Discover True Cost of Fraud™ Study Results

Discover This Year’s Key Fraud Cost Drivers

Building on 15 consecutive years of research, the True Cost of Fraud study explores current and emerging fraud trends, and shares insights and recommendations on how to better manage fraud risks and strengthen customer trust.

Select a True Cost of Fraud™ Study from the tabs below:

Ecommerce and Retail Fraud Increases

Identity and transaction fraud pose double threat

As adoption of digital services increases across North America, cybercriminals are exploiting more opportunities to target both consumers and businesses. The results of the latest LexisNexis® True Cost of FraudTM Study for Ecommerce and Retail show a substantial increase both in the volume and sophistication of fraud.

New account creation poses the greatest risk, according to merchants. Nearly half of fraud losses can be traced back to this stage in the customer journey, due to common challenges verifying consumer identity information, discerning between human and malicious bot transactions and assessing international transactions with specialized fraud prevention tools. Merchants report 30% greater losses due to chargebacks in 2023 than in 2022.

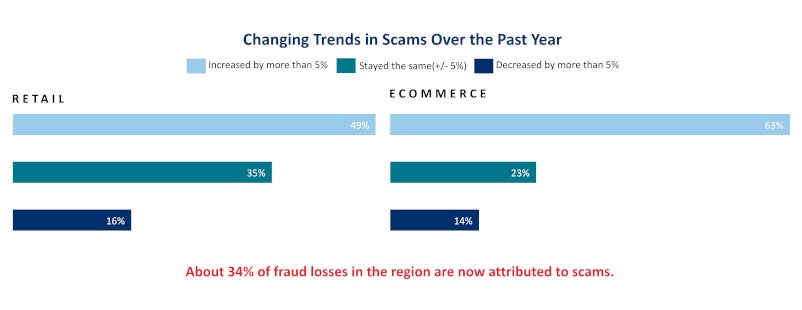

Scams drive over one-third of losses

Additional 2023 True Cost of Fraud Study Highlights

Identity Verification Challenges

Changing Payment Methods

Integration of Cybersecurity and Digital Customer Service

Customer Relationships Are On The Line

Verify Online and Offline Traits

Smart Practices Pay Off

Insights From Past Ecommerce and Retail Studies

Globalization And Digitalization Increase The Risks Of Fraud

Identity Theft And Digital Payment Fraud Grew Quickly according to the LexisNexis® True Cost of Fraud™ Study.

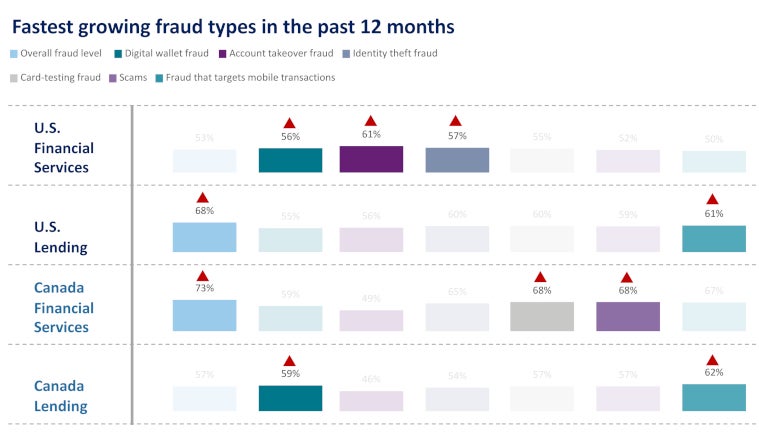

Identity theft and fraud targeting mobile transactions outpaced other fast-growing vectors, with account takeover fraud and scams also increasing at over half of surveyed firms.

LexisNexis® Risk Solutions has been tracking fraud costs and attack trends for more than 14 years. The LexisNexis® True Cost of FraudTM Study: Financial Services and Lending Report examines current challenges and successes:

Fraud Attacks Increase For Financial Services and Lending Firms

The True Cost of Fraud™ Study: North American Financial Services and Lending Report examines (a) how financial services businesses are keeping ahead of fraudsters, (b) what processes they have implemented, (c) what types of fraud are trending and (d) what prevention methods are working.

The findings come from a survey of 350+ risk and fraud management executives in financial services and lending companies in the U.S. and Canada. Subject areas include fraud costs and attack volumes, changes across consumer-engagement channels, scams impacting the customer journey and fraud-prevention smart practices. Get all the latest findings, figures and recommendations.

Infographic: Key Study Findings

The Rising Cost of Fraud

Canadian credit lenders, where every $1 of fraud loss actually costs $4.67. For U.S. firms, every $1 of fraud loss costs $4.41.

Fraud attack volumes rose across industries and geographies, particularly at account login.

Nearly two-thirds (63%) of financial firms report overall fraud increasing at least 6% in the prior 12 months. Synthetic identity fraud

incurred the greatest losses of any fraud type, causing the greatest impact at distribution of funds for U.S. firms and Canadian financial services.

Key Challenges in the Fight Against Fraud

Financial services companies and lending institutions can never let their guard down. Effective fraud prevention begins with confident identity verification and rigorous authentication, but without unnecessarily impacting the customer experience. Both verification and authentication remain challenges for financial services firms and lenders, elevating risk of fraud across the customer journey.

As more transactions occur online, and consumers become increasingly comfortable interacting via digital channels, financial businesses must navigate substantial and varied forms of risk, including some that may evade legacy fraud and risk mitigation processes.

However, consumers expect fast, convenient experiences across platforms and devices. Undue delay or caution can result in a negative customer experience that impacts brand reputation and customer satisfaction.

Plot the Path Forward

There’s also a need to employ more digital identity and behavior data and analysis to enable safer and more efficient remote digital interactions and transactions.

Balance is key: Best results come from a multi-layered approach capable of adapting to the potential risk of each transaction. Organizations that build a broad net of defense against fraud throughout customer journey stages report 41% lower fraud losses than organizations with comparatively limited measures.

Download the study now.

Insights From Past Financial Services and Lending Study

Products You May Be Interested In

-

BehavioSec®

Transform human interactions into actionable intelligence

Learn More -

FraudPoint®

Combat identity fraud with sophisticated scoring and leading analytics

Learn More -

InstantID® Q&A

Authenticate customer identities in real-time

Learn More -

LexisNexis® Emailage®

Get a clear picture of who is behind a transaction and the associated risk, so your team can automate decision workflows, improve customer experience, all in near-real time

Learn More -

LexisNexis® Fraud Intelligence

LexisNexis® Fraud Intelligence predicts the likelihood a new application will result in fraud

Learn More -

One Time Password

Authenticate a user with a one-time login transaction

Learn More -

Phone Finder

Connect phones and identities with rank-ordered results

Learn More -

ThreatMetrix®

Enable cybersecurity and risk management through data science innovation and shared intelligence

Learn More -

TrueID®

Recognize a true identity and fight fraud in real time

Learn More