance, their aim is to help obscure the trail of ill-gotten gains and make it more challenging to trace the ultimate recipients. Money can be moved rapidly through large networks of seemingly unconnected mule accounts held at multiple financial institutions, making it harder to track.

A money mule is a bank account, or the holder of the account, necessary for receiving fraudulent funds so these can be transferred and cashed out.

Mules are also often used for the purposes of laundering money through the financial system. In this instance, their aim is to help obscure the trail of ill-gotten gains and make it more challenging to trace the ultimate recipients. Money can be moved rapidly through large networks of seemingly unconnected mule accounts held at multiple financial institutions, making it harder to track.

Types of money mules can be categorized based on their knowledge and intentions and require appropriate mitigation strategies:

Purposely Opened Mules – Accounts set up specifically for mule activity by the fraudsters themselves or by complicit individuals. They knowingly participate in receiving and transferring funds on behalf of criminals and are typically motivated by financial gain.

Recruited Mules – Legitimate accounts whose owners knowingly begin to engage in mule activity. They may have been lured into the scheme under false pretenses or intimidation or may be convinced that their involvement is legitimate. They may be motivated by promises of easy money or by the belief that they are assisting in a legal financial transaction.

Unwitting Mules – Genuine accounts whose owners have been unwittingly scammed into conducting mule activity. They are completely unaware that they are involved in criminal activities. They are not motivated by criminal intentions; instead, they may believe they are helping a friend or a legitimate business.

Purposely Opened Mules – Accounts set up specifically for mule activity by the fraudsters themselves or by complicit individuals. They knowingly participate in receiving and transferring funds on behalf of criminals and are typically motivated by financial gain.

Recruited Mules – Legitimate accounts whose owners knowingly begin to engage in mule activity. They may have been lured into the scheme under false pretenses or intimidation or may be convinced that their involvement is legitimate. They may be motivated by promises of easy money or by the belief that they are assisting in a legal financial transaction.

Unwitting Mules – Genuine accounts whose owners have been unwittingly scammed into conducting mule activity. They are completely unaware that they are involved in criminal activities. They are not motivated by criminal intentions; instead, they may believe they are helping a friend or a legitimate business.

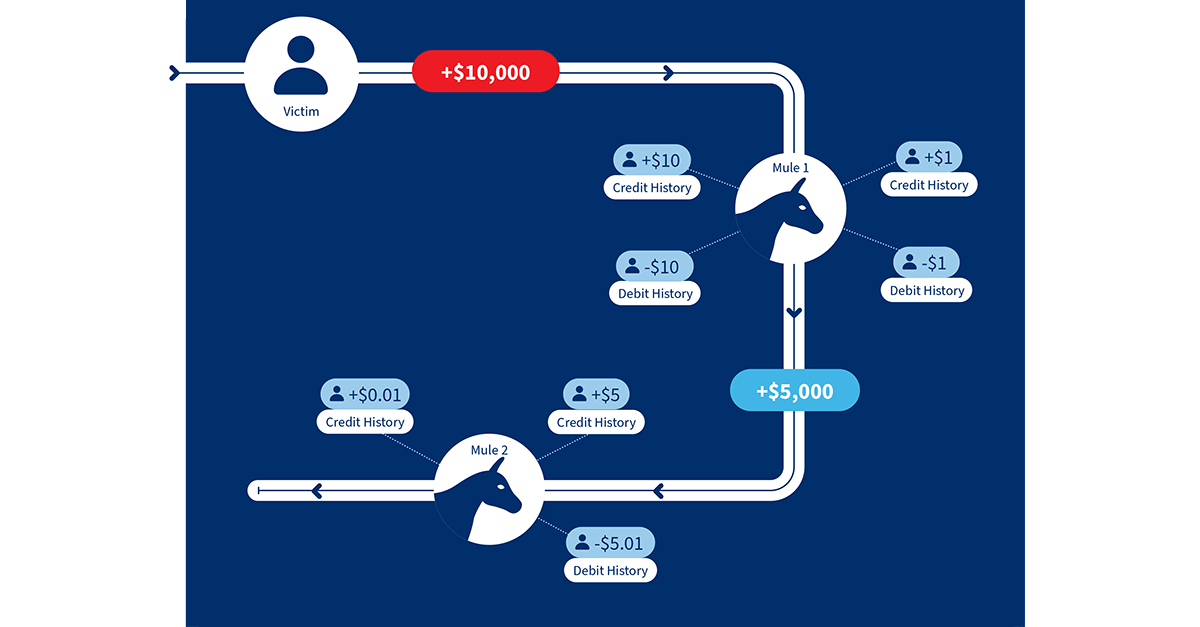

The Movement of Fraudulent Funds Through a Mule Network

The graphic below illustrates an example of movement of funds through a mule network. Prior to receiving fraudulent funds, mule account holders make small arbitrary credits and debits to establish a payment history. In this context, the $10,000 payment from a fraud victim looks atypical and can be used as a reliable fraud indicator.

