Bring context to the complex process of fraud detection and prevention.

Surface hidden connections, visualize larger patterns and strengthen your agency’s fraud detection and prevention efforts

With government services and transactions, timeliness is essential — but so is scrutiny.

Agencies must be good stewards of their limited resources and ensure proper controls. LexisNexis® Risk Solutions helps agencies deliver efficient services fortified by fraud detection and prevention solutions specifically designed for government. Detect sophisticated and coordinated fraud schemes — then feed that intelligence back into upfront tools to strengthen future defenses.

For more information about fraud detection and prevention, download our brochure.

Fraud Detection and Prevention Challenges We Address

Government fraud investigations hinge on the quality of public records data and the linking capabilities that bring it all into a meaningful picture. But investigative resources aren’t endless. Agencies have to know where to best focus their fraud detection efforts for maximum results.

LexisNexis® Risk Solutions helps you overcome common fraud detection challenges like these and ultimately:

- improve investigative outcomes,

- reduce false positives;

- streamline processes.

Harness our unique combination of tools to close information gaps that slow you down. Key into actionable insights on people, entities and their extended networks of connections. We make it simple and streamlined. Our fraud detection solutions rely on broad, diverse data sets — aggregated and resolved down to the individual or entity with our proprietary LexID®️ linking technology — to see beyond limited encounters and isolated data. Advanced analytics and machine learning help you quickly differentiate legitimate individuals from bad actors — and recognize anomalies or high-risk fraud indicators buried deep in the data. Visualization tools sharpen the view, giving you a clear picture of risky connections or patterns that signal larger coordinated schemes or evolving threat types.

Coverage of Over 98% of the U.S. Adult Population

More Small Business Coverage Than Competitors

A Team of Fraud Experts Is Ready to Assist You

Access to our seasoned Special Investigations Unit (SIU) is included with all our fraud product offerings

Fraud is continually evolving — and will get tougher to contain as online services and transactions continue to increase. Synthetic identities. Bots. Account takeovers. Some solutions can catch one type of fraud but not others. Fraud prevention efforts that were effective just a few months ago may now be inadequate.

LexisNexis® Risk Solutions helps defend against the full range of fraud threats, providing actionable insights that enable you to more quickly spot—and prevent—outliers or emerging patterns:

- See beyond your own “four walls” into identities and activities across programs, states and jurisdictions. We aggregate and link data from multiple sources —including internal agency data, large-scale external identity and business data sets and contributed intelligence across government agencies.

- Agilely respond as risks evolve. Easy-to-use dashboards leverage visual analytics to provide a precise view of risk and help you see trends across your programs.

- Pair our fraud solutions with identity assessment and assurance through a single, centralized platform. Spot bad actors and/or risky attributes before they can infiltrate your program. Learn from downstream fraud detection efforts to intercept repeat offenders and prevent future efforts.

Proven Savings with Contributory Databases

Stay Ahead of Fraud with Our Special Investigations Unit (SIU)

Solutions Built Specifically for the Government Sector

LexisNexis® Risk Solutions designs in-depth fraud solutions specifically with Government needs in mind. Leverage automation to score risks and prioritize investigative efforts, reducing manual workload and focusing on the largest incidents or those where you’re most likely to successfully recoup improper payments. Configure the analytics to align with your processes and agency-specific risk scoring. Query the data based on your specific questions — no data scientists required.

Visualization tools make it even easier to derive meaning from the outputs. See the relationships between individual data elements, clusters of people and/or entities, patterns of behavior and associated risks.

Automation and Machine Learning Help Reduce Manual Reviews

Visualization Tools Make Fraud Easier to Identify

End-to-End Fraud Fighting Capabilities

Related Products

Related Brochure

Fraud Brochure: Implement Front-End Identity Verification to Reinforce Equitable Access While Stopping Online FraudLexisNexis EssentialID Brochure

See Solutions By Market

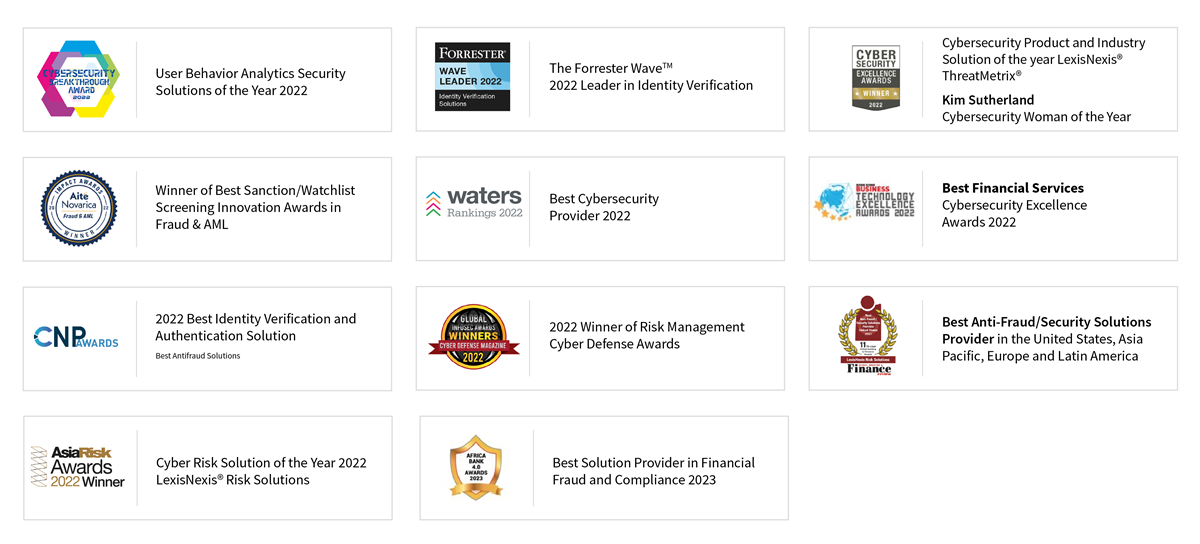

Award-Winning Fraud Defense and Fraud Solutions

Discover What Other Influencers are Saying about Our Award-Winning Fraud Defense and Fraud Management Solutions

LexisNexis Risk Solutions receives recognition from some of the industry’s most respected analysts and associations.

Insights & Resources

Related Products

-

EssentialID™

Ensure fast and secure access to government programs with LexisNexis EssentialID™. Our seamless identity proofing process provides unparalleled global insights, speed, security, and transparency.

Learn More -

AmplifyID™

AmplifyID leverages decades of identity intelligence expertise and insight to preserve program integrity, provide equitable access and prevent fraud across Federal, state and local government.

Learn More -

Accurint® for Government

Locate and identify people, businesses and assets

Learn More -

AmplifyID™ Identity Risk Navigator

Get a clear view of your program’s participants to pinpoint fraudsters and stop improper payments.

Learn More -

AmplifyID™ Program Participation Analyzer

Prevent and detect dual participation and cross-program participation that results in the improper disbursement of benefits to public assistance program participants.

Learn More -

LexisNexis Risk Management Solutions®

Manage risk with technology, information and advanced analytics

Learn More