Changing the View ofConsumer Creditworthiness

Alternative data rounds out the picture — increasing opportunities for you and your applicants.

Uncover Insights to Grow Your

Lending Portfolio

Traditional methods of assessing consumer credit risk have long been a reliable guidepost. But the nature of financial services has changed — requiring new tools for consumer credit risk decisions. For example, with increasing fintech options and the growth of the gig workforce, consumers have more ways to demonstrate financial stability. Yet lenders don’t often see these positive steps because they happen outside of the conventional credit data footprint.

By only leveraging traditional data sources, you may miss critical predictive details that sharpen your understanding of creditworthiness in the context of real life. Details that signal stability, ability to pay and willingness to repay.

By only leveraging traditional data sources, you may miss critical predictive details that sharpen your understanding of creditworthiness in the context of real life. Details that signal stability, ability to pay and willingness to repay.

Rethink the Data and Insights Used to Assess Credit Risk

Alternative data from LexisNexis® Risk Solutions enhances your consumer credit risk assessment so you

can better segment risk to make more effective decisions while managing your risk threshold.

can better segment risk to make more effective decisions while managing your risk threshold.

Approve More Consumers Across the Credit Spectrum

Whether an applicant has a “prime” traditional credit score or little to no credit history, lenders can

leverage insights into alternative credit inquiries and non-credit events to fine-tune lending and

origination strategies. Alternative credit data helps you determine consumer credit risk based on a

more robust understanding of consumers across the credit spectrum.

leverage insights into alternative credit inquiries and non-credit events to fine-tune lending and

origination strategies. Alternative credit data helps you determine consumer credit risk based on a

more robust understanding of consumers across the credit spectrum.

Roughly one-fifth of the U.S. adult population is unscorable by traditional credit assessment methods due to having no credit file (10%) or a thin file (11%). They have credit needs — yet are likely being overlooked by traditional lenders. Barriers to economic access only perpetuate the cycle of financial instability.

But this is a market too important to ignore. From January 2020 to May 2021, “credit invisibles” sought financial products in far higher numbers than consumers with traditional credit histories. These individuals have turned to consumer-friendly credit products such as “Buy Now Pay Later” because access to traditional lenders can be limited. That’s not a surprise, given that nearly 50% of consumer lenders surveyed in 2021 said they are less confident making lending decisions based on traditional credit data compared to 2020.1

1 Parrish, Leslie, Aite Group, Using Alternative Credit Data to Identify, Refine, and Grow. March 2021

About 8% of the U.S. scored population is considered “near-prime” — sitting in the crease between prime and subprime credit score tiers.2 That’s a sizable population and it’s worth clarifying the picture. Some of these individuals may have recovered from a negative event. They might be demonstrating consistent payments of subprime loans or other obligations. This is the kind of detail that can turn a “no” into a “yes” or a solid “maybe.” By tapping into alternative credit inquiries and non-credit events, you can more confidently make decisions on the types of products an applicant is a fit for and offers that should be made.

Our modeling shows that 30% to 40% of individuals who score near prime (with traditional scoring) have improved scores when alternative attributes are incorporated. These customers could actually be a fit for prime products when viewed through this expanded lens.

2 U.S. Bureau of Consumer Financial Protection, The Consumer Credit Market, August 2019

These are your “A-list” targets based on credit score, but they also may be more difficult to attract. Not only that, there may be unknown risks hidden behind that good score.

Your marketing challenge: These are customers accustomed to being courted. They frequently receive offers and they know how to secure the best rates and terms. You need insight your competitors don’t have: insight not only about the true financial picture of these consumers but also “life stage” information that helps you understand their economic trajectory so you can make the most competitive and relevant offers.

Your credit decisioning challenge (yes, there is one): A prime score alone doesn’t reflect whether the applicant’s financial picture is strengthening or weakening based on recent events.

We Saw a 75% Increase in Demand for Financial Products by ConsumersWho Are New to Credit. These Consumers Cross the Full Spectrum ofDemographics, Income and Education Levels.3

3 LexisNexis® Risk Solutions internal data

Clearly, your lending business may be missing out on a growing market

opportunity if you’re sticking solely to traditional assessment methods.

