Expanding Credit Access and Driving Long-Term Portfolio Growth

Turn credit invisibility into opportunity.

Download the EbookA Significant Share of the Global Population Remains Credit Invisible by Traditional Standards

Young adults, individuals relocating to new countries and underbanked communities in emerging economies are often locked out of key financial products and services because traditional data alone may not capture a more holistic view of their true creditworthiness.

Identify and reach new-to-credit consumers with alternative data

New-to-credit consumers represent a largely untapped and undervalued market segment. For credit managers navigating increasing competition and regulatory pressure, engaging this population offers a strategic path to sustainable portfolio growth.

LexisNexis® Risk Solutions offers leading alternative data solutions that can help financial institutions expand inclusion programs, enhance credit risk assessment and unlock new revenue opportunities.

LexisNexis® Risk Solutions offers leading alternative data solutions that can help financial institutions expand inclusion programs, enhance credit risk assessment and unlock new revenue opportunities.

Learn more about how our alternative data offerings can help improve credit risk decisioning at every stage of the customer lifecycle:

- LexisNexis® RiskView™

- LexisNexis® RiskView™ UK

- LexisNexis® Decision Trust

Ready to drive financial inclusion and expand access for new-to-credit consumers?

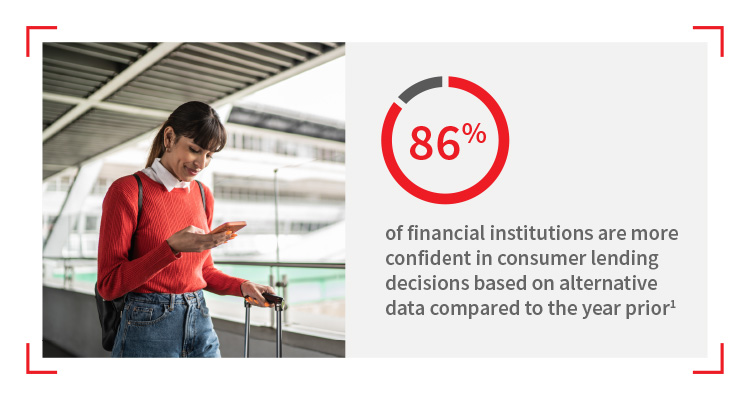

1 LexisNexis Risk Solutions, Alternative Credit Data Impact Report, 2024

Complete the form to learn more

Products You May Be Interested In

-

RiskView™ Payment Score

Accelerate collections results with alternative data

Learn More -

RiskView™ Credit Solutions

Improve consumer credit risk assessment with RiskView™ Credit Solutions

Learn More -

RiskView™ Attributes

Enhance risk modeling performance across the credit spectrum

Learn More -

RiskView™ Credit Misuse

Equips you with the targeted insights you need to support more confident lending decisions

Learn More -

RiskView™ Liens & Judgments

Retain your competitive edge without the added expense of recalibrating your models

Learn More -

RiskView™ List Generation

Expand your market share and increase customer lead generation with reliable marketing lists

Learn More -

RiskView™ Optics and RiskView™ Spectrum Scores

Improve risk assessment performance across the credit spectrum

Learn More