The Gold Standard for Money Mule Detection: A 360-Degree View of Identities

Differentiating between legitimate and suspicious activities from a vast number of daily interactions and transactions can be complex. While it’s easier to spot patterns within an organization’s own customer interactions, difficulty arises when tracking patterns that involve external entities, especially when funds transfer outside the bank’s direct oversight.The foundation for effectively identifying and interrupting more mule accounts rests on the ability to understand the parties involved more holistically, from digital and physical identities and associated attributes, events and behaviors, to the parties’ accounts, interactions and transactions.

Forward-thinking organizations should adopt the following three steps to develop a 360-degree view of a consumer's identity:

1. Link Insights Across Multiple Dimensions

Multi-dimensionality is an important differentiator for effective fraud prevention strategies. A more effective approach should look beyond financial transactions and use broader data to intercept mule accounts more efficiently and help prevent the flow of fraudulent funds.

Multiple solutions can execute in tandem, consolidating insights across physical, digital and email dimensions for a robust perspective that helps support the race toward identifying and preventing money mule activity.

2. Leverage Global, Cross-Industry Intelligence

LexisNexis® Digital Identity Network® crowdsources insights across thousands of businesses globally, building one of the largest unique repositories of digital identity intelligence that grows more powerful with each transaction.

Digital Identity Network® helps shed light on mule operations spanning multiple institutions and allows organizations to make highly-informed risk assessments, not just on transactions, but on the behaviors of the entities making transactions and on hidden associations between the devices and phone numbers they use.

3. Identify Suspicious Patterns with a Machine Learning Model

Continuous pattern analysis, rule modelling and optimization through a machine learning mule model connects insights from an incredibly diverse network of intelligence to help predict the likelihood that an account is being used for mule activity, helping ensure organizations can make the most of the data-driven solutions at their disposal.

The professional services team at LexisNexis® Risk Solutions can develop, train and test the machine learning mule model and can work with customers to identify and mitigate the unique fraud threats they may be facing – even if this requires thinking from a fraudster’s point of view to make their criminal activities as hard to operate as possible.

Detect More Mules and Drive Results That Can Take Your Fraud Prevention to New Heights

Forward-thinking organizations across the globe are making strides in detecting more mule accounts and protecting consumers with LexisNexis® Risk Solutions.Notable Improvements in Mule Detection

A leading bank achieved 100% increase in mule detection

rates over just one month, compared to previous mule

detection strategies.

rates over just one month, compared to previous mule

detection strategies.

Improved Customer Experience

Customers can benefit from a smoother experience by

reducing unnecessary friction associated to the ability to

distinguish between trusted accounts and mule activity.

reducing unnecessary friction associated to the ability to

distinguish between trusted accounts and mule activity.

Streamlined Operational Efficiency

Flagging just four cases per day and reducing the need for

manual reviews, a top financial organization achieved an

uplift of 300% in mule detection, compared to the previous approach.

manual reviews, a top financial organization achieved an

uplift of 300% in mule detection, compared to the previous approach.

Significant Incremental Annual Fraud Value Captured

By adapting their fraud prevention approach, organizations

are improving their ability to identify and stop the flow of

fraudulent funds through mule accounts.

are improving their ability to identify and stop the flow of

fraudulent funds through mule accounts.

Find out more insights about how money mules operate and how forward thinking-organizations are fighting back against the fraudulent flow of funds through mule networks.

Access the ebook "Hunting Money Mules with a 360-Degree View of Identities".

Download the ebook Hunting Money Mules with a 360-Degree View of Identities

Products You May Be Interested In

-

BehavioSec®

Uncover user intent from login to logout with real-time behavioral and device intelligence

Learn More -

Digital Identity Network®

Gain the ability to recognize good, returning customers and weed out fraudsters, all in near real time

Learn More -

Emailage®

Emailage® is a proven risk scoring solution to verify consumer identities and protect against fraud

Learn More -

ThreatMetrix®

World-leading digital identity intelligence and embedded AI models through one risk decision engine

Learn More