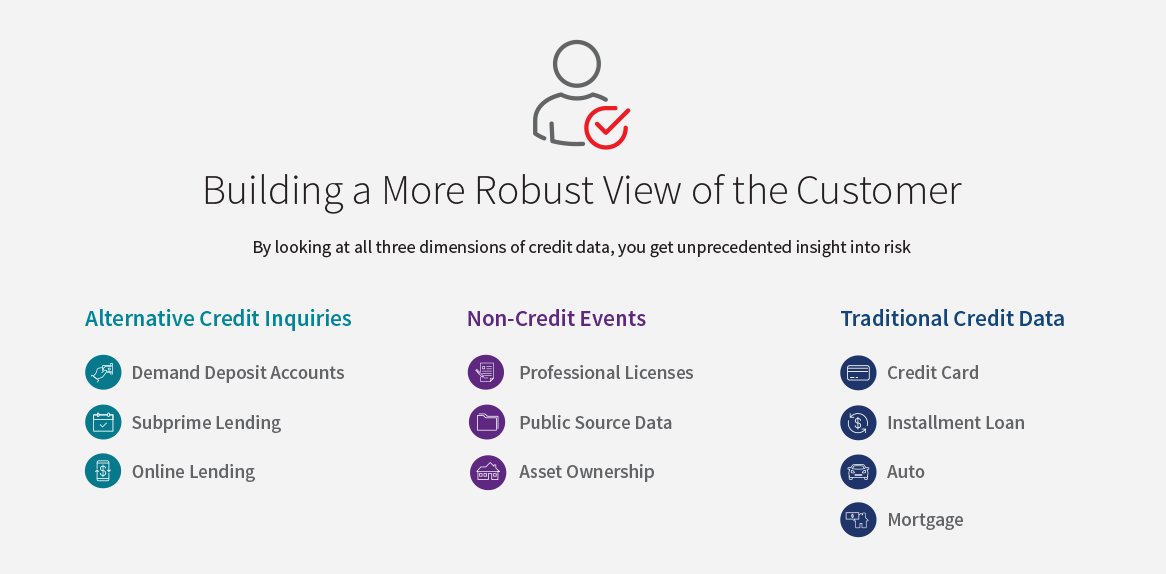

By incorporating alternative data into consumer credit risk assessment,

you can capture new creditworthy customers that your competitors

won’t see.

Expand your view of creditworthiness beyond traditional tradeline data to

include non-credit events — such as address stability, professional

licenses, asset ownership and more. This gives you expanded insight into

details known to reliably predict a positive economic trajectory.

By Scoring and Seeing Applicants in a New Light, a Significant Number of Them May Be Suitable for Prime or Near-prime Products. Imagine the Competitive Edge You’ll Gain With This New Approach.

Improve Consumer Credit Risk

Assessment with RiskView™

LexisNexis® RiskView Solutions adds consumer credit decisioning muscle to your lending organization. We built this robust suite based on our proven credit risk management tools — enabling you to seamlessly incorporate advanced analytics, unique alternative data insights and compliance steps into your existing workflow. Your origination strategies can be built to suit your unique needs — whether you’re a bank, a retail card issuer, an auto lender or a telecommunications provider.

RiskView™ gives you unique insight into consumer life events not just at loan origination but throughout the relationship lifecycle. From initial customer targeting to credit risk management to ongoing account management, RiskView helps you grow your business while managing risk thresholds.

RiskView™ gives you unique insight into consumer life events not just at loan origination but throughout the relationship lifecycle. From initial customer targeting to credit risk management to ongoing account management, RiskView helps you grow your business while managing risk thresholds.

Gain Greater Clarity Between a Consumer’s Traditional Credit Score and Their Creditworthiness. Add Alternative Data to Your Credit Risk Assessment Strategy So You Can Extend Credit to More Applicants With Confidence.

We believe in the power of data and analytics

to manage risk & uncover opportunity.

Products You May Be Interested In

-

RiskView™ Optics and RiskView™ Spectrum Scores

Improve risk assessment performance across the credit spectrum

Learn More -

RiskView™ Attributes

Enhance risk modeling performance across the credit spectrum

Learn More -

RiskView™ Liens & Judgments

Retain your competitive edge without the added expense of recalibrating your models

Learn More