Minimize Health Plan Enrollment Identity Theft

Minimize Health Plan Enrollment Identity Theft

Every aspect of enrollment depends on identity data, making reliable verification critical

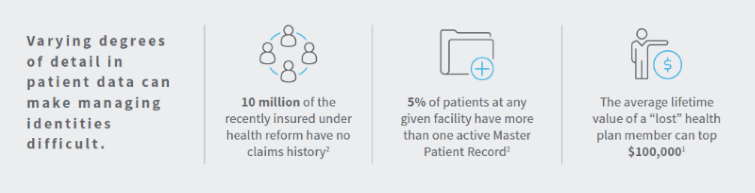

Varying degrees of detail in patient data can make managing identities difficult, leading to health plan identity theft.

Each year, millions of people will join, switch and leave health plans. Some are following their doctors, some are choosing new employer-provided health plans and some are simply ready for a change in their healthcare. Every aspect of health insurance enrollment depends on personal information, or identity data. Payers need to be able to verify that people who enroll are who they say they are – across all their various insurance coverage options. Unfortunately, there’s alarming growth in criminals taking advantage of the enrollment process.

Health plans need a data analytics partner with the tools – and the expertise – to help stop criminals in their tracks to reduce and eliminate identity theft during the enrollment period. Detection and elimination of certain schemes result in new tactics, not less identity theft. Payers can’t count on detection alone to safeguard the integrity of their plan's member data. They must protect their plan's enrollment systems from identity theft as well as criminals who create fake identities out of an assortment of sometimes legitimate and stolen information.

To fight identity theft, payers need to quickly confirm that data being submitted by an individual is real and accurate – and that it belongs to the person seeking health plan coverage. Once the information is confirmed, payers can compare it to the eligibility standards for their different health plans. That requires cross-referencing thousands of databases, current and historic, piecing together and verifying multiple data points all at once – a seamless verification function at critical points in a health plan's workflow.

This e-book details how health plans and payers can spot potential fraud without slowing the enrollment process for new plan members. Download “ Are Your New Enrollees Who They Say They Are? How to minimize Identity Theft during enrollment season” today to get started with understanding how identity data can prevent this type of healthcare fraud.

Access the E-Book Here