Outsmart unemployment fraud without adding friction

Unemployment Insurance (UI)

Claimants need fast, equitable access to assistance. Real-time identity intelligence and sophisticated fraud tools are key to delivering it securely.

Solutions for Speed to Unemployment Compensation

Identity Assessment & Assurance

risk-based authentication to ultimately build identity trust.

Fraud Detection & Prevention

Business Risk Assessment

Data Quality Management

Achieve These Results

Verify Most Claimants in Near Real-time

Our digital and physical identity solutions help you verify up to 99.4% of claimants instantly

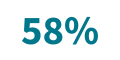

Decrease in Human-Initiated Attacks

In 2020, we saw a 58% decrease in human-initiated attacks, despite a 29% increase in transactions year-over-year.

Fraudulent Claims at One Agency

LexisNexis® Risk Solutions Special Investigations Unit (SIU) helped one Department of Labor connect false claims to stolen identities — and used additional data sets to identify large fraud rings.

Insights & Resources

Real-World Examples Uncovering Fraud Patterns in Unemployment Insurance

Detect Fraudulent Claims and Recover Payments with LexisNexis® Risk Solutions Program Participation Analyzer

Combat Fraud and Optimize Digital Customer Experience

A Surge in Claims: How to ensure friction-less services and reduce post-recovery fraud clean-up

Special Investigations Unit: Research, Analysis and Case Assistance

Solving the Improper Payment Problem

Expert Q&A: Assisting Public Assistance

Why are some states handling unemployment fraud better than others during COVID-19?

Tennessee Reduces Improper Unemployment Payments through Data and Determination

Florida Department of Children and Families stops fraud and saves $1 billion with LexisNexis® Risk Solutions

Five Tips for a Stronger Defense Against Identity-Based Threats

The Right Identity Strategy for Public Healthcare and Social Services

Three Trends in Fraudulent Identity Transactions and How (Not) to Combat Them

TN Department of Labor investigates thousands of unemployment fraud claims with LexisNexis Risk Solutions

Identity Intelligence: An enabler to fighting fraud and serving the public during COVID-19

2019 Unemployment Insurance Survey

Products You May Be Interested In

-

EssentialID™

Ensure fast and secure access to government programs with LexisNexis EssentialID™. Our seamless identity proofing process provides unparalleled global insights, speed, security, and transparency.

Learn More -

AmplifyID™ Identity Risk Navigator

Get a clear view of your program’s participants to pinpoint fraudsters and stop improper payments.

Learn More -

AmplifyID™ Master Person Index

Ensure equitable access and smooth service delivery with a precise, whole-person view

Learn More -

AmplifyID™ Program Participation Analyzer

Prevent and detect dual participation and cross-program participation that results in the improper disbursement of benefits to public assistance program participants.

Learn More -

Accurint® for Government

Locate and identify people, businesses and assets

Learn More -

Payment Solutions

Automate payments of fees and reduce cost

Learn More